Subscription Agreement for Clients and Members

Last revised on November 12, 2022

AVA Investment Analytics reserves the right to refuse to conduct business with anyone who we believe poses as a risk of disseminating our research or analysis, direct or indirect monetization of our research or analysis on another platform, anyone who has violated the terms of this agreement, or for any other reason related to protecting the proprietary nature and exclusivity of our research based on our discretion.

We explicitly prohibit newsletter publishers, research analysts, or any other provider of financial data, analysis and/or investment guidance access to our research publications.

We explicitly prohibit research subscribers from communicating our research, analysis, and viewpoints to anyone or any firm that publishes or discusses economic, investment and/or political research to any venue. All research materials published by AVA Investment Analytics are to be held in complete confidentiality.

Any such publisher who wishes to utilize our research publications in any way (direct or indirect) must contact us to arrange a licensing fee or some other form of compensation depending on the situation.

Any subscriber found or suspected of disseminating our research or analysis without our prior written authorization will be subject to legal retaliation.

We reserve the right to deny our research to all publishers of financial data, analysis and investment guidance, as well as anyone who we believe might disseminate our analysis or insights to others.

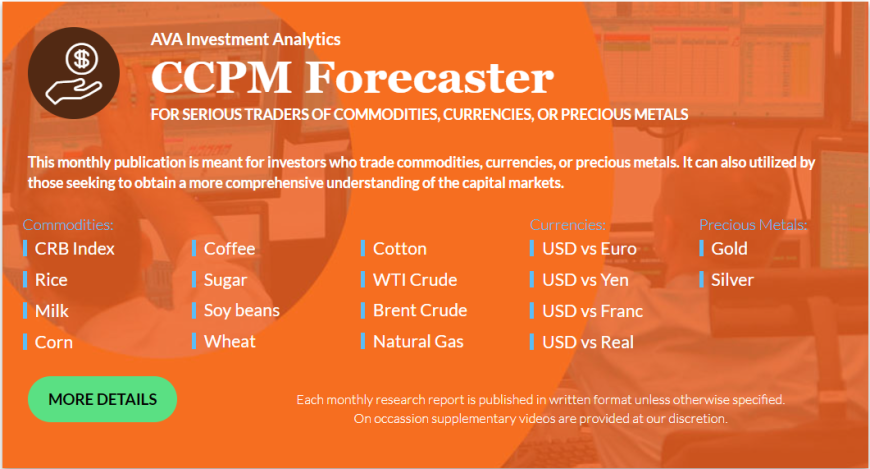

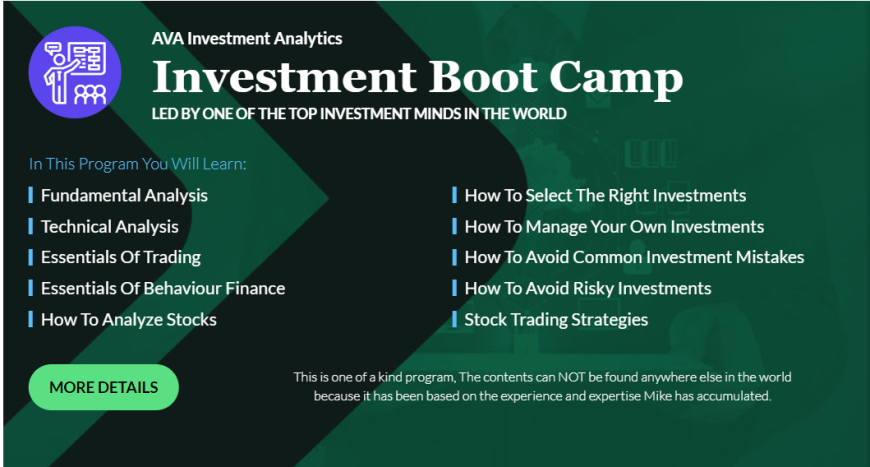

Each of the monthly research publications offered on a subscription basis (Intelligent Investor, Dividend Gems, Market Forecaster and Commodities, Currencies and Precious Metals Forecaster) are published by, supervised under the direction of, and/or approved by Mike Stathis, the Chief Investment and Trading Analyst of AVA Investment Analytics (here after known as the Author). Neither Mike Stathis nor AVA Investment Analytics is a registered investment advisor.

We do not provide any refunds, nor do we offer any guarantees. Your results will depend on how YOU interpret and utilize our research. And your results will also be based on your judgment, skill level, and many other variables.

Our research is designed to provide a basic foundation with which investors can use in the customization of their own investment strategies. However, our analysis can be wrong or things can change prior to our realization of changes that might impact our analysis and conclusions. Therefore, all research subscribers should use our research only as a basic guide and understand that our conclusions may not apply to you for your specific situation.

If you have conformation bias or have developed preconceived notions based on what you have read or seen from media or other sources, you will have a difficult time interpreting and acting on all quality research, including our own.

If you have poor judgment, you may misinterpret our research or you may implement strategies which do accurate utilize our research.

Types of Subscribers to Our Content

We have three types of Subscribers.

1) Retail investors

2) Financial advisers

3) Institutional investors.

Retail investors are defined as individual investors who do not work in the financial industry.

Financial advisers work in the financial industry and have access and/or manage accounts for clients.

Institutional investors include mutual fund managers and analysts, endowment and pension managers, fund managers and analysts of family offices, hedge fund managers and other financial professionals.

Use of Other Providers

You MUST agree to open accounts with all file sending services we select. This is the only way you will be able to receive research publications and access to research videos. There is currently no additional cost to subscribers to set up these accounts, but this could change in the future and without prior notice.

Again, there is no cost associated with setting up an account with these services, but we cannot speak to what the future holds. Because we pay for these accounts, we do not anticipate any fees being assessed by these companies to our members and research subscribers.

In the future, we could change these service providers or we could add additional services and/or service providers which might entail additional costs. You are required to open an account with any replacement or additional services and keep these accounts open throughout the duration of your subscription and/or membership in order to have access to our materials.

Website Member and Client Login Passwords

Members and Clients are expected to remember their website account passwords. If you forget your password you should use the automated password retrieval system instead of contacting us.

Subscribers to our monthly publications will be provided with one or more passwords required to access video research presentations. We will change these passwords regularly and we will send email messages when passwords have been changed. Each subscriber is responsible for taking note of the current password and all changes in passwords.

We reserve the right to charge for each password request we receive. If you do not want to pay to receive your password the best solution is to WRITE IT DOWN IN A PLACE where you can easily locate it. As well, take note of all password changes.

If you lose your password and do not want to pay for staff to provide it to you, you will be required to wait for the next month to receive it when new research publications have been released.

You Might Be Required to Apply for Access to Our Research

You may be asked to fill out an application form prior to receiving approval to subscribe to our research. You are expected to fill out the information requested in the application with complete accuracy and honesty. All of the information requested from the application must be accurate and up to date. We will verify all information.

If we find that any of the information below is found to be inaccurate, we reserve the right to reject your application. If any of the information you provide to us in an application form changes, you must notify us at info@avaresearch(dot)com within 30 days or you risk forfeiture of your research subscription and website access privileges.

You Cannot Republish or Disseminate Our Research and Other Content

Our content is intended only for the individual(s) who paid for the subscription to our publications or Website Membership. Website Members cannot discuss our content in the public domain or send any of our material to anyone without prior written approval.

Research Subscribers cannot send any of our research materials to anyone.

Research Subscribers cannot discuss the results of our analysis from any research publication, including webinars with anyone.

Our research is proprietary and protected by both copyright and trade secret law.

Moreover, Research Subscribers cannot use our research or insights for the purpose of benefiting any business related to investment or business analysis and forecasting. You cannot use our research to incorporate into any newsletters, commentaries, videos or other presentations unless you receive prior written consent from us.

Our research methods, insights and analyses are held as and protected by U.S. trade secret laws which are governed by the U.S.P.T.O. and are enforced worldwide. By accepting this agreement, you agree to accept all of our research methods, insights and analyses as trade secret.

Professional investors, fund managers and financial advisers can use our research for the purpose of advising their clients and managing funds and accounts. However, if you are a publisher of a newsletter (printed, digital, audio or video) or anything else that deals with the economy, investments, securities trading, investment analysis or anything related to these areas, you cannot subscribe to our research prior to disclosing this. And if you publish information in the future based on use of the methods, insights, and analyses obtained from our publications, you will be unlawfully disclosing our trade secrets and could be subject to legal actions.

We will determine to what extent, duration and any limitations and/or additional fees (not limited to licensing fees) we will impose based on all information you provide to us about your related business and your intent to utilize our research and insights.

If any of this information changes throughout the duration of your paid subscription to our publications or Website Membership, you are to notify us within 30 business days. If any of this information changes throughout the duration your paid subscription to our publications or Website Membership, and you fail to notify us of these changes it could possibly cause you to forfeit the remainder of your subscription or Membership.

Research Video Passwords

Under normal circumstances, research and educational videos will not be embedded on or directly available through the website. Therefore, these videos can only be accessed by logging into the website which hosts these videos. The links to these videos will be contained on the website and categorized by folders. These video folder links (i.e. Member 2015 Video Folder, Intelligent Investor 2012-2014 Video Folder) are located on a video index page within our website. The video index page can be found by checking under the top menu for LIBRARY. The video index page also has a link found on the upper left-hand side of the Home Page.

Research subscribers should familiarize themselves with the Monthly Research Release Schedule (typically a box located at the upper left corner of the website). This will discuss when each research publication is to be released.

Please Keep Your Personal Opinions to Yourself

We publish a variety of content in addition to the investment and economic research. The vast majority of this additional content, while not part of the research subscription, is made available to paid subscribers of our publications for the purpose of helping them better understand how media works, and the need to avoid it.

We operate a professional research firm.

Please do not confuse us for an ad-based platform whereby the publishers encourage feedback, as this is a scam designed to pull readers in deeper so that more ad revenues are generated.

If you do not like any of the other content we provide or if you are unable to comprehend the purpose of it, consult friends, family or seek professional assistance. But do not bother us with your issues. We do not operate a blog or provide a feedback system.

If you do not want to read articles that might "upset" or "offend" you, simply do not read them.

We typically do not send article email alerts, because we do not want to burden our subscribers. We do send alerts on occasion.

All Clients and Members have the option to turn off article email alerts by logging into their account on the website.

We Will NOT Respond to Emails that Use Anti-spam Systems

This is a notice to anyone who uses any type of anti-spam email system which requires us to click a link then enter certain codes in order to read the email that has been sent to us (e.g. Spam arrest).

We will NOT click any links regardless what that claim to be and we will not enter any codes in order to comply with some foreign email system.

We will NOT read or respond to such emails. If you want to ask us questions, please get rid of this ridiculous email system which places a burden on us and exposes us to potential phishing attempts.

Complimentary Membership

Although we MAY provide a Complimentary Website Membership to subscribers of our research publications, we do NOT provide access to the Member Video Library and other valuable resources. However (except for possible rare exceptions) all videos and audios contained in the Member Video Library can also be found in the Video Library of the research publications (usually these audios and videos have been previously released into the Video Library of one or more of the Newsletters).

In addition, we are under NO obligation to provide customer support pertaining to any Member-related issues to research subscribers who receive Complimentary Membership (or for those research subscribers who were allowed to use their membership fee as a credit towards the purchase of one or more research publications).

Finally, there is NO monetary value associated with Complimentary Membership. When you subscribe to one of our research publications, your rate covers the research only.

Handling of Emergency Issues

Because we are a small boutique investment research firm, we have greater limitations with regards to dealing with emergency and other unforeseen issues which could hinder our abilities to deliver research publications on time. Even though we will do all in our power to make sure to remedy all emergency situations, there is a possibility that we will be unable to deliver research publications to subscribers during one or more months. If this happens, all Clients and research subscribers will be notified. We will do our best to mitigate the situation. This might entail delivering the research in different formats (e.g. audio, video, written). The research might also be led by one or more individuals designated and approved by Mike Stathis, head of research and trading. If we are unable to publish research to subscribers for one month or more or if research is delayed by one month or more, we will credit each subscriber's account with the number of months research was not delivered as expected.

As of November 12, 2022, after publishing research since May 2009, we have never failed to deliver research publications to any of our Clients as promised even though we have encountered several unforeseen issues.

Lifetime Rate Lock-in

On occasion, we may offer (with limitations) the opportunity for retail subscribers to one or more of our research publications to lock-in their annual subscription rate (to be paid within 30 days of expiration of their newsletter subscription term) for life as long as they remain continuous subscribers and as long as they abide by the terms of this rate lock-in as well as the Subscription Terms.

We plan to notify subscribers that their subscription has ended so they can continue to receive this lifetime rate. We cannot guarantee all subscribers will receive a notification, nor do we guarantee such notification will be timely. If the 30-day grace period lapse without payment for the new subscription period, we reserve the right to cancel the lock-in rate renewal arrangement.

We reserve the right to repeal any lifetime lock-in offer due to any violations of our Terms and Conditions.

Promotions and Price Quotes

All promotions, price quotes and terms are subject to change or expire without any prior notice.

We generally honor all price quotes and promotions listed on the website, provided through email or any other means of written communication for ten (10) days unless otherwise noted.

Professional Investors Are Not Eligible to Lock in Rates

Financial advisers and financial institutions (including research analysts and fund managers) do not qualify for an annual rate lock-in.

Financial advisers, fund managers, analysts and other professional investors who wish to subscribe to one or more of our investment publications must pay the subscription rate for financial advisers or financial institutions even if they plan to use our research publications for personal use only.

Furthermore, financial advisers and financial institutions that are currently subscribed to the Intelligent Investor and wish to renew their subscription are required to renew at the applicable rate listed at the time when they renew, as given on the subscription page.

Any possible discounts we may offer to financial advisers and financial institutions will only be considered based on prepayment for multiple subscriptions and/or time periods.

We reserve the right to verify the status of each subscriber.

We also expect all subscribers to adhere to all copyright and trade secret laws. In no instance do we permit sharing of our research publications (including the investment newsletters) with other individuals or organizations. If we detect any instance whereby subscribers have violated our copyright and/or trade secrets, we reserve the right to cancel your subscription without any refund. In addition, you may be subjected to legal actions.

We also reserve the right to pursue damages in a court of law if our intellectual property rights are violated.

Membership

We may offer complimentary Membership benefits to newsletter subscribers at no additional cost. But this complimentary Membership may not include all content that paying Members receive. In addition, this complimentary Membership does NOT include any customer service whatsoever. We reserve the right to charge subscribers who receive complimentary Membership a fee for handling customer service issues pertaining to their Membership.

If subscribers who receive complimentary Membership violate our Code of Conduct, we reserve the right to terminate their complimentary Membership.

If for whatever reason newsletter subscribers are unable to access articles and other things on the avaresearch.com website, log into their account (Client or Member), we will not provide any credits, refunds or any other financial reward. Payment for research publications is only for research publications. Any and all publications or services we offer in addition to a research subscription (such as Membership) is offered with no warranties or guarantees.

You Agree to Accept Our Code of Conduct

If you do not agree to accept our Code of Conduct, do NOT use our website, do NOT subscribe as a Member and do NOT subscribe to our research. We reserve the right to terminate your subscription with no refund at any time and without prior warning if you violate our Code of Conduct. We will not tolerate any form of inappropriate or abusive behavior or comments in emails.

We do NOT acknowledge any form or so-called "political correctness" and we will NOT structure our content in order to satisfy rules of behavior that seek to comply with commonly accepted norms of "political correctness." This means we could use "foul language," gender specific slants, so-called "racial slurs" and so forth. The use of certain words are only harmful if you allow them to be harmful.

Furthermore, we do NOT acknowledge the term "racism." We believe it is a term created and used with the intent to manipulate the psyche in order to paralyze individuals into a fear of speaking facts.

We often discuss topics that are viewed as politically incorrect or even so-called "hate speech" by the powers at be. We do NOT recognize these ridiculous designations and we will continue to express our views unhindered. Although it is rare that we discuss such topics in the research, it is a possibility, especially during live webinars. More often, these topics will be discussed in the articles and videos we publish on the site.

Also see the section "Keep Your Personal Opinions to Yourself."

Penalties for Subscription Fraud

All prospective (and current) subscribers must subscribe to the option that fits their category. Failure to do so constitutes fraud. Upon detecting subscriber fraud, we will immediate terminate all subscriptions associated with the fraud without refund. We may also pursue fraud charges in criminal and/or civil court.

Subscribers must pay for individual research subscriptions. We own all copyrights to our publications. As a paid subscriber to one or more of our research publications, you agree to not distribute, republish or use any of the information, forecasts or insights from these publications for anything other than your own personal use.

You are not permitted to share the research or analysis with anyone without our prior written approval.

You are not permitted to disclose any securities recommendations, analyses, opinions, etc. in the public domain or with anyone without our prior written approval.

You are not permitted to use our research (all publications including all investment research) to manage any investment funds other than those directly in your name without our prior written approval.

If you are a financial adviser, fund manager, analyst, fund manager of a family office, pension or endowment fund manager, or other category of professional investor, you are required to disclose this to us as well as additional information we request in order to determine your eligibility.

If you fail to disclose that you are a financial adviser, fund manager, analyst, manager of a family office, pension or endowment fund manager, or any other category of professional investor, we reserve the right to terminate your subscription immediately without issuing a refund and to pursue a legal judgment against you and your representing firm for violating our intellectual property rights.

All opinions expressed on the website in the form of written articles, audios, videos, any research reports, special reports, or any other form of communication published by AVA Investment Analytics either located on , print or digital format are solely the current opinions of the Author and the staff at AVA Investment Analytics at the time they were written or otherwise communicated in relation to AVA Investment Analytics.

None of the Author, staff of AVA Investment Analytics owes any fiduciary obligation to any reader of the Newsletter. The opinions expressed on our websites (avaresearch.com and avaresearch.net) as well as in our research publications, webinars and consultations may be short-term in nature and are subject to change.

The Author is considered an agent of AVA Investment Analytics and is employed as a research analyst. The Author discusses analysis of securities which he may or may not hold positions. During periods when the Author discusses that he may hold positions or plans to liquidate, initiate or add to securities positions, the decision to follow through with these plans may change based on numerous variables.

Any mention by the Author of his own asset allocation, securities positions, trading, risk management or other strategies are only meant to serve as a general illustrative example and in no instance should readers interpret these disclosures, opinions and strategies to be suitable for their own financial profile.

It is the responsibility of each member and/or research subscriber to determine his or her own suitability for all recommendations and illustrations contained within our websites and research publications as well as all other communications distributed by AVA Investment Analytics.

Past performance is not indicative of future results. None of the Author, staff of AVA Investment Analytics guarantees any specific outcome or profit. All investments involve substantial monetary risk, including the risk of losing one's entire investment.

None of the information contained within any of our research publications, consultations and webinars constitutes, or is intended to constitute, a recommendation by the Author, staff or AVA Investment Analytics that any particular security, investment or strategy is suitable for any specific person. Each reader should determine his or her own investment suitability, preferably with the assistance of a registered financial representative or investment adviser.

None of the information contained in our research publications or in live webinars is intended to be personalized investment advice. Investments or strategies mentioned in our research publications or in live webinars may not be suitable for all individuals. Subscribers to our research should make their own independent decisions regarding risk and suitability. The material contained in our research publications does not take into account each subscriber's particular investment objectives, financial situation or needs. All subscribers should strongly consider seeking personalized advice from their own investment adviser.

We do not issue refunds. Under no circumstances will we provide a refund of the newsletter subscription, research subscription, website membership, or any other services. We provide investment research, analysis and educational material. Thus, there are no guarantees or warranties of any kind offered by this publication or on the web site, implied or non-implied. You should check our research publications track record prior to subscribing. If you have difficulties receiving the newsletter, you are expected resolve these issues, as we cannot control your Internet Service or email Provider.

If by chance an refund is issued, the individual or organization receiving the refund will be barred indefinately from subscribing to our research publications.

It is up to each reader to ensure they have provided AVA Investment Analytics with access to a working and reliable email account. We are not responsible for publications that may get lost in email transit. Readers are expected to contact AVA Investment Analytics if they have not received the scheduled publication as soon as possible.

The material contained in each research publication is protected by copyright and trade secret law and cannot be shared or discussed with anyone. Laws pertaining to copyright and trade secret will be rigorously enforced according to the statues set forth by the U.S. Patent and Trademark Office and the applicable Copyright Acts.

AVA Investment Analytics reserves the right to refuse to conduct business with anyone who we believe poses as a risk of disseminating our research or analysis, anyone who has violated the terms of this agreement, anyone we believe to be dishonest, or for any other reason we deem might harm our business.

We explicitly prohibit newsletter publishers or any other provider of financial data, analysis and/or investment guidance access to our research publications. Any such publisher who wishes to utilize our research publications must contact us to arrange a licensing fee. We reserve the right to deny our research to all publishers of financial data, analysis and investment guidance.

Everything We Publish Should Be Taken to Be Our Opinion

By using this website and research you agree that you have read the following statement, fully understand it, and agree to accept it as a condition for using this website.

The opinions, statements, comments, and remarks published as articles, audios and videos on this website (avaresearch.com) as well as affiliated sites under the control of AVA Investment Analytics should not be assumed to factual.

Even if we report or claim that something is a “fact” or is “factual” this claim or characterization should not be relied upon. All claims made by AVA Investment Analytics that something is a “fact” should be interpreted only as a figure of speech or an opinion.

Each reader should conduct his/her own research to determine for their own benefit whether all information published on this website is factual or simply our own opinion.

Membership Disclosures

Members do not have access to special data portals or any other premium service.

We do not guarantee members will receive access to any specific number of articles, videos or podcasts. These publications will be made available at our discretion.

All Members must accept our Terms and Conditions as a part of their Membership requirements.

We do not provide refunds for any reason.

We reserve the right to deny Membership to anyone if we feel could cause harm to us or our business.

We reserve the right to revoke anyone's Membership for violation of one or more statutes in our Terms and Conditions.

We reserve the right to change the terms of the Membership Agreement at ANY time, without prior notice or approval by current Members.

If you do not agree to ALL of the terms of this Agreement, including the Terms & Conditions, do NOT sign up as a Member or Client.

The analysis contained in our presentations (written, audio, video, and webinars) is intended for informational and/or educational purposes and discusses our own opinion(s) as of the date of publication of these presentations. The content contained in our presentations should not be considered to be a complete statement of material facts nor relied upon to be accurate, and therefore is not a sufficient basis alone on which to base an investment decision.

Our presentations do not represent personalized investment advice and should not be taken as such. We are not financial advisers and our presentation materials should not be interpreted to be financial advice. Prior to making any investment decisions, you should contact your registered financial representative to discuss your suitability. All information is subject to change without notice.

Predictions, forecasts, and estimates for any and all markets and individual securities should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments.

AVA Investment Analytics is not registered as a financial adviser. Our research and analysis are meant to be generic and should not be considered personalized financial advice. You should always consult your registered financial representative to determine the suitability of any actionable research we provide.

The presentation and analysis contained in our presentations is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument, nor is it an official confirmation of any transaction, or representative of an official position or statement of AVA Investment Analytics.

The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein.

The views and the other information provided in our presentations are subject to change without notice. All articles, videos, audios, and research reports (including all investment newsletters) published by AVA Investment Analytics are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally but should not be construed as a recommendation to buy, sell, or hold the company’s stock.

OUR RESEARCH METHODOLOGIES ARE PROTECTED BY COPYRIGHT AND TRADE SECRET LAWS. No portion of our analysis or research presentations may be discussed with anyone who has not paid to our research content. No portion of our content may be summarized, paraphrased, published, or posted to any platform by anyone. Violation(s) of these mandates will be considered infringement of our intellectual property and will be subject to legal action.

By registering with us as a member or client, you hereby agree unconditionally to all of the above terms and conditions.