A longer, more comprehensive version of this article may be found by clicking the link below.

Mike Stathis Has Been Recommending Nvidia (NVDA) Since May 2009

Do you have a competitive advantage to help you beat the market indexes?

If not, you stand no chance of beating the indexes in the long run.

INVESTORS MUST HAVE A COMPETITIVE ADVANTAGE IF THEY WANT TO OUTPERFORM

There aren't many sources that can help you gain a competitive advantage because there aren't many real experts who are willing to help main street.

HOW CAN YOU GET A COMPETITIVE ADVANTAGE?

You need access to a top investment expert.

And you need access his excellent research.

You also need to either have or else develop good judgment.

I define "excellent research" as an unbiased source of unique insight with a proven track record of excellent forecasts and recommendations.

Note that the insight needs to be somewhat unique or else it won't be so valuable.

Part of having a competitive advantage means your insights are unique.

If the insights are not at least somewhat unique, there is no competitive advantage.

Ideally, you should aim for access to a top expert with extensive industry experience, as well as a long history of consistently proven results as seen by their track record.

Ideally, you should seek out a top expert with a long history of great results, as well as the ability to think independently.

This individual will know when to counter investment recommendations of "top experts" and analysts. Such an individual will be capable of providing unique insights.

We know of no better analyst that fits this description than Mike Stathis.

We urge you to examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

Mike Stathis' investment research track record here, here, and here.

Check the article link below for an overview of Mike's 2008 Financial Crisis track record.

Mike Stathis' Track Record on the 2008 Financial Crisis

Check this video to understand why Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

Not long after the 2008 financial crisis and soon after Mike advised investors to begin buying into the stock market (March 10, 2009, which would later turn out to be the exact bottom), on May 27th 2009 we released the first issue of the AVA Investment Analytics newsletter (Volume 1, June 2009) now known as the Intelligent Investor.

In this publication Mike discussed his top three stocks for long-term growth.

So now let’s have a look at this list and see how it has performed.

As you can see (below) from page 31 from Volume 1 of the Intelligent Investor (published May 27, 2009) Mike's number one stock for long-term growth was Nvidia (NVDA).

His number two stock for long-term growth was UnitedHealth (UNH).

And his number three stock for long-term growth was Whole Foods (WFMI).

In Summary, in the first issue (June 2009) of the Intelligent Investor, Mike published his top 3 stocks for long-term growth:

#1 - Nvidia (NVDA)

#2 - UnitedHealth (UNH)

#3 - Whole Foods (WFMI, later changed to WFM)

Nvidia (NVDA)

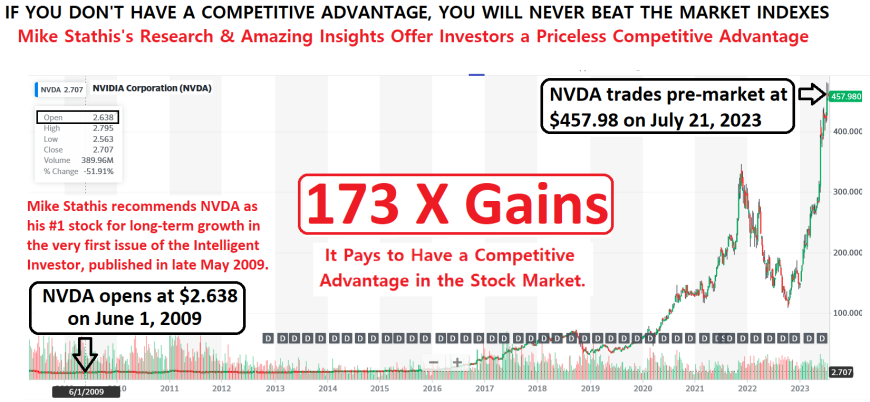

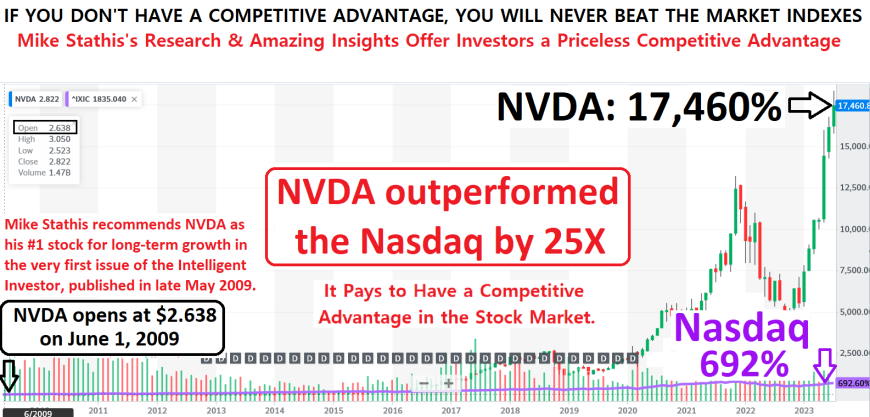

First, let's examine how Mike's #1 pick for long-term growth, Nvidia (NVDA) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

It's important to note that NVDA has remained on Mike's securities recommended list every month since he first added it in Volume 1, June 2009.

Once you adjust the share price for stock splits, Mike added NVDA to his recommended list at a price of less than $3/share in 2009.

At a current price (June 2023) of just under $400, you can see that shares have increased by 173-fold since 2009, representing gains of nearly an incredible 17,300%.

Over the same time period, the Nasdaq did quite well. But the Nasdaq's 646% gains pale in comparison to NVDA's 17,300%.

I won't get into the details as to why Mike selected NVDA as his #1 growth stock back when virtually no one knew about the company. This is a discussion for another time.

But you should note that this wasn't the first time Mike recommended Nvidia (NVDA) as a great stock for long-term growth.

He began recommending NVDA as a great stock for long-term growth as early as 2002 when he was still working on Wall Street.

UnitedHealth (UNH)

Next, let's examine how Mike's #2 pick for long-term growth, UnitedHealth (UNH) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

Although Mike recommended UNH less than a year earlier at roughly $18/share and called it a once in a lifetime buy, he had not yet begun to publish his investment research.

See Market Guidance: Past, Present and Future (November 23, 2008)

Once he began publishing his research he added UNH to his recommended list in Volume 1 of the Intelligent Investor although shares had nearly doubled and were selling for under $25.

At a current price of just under $500, simple math shows that UNH share price grew by more than 20-fold delivering 2,000% returns since Mike added it to the list.

And while the Dow Jones Industrial Average and S&P 500 Index (the appropriate benchmarks) performed extremely well over that time frame, the Dow's 305% and S&P's 384% returns pale in comparison to UNH's 2,000% returns.

Whole Foods/Amazon (WFM/AMZN)

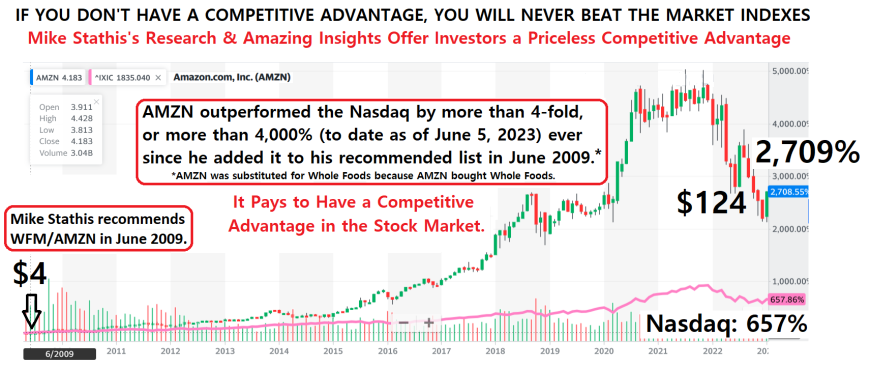

Finally, let's examine how Mike's #3 pick for long-term growth, Whole Foods (WFMI) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

At the time Mike added WFMI to his list in 2009, shares were selling for roughly $20.

Because Amazon (AMZN) bought Whole Foods a few years later, the standard way to track this performance is to replace Whole Foods (WFMI) with Amazon (AMZN).

Adjusted for stock splits, AMZN was selling for roughly $4 in June 2009.

At a current price of around $124/share (June 2023), this means AMZN share price grew by 31-fold, delivering cumulative returns of 31,000%.

This was of course much better than the Nasdaq's ~650% returns over the same time period.

It's time to get the BEST COMPETITIVE ADVANTAGE money can buy.

The amazing thing is that we're offering the world's best investment research at affordable rates.

(until further notice, new research subscribers must first apply for access to our research)

Intelligent Investor Market Forecaster Dividend Gems CCPM Forecaster

Profit While Learning from the World's Best Investment Analyst

(Track Record is Here)

Mike Stathis' investment research track record here, here, and here.

Evidence of Mr. Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits can be confirmed here, here, here, here, here, here, here, here, here, here, and here.

Check the article link below for an overview of Mike's 2008 Financial Crisis track record.

Mike Stathis' Track Record on the 2008 Financial Crisis

Check this video to understand why Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

Do You Have a Competitive Advantage?

Mike Stathis Certainly Does.

(to date only exhibits #1 through #6 have been published; exhibits #7 through #12 will be published in the future)

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #12

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #11

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #10

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #9

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #8

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #7

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #6

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #5

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #4

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.