I began my mission helping investors steer clear of Wall Street because I learned firsthand how the game was played after having worked in the industry.

Thereafter, I learned how the media helps Wall Street after I was black balled by all media in 2006 and thereafter for trying to warn main street about what would become an unprecedented financial crisis in 2008.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content.

I think I've done quite well in that regard.

As a part of this mission, I have also spent a great deal of time and effort exposing the criminal activities of the financial media, as it works with Wall Street to deceive and defraud main street.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with Mike Stathis can find out more about his credentials, background, and his investment research track record here, here, and here.

We urge you to examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

INVESTORS MUST HAVE A COMPETITIVE ADVANTAGE IF THEY WANT TO OUTPERFORM

Do you have a competitive advantage to help you beat the market indexes?

If not, you stand no chance of beating the indexes in the long run.

Without a reliable and sustainable competitive advantage, most investors are better off investing in index funds.

Furthermore, investors lacking a competitive advantage stand no chance to beat Wall Street.

For example, consider the following facts about Wall Street professionals and fund managers.

Finally, most of the biggest investors and investment firms have access to insider information. Perhaps you need a reminder of this fact (see the video below).

How can you compete with investors who have insider information?

You stand no chance without a competitive advantage.

When it comes to both investing and trading, there's only two sides.

There's the winning side and the losing side.

For each stock that goes up in price, there are investors who owned the stock before the price surge.

These are the winners.

Each of these investors are the losers.

Remember, for every dollar of profit made by investors in the stock market, a dollar is lost by other investors who made the wrong decisions.

That's what you call a zero-sum game.

And it describes how the stock market works.

So if you want to beat "the street," you MUST HAVE a Competitive Advantage.

And if you want to beat the indexes, you MUST HAVE a Competitive Advantage.

SO, WHAT'S YOUR COMPETITIVE ADVANTAGE??

Are you getting a competitive advantage by watching CNBC, Bloomberg, or Fox Business?

Maybe you think you're getting a competitive advantage by reading Barron's or the Wall Street Journal.

If you actually think you're going to obtain a competitive advantage or even an edge by following the financial media, I have ocean front property in Wyoming that I'd like to sell you.

Most investors are oblivious to the fact that financial media is useless.

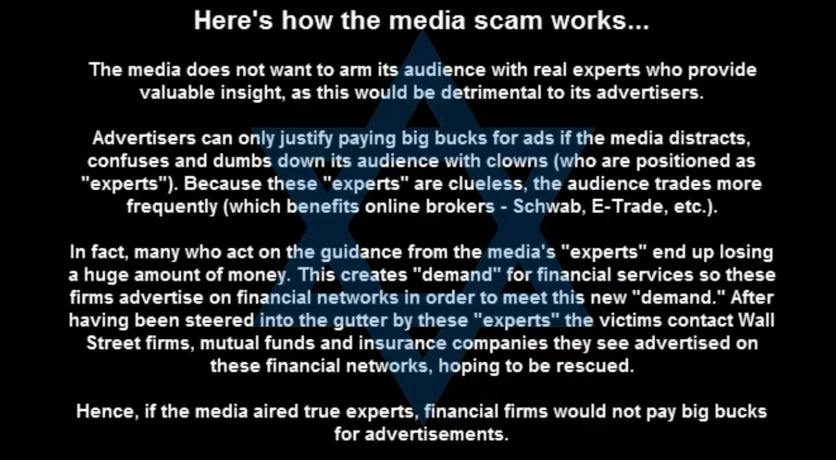

In fact, the financial media is detrimental to your investment performance.

That's the way the financial media has been designed.

Mike Stathis has been exposing the media scam for well over a decade.

And he's published hundreds of articles and videos showing how it operates.

And then there are really naive investors who think they'll find value by reading the lowest level financial content plastered on hundreds of websites, such as Yahoo Finance, Zach's, MarketWatch, Motley Fool, The Street, Morningstar, Benzinga, Seeking Alpha, Zach's, Tipranks, Insider Monkey, Guru Focus, etc.

Let's get real. These websites are boiler rooms that publish clickbait trash.

They publish ad-based content which has been proven to be disinformation.

They also sell paid subscription services using false claims in order to lure the sheep into their scam.

But the fact is they have no investment experts publishing their content.

They employ copywriters, cons, and scam artists.

It's quantity over quality.

That's the business model of ad-based content.

And it's the result of the Internet.

The content from these types of websites is pumped out like a machine for the purpose of triggering search engine results intended to lure more sheep into the slaughterhouse of scams and deceit.

Similar to financial TV networks and newspapers, these copywriting boiler room websites hide behind the shield of being classified as media companies in order to get away with deceiving and defrauding the public with fake news, stock manipulation, and false claims.

And they pay websites like Yahoo Finance and many others to have their content published so that everywhere you look you see their content.

Mike Stathis has previously described this as the media's "flooding approach."

Others actually think they can invest well by listening to fake investment gurus on social media.

The problem is that such individuals aren't even aware they are listening to frauds and idiots.

If you actually think you're going to gain a competitive advantage by listening to fake investment gurus on YouTube, Facebook, and other social media platforms, even God won't be able to help you.

It's important to remind you that ALL of the sources I have mentioned are partners with the copywriting industry because they sell advertisements promoting sensational videos from con artists like Jim Rickards, Porter Stansberry, Whitney Tilson, Nomi Prins, Jim Rogers, Harry Dent, Robert Kiyosaki, David Stockman, and hundreds of other copywriting clowns.

Mike Stathis has previously exposed these and countless other cons, so check the website.

Check the end of this article for some examples of sources of disinformation, scammers and frauds.

There aren't many sources that can help you gain a competitive advantage because there aren't many real experts who are willing to help main street.

The fact is that, with rare exception all of the real investment experts are focused on making money for themselves by managing large funds.

They aren't going to waste time with media interviews unless they want some face time just to market their fund.

But if their fund is truly doing well, they won't need to market themselves.

Everyone else promoted by the media as an "expert" has no clue what's going on.

Instead of an investment expert, these people are really a marketing experts.

But if you aren't sufficiently knowledgeable about the markets, you're likely to be fooled by their fast talking BS lines.

These characters pose as experts in order to market themselves so they can land big speaking fees at investment events and conferences, pitch their useless books, and so on.

That's how they really make their money, not from investments.

Even on the rare occassion when a legit fund manager or other true expert appears in the media, you won't hear anything from them that will help you perform well in the markets.

That's a guarantee from Mike Stathis.

He knows this because he has been observing the financial media for many years, so he knows all of the games and tricks they play.

Yet investors are always searching for this "holy grail."

That explains why they watch financial media shows and read articles on websites.

They think they will be able to spot when there's some value.

The reality is that you won't know when you've come across valuable insight in financial media unless you're a very knowledgeable investor.

Some of you might be thinking that you're a very knowledgeable investor.

If that's the case, why would you waste your time searching for valuable insight in one of the worst places - in the financial media?

If you think the financial media provides a good source of investment insight, you aren't a knowledgeable investor.

You're what's commonly referred to as the "dumb money."

HOW CAN YOU GET A COMPETITIVE ADVANTAGE?

You need access to a top investment expert.

And you need access his excellent research.

You also need to either have or else develop good judgment.

In this case I will define "excellent research" as an unbiased source of unique insight with a proven track record of excellent forecasts and recommendations.

Note that the insight needs to be somewhat unique or else it won't be so valuable.

Part of having a competitive advantage means your insights are unique.

That's how you find yourself on the winning side of the trade or investment.

If the insights are not at least somewhat unique, there is no competitive advantage.

Ideally, you should aim for access to a top expert with extensive industry experience, as well as a long history of consistently proven results as seen by their track record.

Ideally, you should seek out a top expert with a long history of great results, as well as the ability to think independently. This individual will know when to counter investment recommendations of "top experts" and analysts. Such an individual will be capable of providing unique insights.

We know of no better person that fits the description above than Mike Stathis.

Mike is that exception I spoke of earlier as a true expert who isn't focused on making money for himself. That's why he's declined numerous offers to run investment funds and work as the head of research of funds.

Take a look at a few of his remarkable investment calls in the charts below.

Note: If you are unable or unwilling to go through and examine each of these well-annotated charts and carry out the sufficient leg work required to understand and appreciate the significance of Stathis' insights and recommendations as shown in the charts below, you will never be able to utilize world-class research such as that published by Mike Stathis.

The first two charts below show the results of those who followed Mike Stathis' analysis and recommendations to short Fannie Mae and Freddie Mac in his 2007 book, Cashing in on the Real Estate Bubble.

Not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

He even warned that General Electric and General Motors would get hit hard because he realized these companies had grown to become essentially consumer finance companies.

We urge you to examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, and here.

The following video summarizes Mike Stathis' 2008 Financial Crisis Track record.

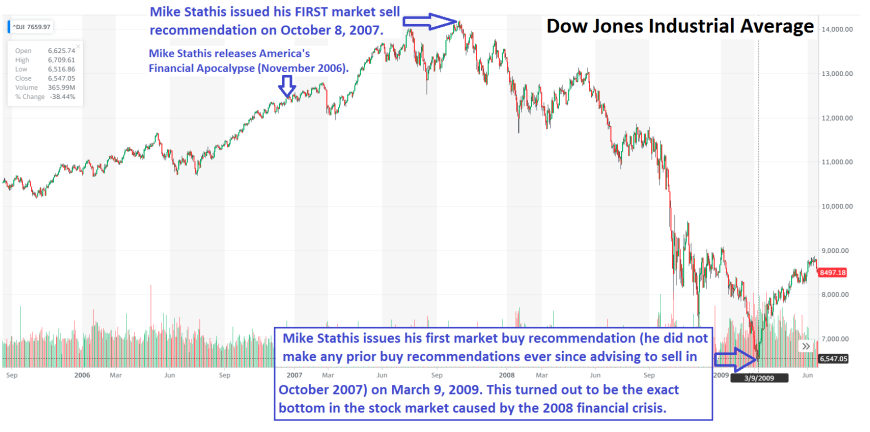

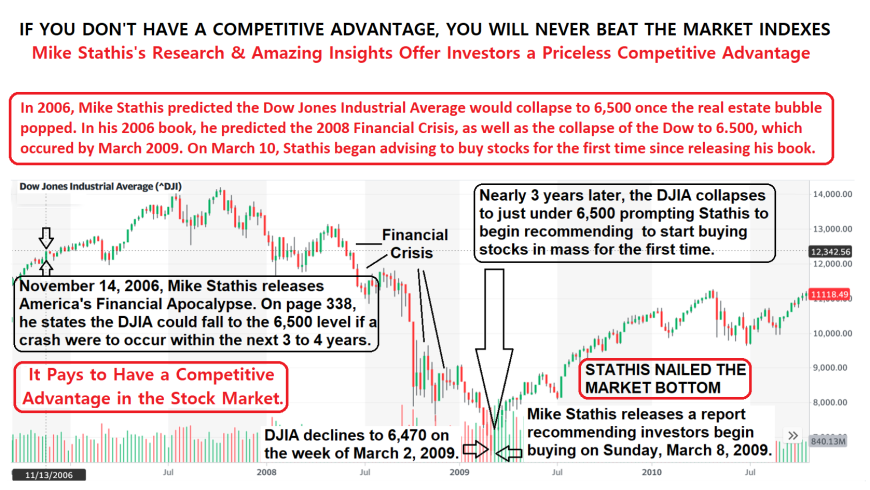

Next, take a look at Mike's financial crisis stock market forecasts and recommendations, published in his 2006 book, America's Financial Apocalypse as well as in several articles in the public domain in 2008 and 2009.

The next chart is a summary of the results of stock market forecasting recommendations made by Mike Stathis since late 2006 (from America's Financial Apocalpyse) through the end of 2014.

We have not updated this chart because there is not enough space on the chart to show his accurate forecasts since 2014. However, Mike's results have similar accuracy which is extremely high.

If you want to examine his market forecasting track record in more detail, check the Newsletter Track Record section.

Mr. Stathis' Forecasting Track Record Since 2015

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

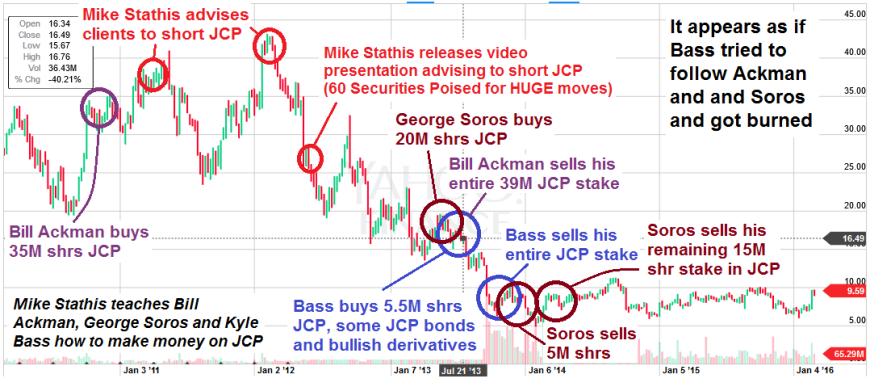

The next chart shows Mike's recommendations to short JC Penny long-term because he believed it would file for bankruptcy, which is exactly what happened. In contrast, you can see that the investment "experts" got it completely wrong.

The next chart illustrates how Mike Stathis was warning about Alibaba (BABA). He specifically told investors to avoid the stock. Mike had been warning about the dangers and risks of U.S.-listed Chinese stocks years before it was discussed in the media.

Meanwhile, the "legendary investor" Charles Munger was buying Alibaba (BABA) while praising the company and the Chinese government.

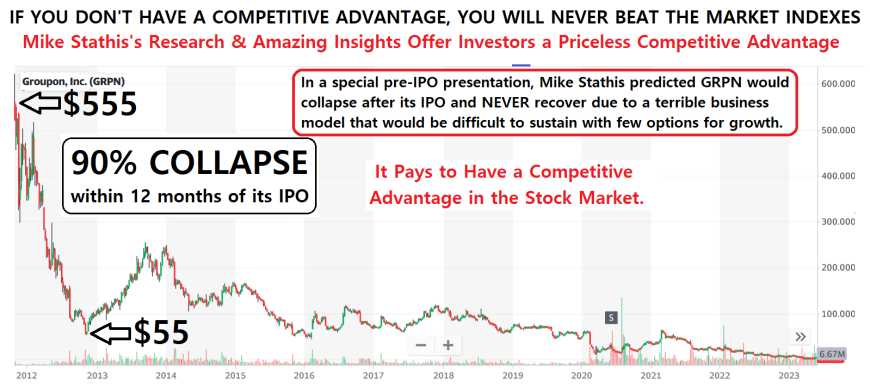

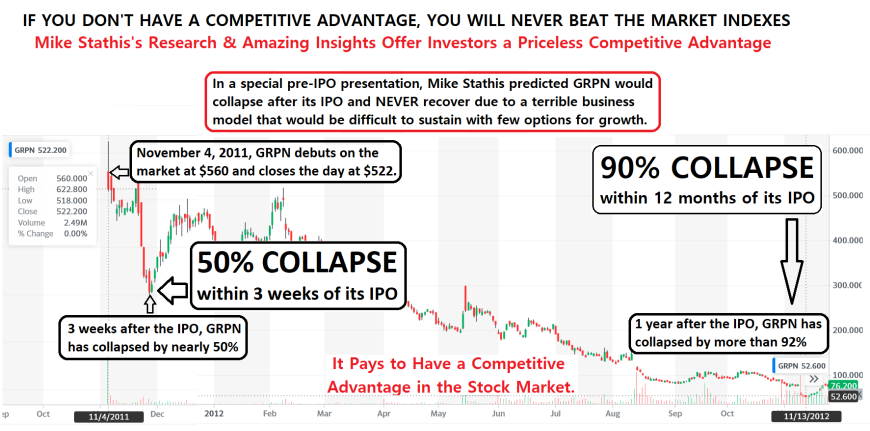

The next two charts illustrate the results of Mike's pre-IPO research presentation of Groupon. In this presentation Mike discussed why the business model was flawed and why the stock would collapse after its IPO, never to recover due to limited growth options. He recommended to short the stock.

See Shorting & Short Squeeze Case Studies

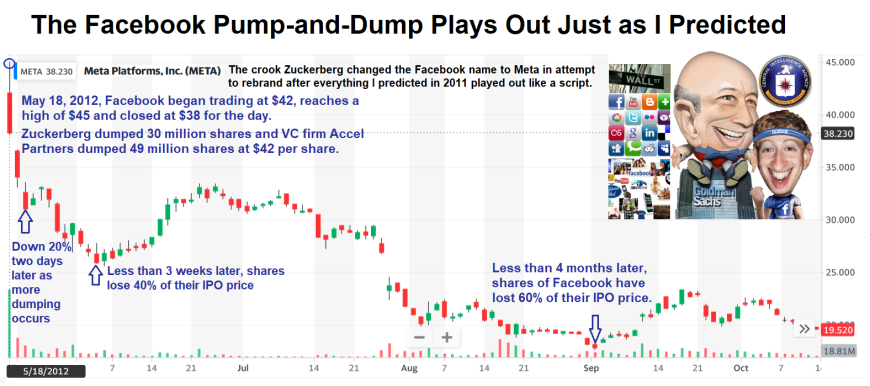

The next grand slam was provided to the public for free. Just over one year before Facebook's IPO, Mike wrote an article which was made available to the public explaining why he was confident Wall Street was orchestrating a pump-and-dump for Facebook's IPO.

Take a look at the results.

As usual, Mike was right. Shares of Facebook collapsed immediately upon entering the public markets.

After four months, Facebook shares had collapsed by nearly 60% before staging a comeback.

Facebook's comeback after its collapse is a story Mike is open to discuss upon request by research subscribers.

See Goldman Sachs and the Facebook Pump and Dump

See Shorting & Short Squeeze Case Studies

Take a look at the results of Facebook within a couple of months of its IPO.

If you had read the Wall Street Investment Bible, you would have been convinced to buy Netflix (NFLX) at $3.

Mike Stathis' Credentials and Track Record

You can learn more about Mike and his investment research track record here, here, and here.

You should examine his track record of having predicted the 2008 financial crisis. See here, here, here, here, here, here, here, here, here, here, and here.

Along with the most detailed analysis in the world at the time, Mike's research prior to the financial crisis enabled investors to capture life-changing profits.

You should confirm these claims by checking his 2008 financial crisis track record here, here, here, here, here, here, here, here, here, here, and here.

No one can match the accuracy, detail, and comprehensiveness of his 2008 financial crisis predictions.

Mike Stathis holds the leading investment forecasting track record since he began publishing research in 2006. And we have backed this claim with up to a $1,000,000 guarantee. See here.

The reader should check the following links here, here, and here to see much of this material.

Today, we are going to examine what we believe to be as one of the greatest investment forecasts made in at least the past two decades.

This call might even rival that made by Mike when his 2006 book, America's Financial Apocalypse predicted the 2008 financial crisis along with his accurate forecast of an average 35% collapse in residential real estate prices (real estate bottomed in 2011, 35% down from highs), as well as his prediction that the Dow Jones Industrial Average would bottom at 6,500, which it did in March 2009.

Notably, he recommended investors begin buying into the stock market on March 9, 2009, as the Dow reached 6,500.

Let's have a look at this call.

Not long after the 2008 financial crisis and soon after Mike advised investors to begin buying into the stock market (March 10, 2009, which would later turn out to be the exact bottom), on May 27th 2009 we released the first issue of the AVA Investment Analytics newsletter (Volume 1, June 2009) now known as the Intelligent Investor.

In this publication Mike discussed his top three stocks for long-term growth.

Note that prior that time (May 2009) and since then, Mike has NEVER come out with another list of top stocks for long-term growth.

Why?

Because he's not a BS artist.

MIke Stathis is legit.

So he's not constantly generating click bait content like others in order to generate sales.

He reports on things only when he believes there are tremendous opportunities or dire risks.

So now let’s have a look at this list and see how it has performed.

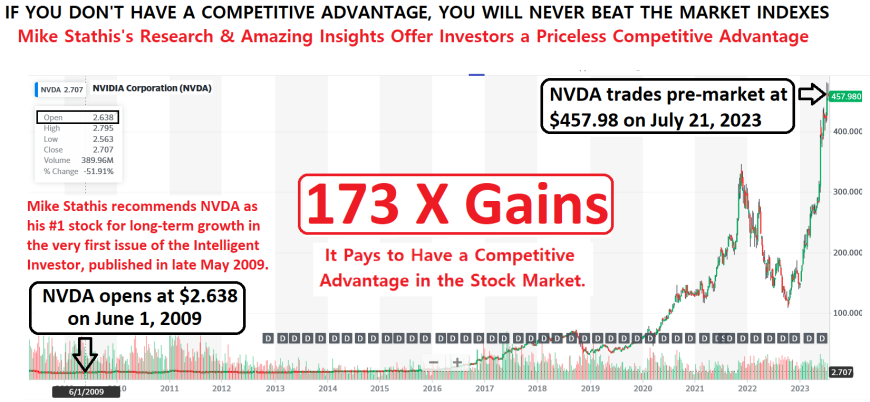

As you can see (below) from page 31 from Volume 1 of the Intelligent Investor (published May 27, 2009) Mike's number one stock for long-term growth was Nvidia (NVDA).

His number two stock for long-term growth was UnitedHealth (UNH).

And his number three stock for long-term growth was Whole Foods (WFMI).

In Summary, in the first issue (June 2009) of the Intelligent Investor, Mike published his top 3 stocks for long-term growth:

#1 - Nvidia (NVDA)

#2 - UnitedHealth (UNH)

#3 - Whole Foods (WFMI, later changed to WFM)

Nvidia (NVDA)

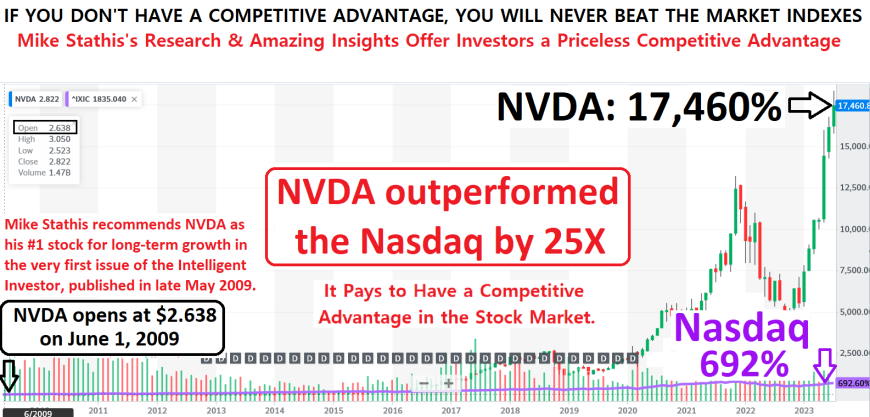

First, let's examine how Mike's #1 pick for long-term growth, Nvidia (NVDA) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

It's important to note that NVDA has remained on Mike's securities recommended list every month since he first added it in Volume 1, June 2009.

Once you adjust the share price for stock splits, Mike added NVDA to his recommended list at a price of less than $3/share in 2009.

At a current price (June 2023) of just under $400, you can see that shares have increased by 173-fold since 2009, representing gains of nearly an incredible 17,300%.

Over the same time period, the Nasdaq did quite well. But the Nasdaq's 646% gains pale in comparison to NVDA's 17,300%.

I won't get into the details as to why Mike selected NVDA as his #1 growth stock back when virtually no one knew about the company. This is a discussion for another time.

But you should note that this wasn't the first time Mike recommended Nvidia (NVDA) as a great stock for long-term growth.

He began recommending NVDA as a great stock for long-term growth as early as 2002 when he was still working on Wall Street.

UnitedHealth (UNH)

Next, let's examine how Mike's #2 pick for long-term growth, UnitedHealth (UNH) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

Although Mike recommended UNH less than a year earlier at roughly $18/share and called it a once in a lifetime buy, he had not yet begun to publish his investment research.

See Market Guidance: Past, Present and Future (November 23, 2008)

Once he began publishing his research he added UNH to his recommended list in Volume 1 of the Intelligent Investor although shares had nearly doubled and were selling for under $25.

At a current price of just under $500, simple math shows that UNH share price grew by more than 20-fold delivering 2,000% returns since Mike added it to the list.

And while the Dow Jones Industrial Average and S&P 500 Index (the appropriate benchmarks) performed extremely well over that time frame, the Dow's 305% and S&P's 384% returns pale in comparison to UNH's 2,000% returns.

Whole Foods/Amazon (WFM/AMZN)

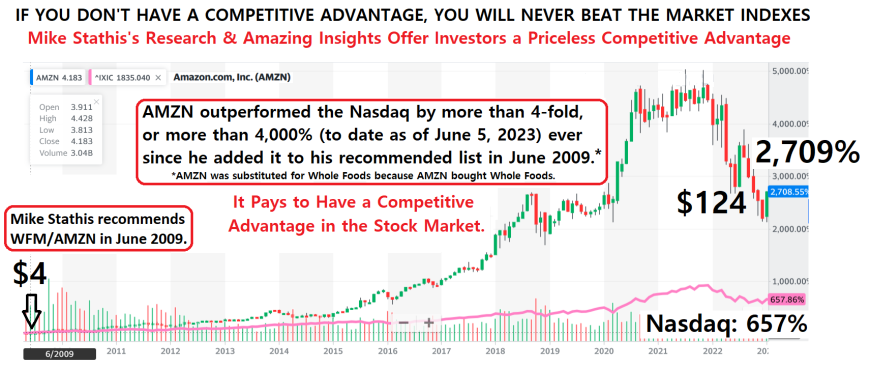

Finally, let's examine how Mike's #3 pick for long-term growth, Whole Foods (WFMI) has performed since Mike added it to the Intelligent Investor recommended list in June 2009.

At the time Mike added WFMI to his list in 2009, shares were selling for roughly $20.

Because Amazon (AMZN) bought Whole Foods a few years later, the standard way to track this performance is to replace Whole Foods (WFMI) with Amazon (AMZN).

Adjusted for stock splits, AMZN was selling for roughly $4 in June 2009.

At a current price of around $124/share (June 2023), this means AMZN share price grew by 31-fold, delivering cumulative returns of 31,000%.

This was of course much better than the Nasdaq's ~650% returns over the same time period.

Less than two years after we published Volume 1 of the Intelligent Investor, in 2011 we gave the public an opportunity to see Mike's top three stocks for long-term growth.

All they had to do was subscribe to the Intelligent Investor.

Some were wise enough to subscribe, but many others missed the boat.

Mike's Top 3 Stocks for Long-term Growth

A few years later in 2016, we reminded the world of Mike's top three stocks for long-term growth and gave everyone yet another opportunity to learn what these stocks were.

This time, we only required investors to pay a few dollars to see this list.

Again, many investors ignored this opportunity.

Apparently, they weren't aware of Mike's remarkable track record because the media had long-since black-balled him.

But all they had to do was to check his track record based on our website.

An Update on Mike's Top Three Stocks for Long-Term Growth

The situation is similar to Mike's 2008 written recommendation to buy Netflix (NFLX) when it was roughly $3/share in the Wall Street Investment Bible.

He also advised investors to short Blockbuster Video (BBI) in the same book.

Blockbuster Video would file for bankruptcy a few years later while Netflix (NFLX) soared.

Mike continued recommending NFLX for the long-term due to his analysis and understanding of the industry, the company, and management.

You know the saying.

You can lead a horse to water, but you can't make it drink.

It's time to get the BEST COMPETITIVE ADVANTAGE money can buy.

The amazing thing is that we're offering the world's best investment research at affordable rates.

(until further notice, new research subscribers must first apply for access to our research)

Intelligent Investor Market Forecaster Dividend Gems CCPM Forecaster

Profit While Learning from the World's Best Investment Analyst

(Track Record is Here)

Mike Stathis' investment research track record here, here, and here.

Evidence of Mr. Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits can be confirmed here, here, here, here, here, here, here, here, here, here, and here.

CNBC Stock Manipulator Jim Cramer and TipRanks Lead Sheep to Slaughterhouse. CANO

Proof that TipRanks is a Disinfo, Garbage Scam Service

Fake Investment Guru Larry Jones Shows You How to P1ss Your Money Away Using Google and TipRanks

Mike Shows You How Useless Financial Media is Using Motley Fool As an Example

CNBC - Watch TV, Lose Money: Theranos, Another Scam Promoted by Jim Cramer and CNBC

CNBC Trading "Expert" Jon Najarian Promotes "Crypto King" Ponzi Scheme Crook John Caruso

Jewish-Run Scam Network CNBC Promotes Jewish Con Tony Robbins as 401k Expert

Jewish Moron Dennis Gartman Positioned as an Expert by Jewish Scam Network CNBC

Another Jewish "Expert" from CNBC and FOX Involved in Fraud

MarketWatch Clown Brett Arrends Claims Stock Market Overvalued in 2014 More than Dot-Com Bubble

MarketWatch, Bloomberg and Goldman Sachs Are Spin Doctors of Confusion and Disinformation

MarketWatch Fake News Peddler Mark DeCambre Keeps Creating Fake Track Records to Sell Ads

Mark DeCambre is a Fake News Click Bait Scam Artist Working for Boiler Room Marketwatch

Jewish-run Scam MarketWatch Promotes Jewish Charlatan Tony Robbins as an Investment Authority

MarketWatch Jewish Crooks Promote Jewish Robert Prechter as an Expert AGAIN!

Jewish Mafia-run Barron's and Wall Street Pumped Luckin Coffee Before Shares Collapsed

Barron's Promotes Jewish Charlatans & Clowns as Experts

Yahoo Finance Scammers Defend Broken Clock Jeremy Grantham Who Missed Longest Bull Market in History

Yahoo Finance is a Complete Jewish-Run Scam Which Only Promotes Jewish Frauds

Yahoo Finance Teams Up With Zero Hedge Scam Artist and Liar Bob English/Jared Blikre

Yahoo Finance Promotes Airhead Millennials in Order to Pump Crypto Scams

Disgraced Economist Ken Rogoff Promoted by Liar and Promoter of Scam Artists, Jared Blickre

Yahoo Finance's Jared Blikre Promoted Con Man Mike Maloney

Yahoo Finance Jewish Cons Whore More for Jewish Con Porter Stansberry

Yahoo Finance Deceives its Audience by Partnering Up With Con Artist Jason Bond (April 2, 2019)

Con Artist Deepak Chopra Promoted as Investment Guru by Yahoo Finance

Yahoo Finance Hypocrites Criticize Doomsday Clowns

Marketing Fraud: TheStreet Promotes Reporter as Retirement Expert

Jim Cramer's Boiler Room TheStreet Receives Millions of Dollars in Taxpayer Funds

Proof that Jim Cramer is a Contrarian Indicator and Investment Idiot: NVDA

Watch TV, Lose Money: Stock Manipulator Jim Cramer Pumps CF Industries at the Top

Jim Cramer Pumps Silicon Valley Bank Stock as "Cheap" Days Before It's Seized

Jewish Scam Artist Jim Cramer Pumped Cryptocurrencies at the Peak

CNBC Liar & Con Man Jim Cramer Steers Sheep into Slaughterhouse with StitchFix (SFIX)

Jim Cramer, CNBC and the GoPro Pump and Dump Scam

How Jim Cramer, CNBC and Other Jewish Con Men Screw the Sheep

CNBC's Josh Brown and Other CNBC Idiots Show You How to Lose Money

CNBC Promotes Morningstar as a Credible Source But Mike Stathis Sets the Record Straight

CNBC Promotes FIRE Movement Frauds & YouTube Cons Graham Stephan and Kevin Paffrath

Tom Nash is a Fake Investment Guru, Idiot, Liar and Fraud

Meet Kevin and Tom Nash Are Frauds

Fake Investment Guru Tom Nash Claims No One on Wall Street Pays Attention to P/E Ratios

Exposing YouTube Fake Investment Gurus Series: Introduction to Tom Nash

Cathie Wood Pumper, Tom Nash Exposed as a Fraud by Leading Investment Expert

FTX Paid Whore Tom Nash Claims FTX is Fine One Day Before Collapse (Nov 12 2022)

Scam Artist, Liar and Fake Investment Guru Meet Kevin is YouTube's Sham-Wow Guy

Meet YouTube Liar and Con Man Kevin Paffrath (re-released)

Meet Kevin (Kevin Paffrath) Goes from Real Estate Con to Fake Investment Guru Scam Artist

YouTube Fraudster of the Year: Kevin Paffrath (Meet Kevin) Parts 1-3

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

Opening Statement from the April 2016 Dividend Gems Originally published on April 17, 2016 In previous research we pointed to the positive correlation between oil pricing and stock market pe...

Opening Statement from the April 2016 CCPM Forecaster Originally published on April 3, 2016 After a tremendous rally in the USD, recent weakness has caused several other currencies to rally.......

Opening Statement from the March 2016 Dividend Gems Originally published on March 21, 2016 (pre-market release) Subscribers should have received access to the 30-minute overview we published on Su...

Opening Statement from the March 2016 CCPM Forecaster Originally published on March 6, 2016 In late 2015 we discussed a speculative forecast of a sizable rally in the commodities market expected...

Opening Statement from the February 2016 Dividend Gems Originally published on February 22, 2016 (pre-market release) In the January 2016 issue of Dividend Gems (Volume 60) for many of the s...

As a result of Stathis' accurate interest rate forecasts, his institutional clients and others who might have access to interest rate swaps and other dervivatives linked to interest rate changes have...

Opening Statement from the February 2016 CCPM Forecaster Originally published on February 7, 2016 For several years we have been discussing our concerns of weak global demand as the primary...

Opening Statement from the January 2016 Dividend Gems Originally published on January 18, 2016 Weakness in commodities pricing continues to cause the global stock markets to selloff due to d...

Here we offer more evidence that no one in the world came remotely close to Mike Stathis in predicting the exact details of the financial crisis. What is truly shocking as much as it is unfortun...

Opening Statement from the January 2016 CCPM Forecaster Originally published on January 3, 2016 We have been discussing our forecast of a December 2015 rate hike of 25 bp for more than one y...

Opening Statement from the December 2015 Intelligent Investor Originally published on December 9, 2015 (pre-market) A growing consensus of lower oil prices for a longer period has sparked a...

Opening Statement from the November 2015 Dividend Gems Originally published on November 15, 2015 For several years we have been discussing our view that the US is not likely to enter into a...

Opening Statement from the October 2015 Dividend Gems Originally published on October 18, 2015 Due to the high level of market risk, most of our recommendations from the September issue were...

Opening Statement from October 2015 Intelligent Investor Originally published on October 7, 2015 Review of the Past 12 Months First, let’s summarize our assessment and guidance from...

Opening Statement from the October 2015 CCPM Forecaster Originally published on October 4, 2015 On September 18th the Federal Reserve announced its decision to keep interest rates unchanged...

Opening Statement from the September 2015 CCPM Forecaster Originally published on August 30, 2015 China and Yuan Devaluation Two days after reporting a huge decline (8.3%) in exports for t...

Opening Statement from the August 2015 CCPM Forecaster Originally published on August 2, 2015 As we have been discussing in the Intelligent Investor, it is very important period to pay clos...

Opening Statement from the July 2015 Dividend Gems Originally published on July 19, 2015 In the November 2014 Intelligent Investor we surmised the globe was likely to enter a new economic and in...

The following audio represents another small portion of a presentation discussing global economics from Video 1 of the July 2015 Intelligent Investor.* *The July issue contained a written section...

Opening Statement from the July 2015 CCPM Forecaster Originally published on July 5, 2015 Alert traders were rewarded on June 28/29 after Greece rejected the troika’s bailout terms. T...

The June 2015 Global Economic Analysis is a 40 minute video presentation that was originally prepared for subscribers to the Intelligent Investor and Market Forecaster. We just added this presentati...

Recently we added the December 2014 Global Economic Analysis and Forecast to the Member 2015 Video Folder. I also have decided to add two additional audio supplements which were part of the or...

Opening Statement from the June 2015 Dividend Gems First published on June 21, 2015 for subscribers to Dividend Gems For about one year now we have been leaning towards a first rate hike in the US d...

The December 2014 Global Economic Analysis and Forecast which was originally provided to subscribers of the Intelligent Investor and Market Forecaster on December 14, 2014 has just been added to the M...

Opening Statement from the June 2015 CCPM Forecaster First published on June 1, 2015 for subscribers to the CCPM Forecaster We see no material changes in the global economy relative to the past fe...

Opening Statement from the May 2015 issue of Dividend Gems First published on May 17, 2015 for subscribers to Dividend Gems Our suspicions of an improvement in Q1 earnings has come to fruiti...

Opening Statement from the May 2015 Intelligent Investor (Part 1) First published on May 6, 2015 for subscribers to the Intelligent Investor After soaring for months, the biotech and healt...

Opening Statement from the May 2015 CCPM Forecaster First published on May 3, 2015 for subscribers to the CCPM Forecaster We see no material changes in the global economy relative to the past few...

Opening Statement from the April 2015 CCPM Forecaster First published on April 5, 2015 for subscribers to the CCPM Forecaster In coming weeks/months, the site will be permanently closed to the...

Opening Statement from the March 2015 CCPM Forecaster First published on March 1, 2015 for subscribers to the CCPM Forecaster After soaring for months, the dollar has recently experienced s...

America’s Financial Apocalypse remains as the most accurate, comprehensive and insightful investment book predicting a depression for the U.S. even nearly ten years after it was first published...

In addition to the loads of valuable content we provide to Members, we have added another critical research publication to the Member Library. All Members will receive the report below at no...

For some time now we have been emphasizing the growing momentum in the U.S.. economy relative to the rest of the world. The recent (preliminary) Q4 GDP growth of 5% year-over-year confirms this trend...

Opening Statement from the January 2015 Intelligent Investor (Part 1) First published on January 4, 2015 for subscribers to the Intelligent Investor For some time now we have been emphasizing th...

Recently, the IMF once again revised global economic growth downward. We released an article which discussed the implications of this revision. We also released an audio presentation which foc...

Opening Statement from the December 2014 Intelligent Investor (Part 1) First published on December 5, 2014 for subscribers to the Intelligent Investor Despite persistent and widespread clai...

Opening Statement from the November 2014 issue of Dividend Gems First published on November 17, 2014 for subscribers to Dividend Gems Over the past several months economic headwinds from aro...

Opening Statement from the November 2014 Intelligent Investor (Part 1) First published on November 5, 2014 for subscribers to the Intelligent Investor Over the past several months ec...

Opening Statement from the October 2014 Intelligent Investor (Part 1) First published on October 5, 2014 for subscribers to the Intelligent Investor As expected, the commodities market cont...

Opening Statement from the September 2014 issue of Dividend Gems First published on September 17, 2014 for subscribers to Dividend Gems While much of the global economy continues to lose ste...

Opening Statement from September 2014 Intelligent Investor (Part 1) First published on September 2, 2014 for subscribers to the Intelligent Investor It is of no surprise that economic data f...

Opening Statement from August 2014 Dividend Gems First published on August 18, 2014 for subscribers to Dividend Gems In line with our expectations, US second quarter GDP came in at 4....

Opening Statement from August 2014 Intelligent Investor (Part 1) First published on August 4, 2014 for subscribers to the Intelligent Investor As expected, the “Iraq trade” has...

Here are just a few predictions made by Mike Stathis in America's Financial Apocalypse.

Opening Statement from July 2014 Intelligent Investor (Part 3) First published on July 10, 2014 for subscribers to the Intelligent Investor The recommendations provided in the June issue add to...

Opening Statement from June 2014 Dividend Gems First published on June 17, 2014 for subscribers to Dividend Gems Over the past several years we have discussed that the IMF has had a tendency...

Opening Statement from June 2014 Intelligent Investor (Part 3) First published on June 4, 2014 for subscribers to the Intelligent Investor Thus far our market forecast has been very accurate...

Opening Statement from June 2014 Intelligent Investor (Part 1) First published on June 1, 2014 for subscribers to the Intelligent Investor Last month we highlighted the downward revision in Q...

Opening Statement from May 2014 Intelligent Investor (Part 1) First published on May 5, 2014 for subscribers to the Intelligent Investor We have been discussing the relative progress made in...

We recently ran across this excerpt from an interview given by Mike in June 2012, discussing the Rape of Greece by the Jewish bankers. You sure aren't going to hear this from the Kosher media because...

Normally, these libertarian goofballs lack sufficient knowledge to put forth an argument in support of their pro-fascist views. By now you probably know who the libertarian goofballs are...the Peter S...

Opening Statement from April 2014 Intelligent Investor (Part 1) First published on April 2, 2014 for subscribers to the Intelligent Investor Over the past couple of months we have highlighted...

Originally Published on March 2, 2014 in Part 1 of the March 2014 Intelligent Investor It is always important to remember that salesmen always have reasons why something they sell or promote will g...

Today, Detroit's emergency manager announced a plan for the city to emerge out of bankruptcy. Throughout Detroit's solvency crisis, investment pundits and other hacks and lackeys have spread rumors an...

Originally Published on January 6, 2014 in the January 2014 Intelligent Investor As we enter the New Year, US economic data is gaining momentum. Meanwhile, the confirmation of the Fed’......

Originally published on January 5, 2014 in the January 2014 Intelligent Investor Although the European Union continues to gravitate towards a deflationary environment, there have been modest...

You have probably heard what the clowns in the media have said about the economy. Unfortunately, the media is littered with misguided salesmen like Peter Schiff, Mark Faber and other gold deal...

We have released a nice 10-minute video presentation summarizing the economic landscape since the 2008 financial crisis. Included in this overview is a consideration as to where the US economy...

Last month we reminded readers about the earnings weakness we have been discussing since early in the year. Specifically, we felt that the second half of 2013 would be met with greater than expected w...

We have just released a 2-part video presentation covering some select topics for discussion and analysis. Each video of this 2-part video series is approximately 40 minutes in length. This vide...

Originally published on November 4, 2013 (November 2013 Intelligent Investor, Opening Statement Part 1) As previously discussed, the recent sell off in bonds has been due to the outlandish response...

Over the past several months we have been warning about what we felt would be earnings weakness. Since June, S&P earnings growth for Q3 has now been slashed by more than xxx. While this may seem a...

In mid-September, the Federal Reserve decided not to begin tapering as we predicted. As you will recall, we have been warning readers since May that the US economy was weakening. This was in contrast...

Please enjoy the video below. Feel free to share it or upload it anywhere you wish. Check Our Current Newsletter Promotions...

In this video, Mike discusses an aspect of the Fed’s recent decision to hold off on scaling back on its bond-buying program that you probably have not heard or read about.

Recently, the Fed stated that the economy had weakened somewhat relative to its previous assessment in late May. We had already warned that the Fed would need to readdress investors once the...

The emerging markets have continued to weaken along with Europe, as the US economy and stock market gain more momentum. India was the first of the three major emerging markets we cover to show weak...

Last month we discussed the fact that we felt the Federal Reserve had expressed too much optimism with regards to the progression of the economic recovery in the US. In addition, we also discussed t...

Although we have seen some noteworthy earnings disappointments for Q2, this has been overshadowed by overall impressive results as well as upbeat estimates for Q3 and even Q4. In short, the US stock m...

Since we first published The Implosion of the Commodities Bubble we have added more charts and content, so check it out! Click Here. We have been warning about what we felt would...

July 2013 Intelligent Investor (Part 1) Opening Statement Originally Published on July 7, 2013 The correction in the commodities bubble continues, as overall global demand continues to...

As we have been discussing for several months, the global economy continues to weaken. Although the establish economists have been forecasting a stronger second half for 2013, we have been warning our...

We just published a brief update discussing how recent developments have altered our US and emerging markets forecast, along with trading guidance. This video presentation is available to subscriber...

You have probably heard what the clowns in the media have said about the economy. Unfortunately, the media is littered with misguided salesmen like Peter Schiff, Mark Faber and other gold deale...

Recently I wrote an article discussing reasons for the retreat in gold pricing. As I have done countless times in the past, I pointed out the common myth held by gold bugs that gold protects against i...

In this 11-page overview we discuss the health of the U.S. economy, including comparisons of its real credit rating with the rest of the world. We also discuss corporate earnings, what to expect from...

Hell, someone had to do it.

Originally published in the August 2012 Intelligent Investor, Part 2 As detailed in many issues of this publication for some time now (as well as in America’s Financial Apocalypse), the U.S. go...

The large wealth and income inequality in the U.S. has continued to widen for nearly three decades. Over the past few years the disparity has become even larger. For instance, the top 1% of income ear...

Although poverty rates have been high in the United States for over a decade, they have increased appreciably since the economic crisis. As first detailed in America's Financial Apocalypse and discuss...

Originally published in the September 2012 Intelligent Investor Each year, Washington spends money to provide a variety of services. Ideally, Washington should only spend as much as it takes...

Fiscal cliff negotiations turned out to be a disaster. As you will recall, the fiscal cliff referred to automatic expiration of numerous tax breaks and expenditures. It was meant to serve as an econom...

As the Fed continues with quantitative easing, commodities continue to sell off as expected. This makes sense if we consider the primary force driving commodities right now is the global economic slow...

Last Friday the Labor Department reported that non-farm payrolls grew by 155,000 jobs last month, slightly below November's level. Last Tuesday marked the commencement of Q4 earnings, with Alcoa meeti...

I have been discussing the adverse impact of U.S. trade policy on America’s working and middle-class for several years now. I began this discussion in America’s Financial Apocalypse. As m...

Little has changed since we released the last monthly publication. The global economy continues to weaken. Europe is sinking deeper into recession and even Germany is now most likely headed for a cont...

Based on the performance of several stocks considered to be very reliant on the outcome of the election, it appeared that Wall Street had determined at least a few weeks ago that President Obama would...

One cannot deny that the chart of the Dow looks impressive since March 2009. This is by no coincidence. A trend of record earnings have combined with record-low Treasury yields and the safe haven stat...

In this article, you are going to see what has happened to America, what the future holds and who is responsible for the nation's decline. See Also: Free Trade And The Suicide Of A Superpower (Part...

In this 14-page article, Mike details the inner workings of how the global game is played, explaining the macroeconomic forces that underlie the risks and merits of investing in the U.S. and other wor...

This article was originally written in 2012 as a followup to the material I first wrote about pertaining to US trade policy in my banned 2006 book, America's Financial Apocalypse. This book was not on...

We have released a PDF of the Opening Statement as well as the Employment analysis from the August 2012 Intelligent Investor.

We have released a presentation on the Fiscal Cliff situation first published in the August 2012 Intelligent Investor.

Economists, analysts, policy makers and of course central bankers are always paying attention to the household savings rate data for a variety of reasons. Regardless of the reason for their interest,...

This article was originally written in 2012 as a followup to the material I first wrote about pertaining to US trade policy in my banned 2006 book, America's Financial Apocalypse. This book was...