Would you like to learn insights from the man who most accurately predicted the 2008 financial crisis?

Would you like to learn from the man who recommended Nvidia (NVDA) as his #1 pick for long-term growth in 2009?

Learn unique insights and strategies from the world's top investment analyst.

What Makes Our Boot Camp Series So Valuable?

The material found in our investment boot camp series is very unique, extremely valuable, and essential for stepping up your investment education to the next level. You won't find the material in our Boot Camp Series anywhere else in the world.

The material is unique, extremely insightful and has been created by one of the world's top investment minds backed by three decades of experience in the financial industry along with what we believe to be the world's leading investment analysis and forecasting track record.

Quite simply, the material in our Boot Camp Series will provide you with a Competitive Advantage.

More About Our Boot Camp Series

Our Boot Camp Series are Not so-called "investing courses," but rather a series of instructional videos presented to a live audience.

The lectures don't waste time on basic concepts you can learn from free sources.

Rather, each lecture has been designed to teach investors essential knowledge, insights, and skills required to raise their investment IQ so that they are able to better understand how the capital markets really work, how to analyze stocks, understand risk, and manage their investments.

The goal of this series is to provide investors with sufficient insight and knowledge in order to help them establish a competitive advantage when going up against market participants.

Boot Camp Series 2 Gives You Access to Over 40 Hours of Unique, World-Class Video Content.

Each presentation was created and delivered by Mike Stathis.

Our Boot Camp Series might be the world's best investment education.

What's the basis of this claim?

Because Mike could be the world's best investment analyst.

Please examine his investment research track record.

Check his research track record here, here, here, and here.

Mike's Financial Crisis track record may be found:

here, here, here, here, here, here, here, here, here, here, here, and here.

Netflix (NFLX)

How would you like to have bought Netflix (NFLX) at $0.30 per share?1

Mike recommended NFLX in 2008 to take over video rentals.

He recommended NFLX in the Wall Street Investment Bible (WSIB).

He predicted Blockbuster Video (BBI) would go bankrupt.

He recommended shorting Blockbuster Video in WSIB.

And he has recommended NFLX every year since then.3

1 He first recommended NFLX in the Wall Street Investment Bible.

Nvidia (NVDA)

How would you like to have bought Nvidia (NVDA) at $0.25 per share? 2

Everyone realizes how dominant Nvidia (NVDA) is today.

Mike recommended NVDA to his research clients in 2009.

He named NVDA his #1 stock for long-term growth in 2009.

Mike kept NVDA on this recommended list each year since then.3

He has forecast most of the major selloffs and nailed reentries enabling active investors to add even more gains.

1 this number had to be reduced to $0.30 per share relative to previous documentations of our track record in order to adjust for more recent stock splits, as of December 17, 2024.

2 this number had to be reduced to $0.25 per share relative to previous documentations of our track record in order to adjust for more recent stock splits, as of December 17, 2024.

3 as of December 17, 2024.

Mike Even Predicted the Exponential Rise in NVDA in 2017

He Also Warned NVDA Could collapse from $280 to $100 Ten Months Before it Happened

Learn How Mike Predicted Bankruptcies for Dozens of Companies Years in Advance

Below, Mike answers questions about our Boot Camp Series.

He also discusses How to Get Started as an Investor.

Mike has made many other amazing forecasts.

But there's much more to Mike's research than spotting future market leaders early on.

Ever since he accurately forecast the 2008 financial crisis nearly two years in advance,* he has accurately forecast most of the major stock market selloffs and recommended reentering at or very close to the bottom, enabling more active investors to add even more gains.

*See here, here, and here for Mike's track record on the 2008 financial crisis.

Mike is also one of the top distressed securities analysts in the world.

And he has the track record to prove it.

For instance, Mike predicted the following bankruptcies:

There's even a longer list of stocks Mike predicted would avoid bankruptcy after having become distressed.

This is where you can make huge money.

But you need to be very careful because if you're wrong you can lose it all.

If you're able to get it right just 60% of the time you're doing pretty good. Mike's track record of predicting companies that would rebound from being distressed is thus far 100% (as of February 2024).

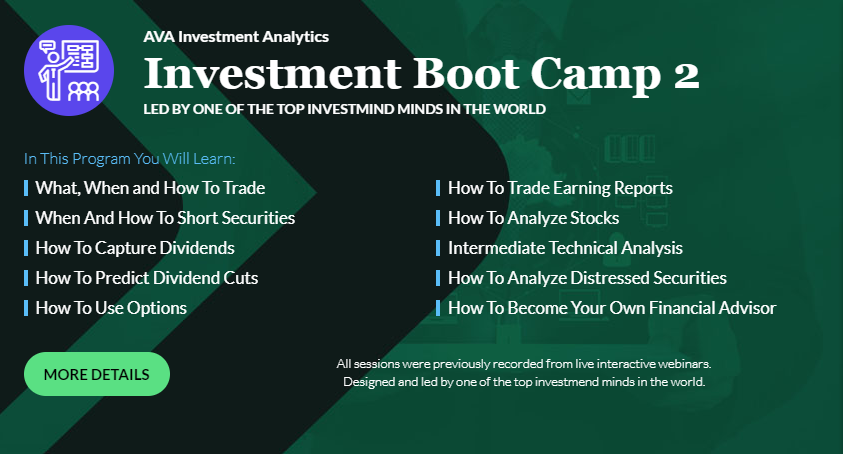

AVAIA Investment Boot Camp Series 2

12 Formal Video Sessions plus 4 Bonus Video Sessions

(Over 30 hours of Unique Educational Video Content from Mike Stathis)

In addition to the priceless education from this program, Mike analyzes several stocks

during the case study sessions in order to demonstrate the practicality of his insights.

Most of the stocks he highlighted led to huge gains in coming weeks to months.

List of Some of the Topics Discussed:

We only accept Zelle (zellepay.com) for U.S. customers.

Customers located outside the U.S. must send payment via bank wire.

If you reside in the U.S.A. please send payment via Zelle (www.zellepay.com).

You will need to first contact us to obtain the email linked to our Zelle and to confirm accurate pricing.

If you reside outside of the U.S.A. you will need to send payment via bank wire.

See here to learn how to make payment via bank wire.

NOTE: the current rates are extremely low given the world-class insights and analysis offered.

Rates will increase over time, so you should take advantage of these rates while they last.

This material is very unique, essential and extremely valuable for furthering your investment education. Perhaps most important, each presentation was created and delivered by one of the top investment minds in the world.

Having access to the best investment research in the world can only help you so much. If you do not understand how to interpret and utilize the research to suit your own skill level and investment strategy, you might not be able to properly utilize the research. Remember, real investment research does not advise you to consistently take specific actions. Rather, it provides general guidance with additional considerations which enable you to formulate a decision tree based on your own investment strategy along with any changes that occur once the research has been published.

In short, you must understand what you are doing. You must also have good judgment. This means you need to understand many things about the investment process that you will never learn from reading investment books. In fact, reading investment books is a huge waste of time and is usually even detrimental to becoming a really good investor. So where does one turn for the insight they need to become a great investor?

Unless you're a very experienced and successful investment professional, you're not likely to understand what you need to go at it on your own or even with our research. That's why we've created the AVA Investment Analytics Investment Boot Camp.

If you glance at the topics of discussion you will notice the absence of very generic and basic concepts such as a discussion of PE ratios and so forth. This was intentional. We want enrollees to get the most for their money so Mike has designed this program to include concepts and insights beyond the very basic material. Basic information can be obtained for free everywhere but is only worth what you pay for it which is nothing.

Most investors are likely to view this material as advanced. If you think this material is advanced, you have set the bar too low for yourself. If so, you most likely get slaughtered in the markets. We believe this material to be the bare minimum of what investors need in order to create a competitive advantage. And if you do not have a sustainable competitive advantage with regards to other investors, you had better have an endless supply of money or else you should expect to get slaughtered.

While these programs have been designed specifically for retail investors, even experienced financial professionals have told us that these sessions provided priceless insights they had never come across even after several years in the industry.

And if you are familiar with Mike's investment forecasting track record, the unique insights he has presented in his books, articles and videos, this should come as no surprise because he is clearly one of the world's leading financial minds today.

The material presented in these programs is 100% original and unique. You aren't going to find this material anywhere else in the world because it has been developed by Mike Stathis based on two decades of professional experience and success working in the capital markets as a financial adviser, merchant banker, analyst, hedge fund adviser and venture capitalist.

Subscribers to the Boot Camp Series will receive no less than one (1) year access to the Boot Camp videos.

After the one-year period they will be required to pay an annual fee to continue to access the videos in each Boot Camp Series.

You must agree to our and before you are approved to receive access to this video series.

Send us an email stating that you accept our and

By submitting payment for this program, you agree to accept the .

By submitting payment for this program, you agree to accept the .

If you have any questions or unsure whether you might be prohibited from accessing this video series based on anything written in these documents, please let us know and we will determine if we have a solution.

PLEASE EMAIL US FOR PAYMENT INSTRUCTIONS.

[1] The prices quoted are for one year of access to the videos. If you would like access to the course beyond one year, please email us.

[2] The prices quoted for the combined package is for two years of access to the videos. If you would like access to the course beyond one year, please email us.

The following is a list of some of the topics Mr. Stathis discussed in Session 2 of the Series 3 Boot Camp. The webinar was divided into two parts and lasted a total of 5 hours. S......

The following is a list of some of the topics Mr. Stathis discussed in Session 3 of the Series 3 Boot Camp. The webinar was divided into two parts and lasted a total of 5 hours. See......

The following is a list of some of the topics Mr. Stathis discussed in a special Preliminary Session 3 of the Series 3 Boot Camp, focused on advanced valuation considerations. The webinar......

The following is a list of some of the topics Mr. Stathis discussed in the first introduction session of the Series 3 Boot Camp. The webinar lasted 2 hours. See HERE & HERE&n......

AVAIA Boot Camp Series 2 Session 1: Overview of Trading Techniques In this session Mike discusses: Trading Tips – what, when and how to trade securities Trading in IRA-ty......

AVAIA Boot Camp Series 2 Session 2: Overview of Trading Techniques (continued)

AVAIA Boot Camp Series 2 Session 13: Distressed Securities Analysis Wrap-Up with Q&A

2017 AVAIA Investment Boot Camp Session 12: Introduction to Distressed Securities Analysis (Cont'd) Scheduled for Wednesday February 7, 2018 12:00 pm to 2:00 pm EST