Sales of Bud Light and other alcoholic beverage brands owned by Belgium-based AB InBev continue to collapse after the (fortunate) boycott by consumers.

Why are consumers boycotting ths iconic brand?

It's simple.

People are sick of the racist lies and hate rhetoric from "woke" propaganda.

Woke propaganda, disguised as "ESG" certainly has no place in corporate agendas.

Apparently, many Fortune 500 executives who embraced the woke agenda are beginning to realize they stepped into quick sand as consumers react negatively towards their woke ad campaigns.

For instance, data from Factset shows that firms in the S&P 500 have been emphasizing ESG less in the past few months.

Investors in these companies should hope this trend continues.

Let's take a closer look at the details behind the Bud Light boycott.

In March 2023, Bud Light formed a business partnership with "trans activist" and "influencer" (a.k.a scam artist) Dylan Mulvaney.

The partnership began with a sponsorship deal that was annnounced by Mulvaney in late March 2023.

By early April, Budweiser customers began boycotting the beer.

You might recall that Budweiser merged with the Belgium beer company In Bev to form AB In Bev, a few years ago.

The deal was led by Jewish-run private equity firm 3G Capital Partners located in Brazil.

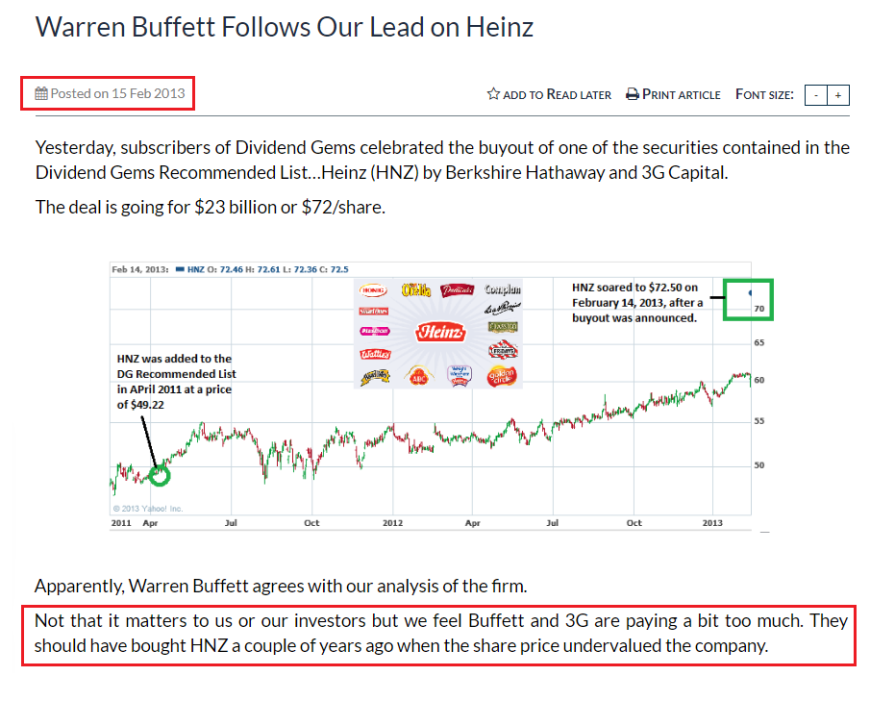

You might also recall that 3G Capital was responsible (along with Warren Buffett) for the destruction of billions of dollars in shareholder value when these investment "geniuses" structured the merger of Kraft with Heinz.

The problem was they paid way too much for the merger.

We owned Heinz for years in Dividend Gems, but had always shunned Kraft due to its excessive debt.

See Buffett Follows Our Lead on Heinz

When the deal between Kraft and Heinz was announced, I immediately realized Buffett and 3G were paying too much for Heinz. I discussed this in several research webinars. I also wrote about it.

See More Proof that Mike Stathis Is a Much Better Investor Than Warren Buffett

Similar to the Jewish-run 3G Capital, AB In Bev is also run by an army of Jews.

Berkshire Hathaway isn't much different.

Why is it important that I mention the role of Jews here?

For the same reason I have been highlighting the role of Jews in media, banking, finance and other sectors.

We are talking about the Jewish mafia.

It should be noted that the Jewish mafia is sole force behind the woke movement, as well as the White Nationalist Movement, the Alt-Right Movement, BLM, LGBT, feminism, affirmative action, open borders, and other movements that seek to weaken society.

If you don't already know this, you aren't too observant.

The individual at AB InBev most responsible for jumping aboard the "woke" band wagon is the company's Brazilian Jewish CEO, Michel Doukeris.

Doukeris approved the hiring of the Jewish liberal Alissa Heinerscheid as the company's marketing vice-president,

In the image below we see Alissa along side of her twin sister (separated at birth) who appears to resemble a lesbian.

It was Heinerscheid who decided to promote"inclusivity" in Bud Light ad campaigns which included paying more than one tranny to promote the brand.

The term inclusivity is synonymous with the promotion of everything that's weird and racist, from LGBT to anti-White propaganda.

You really can't make this stuff up because no one would believe you.

It's as if we are watching some weird fictional movie from Hollywood, called "The World Upside Down."

The only problem is that it's reality.

God help America, before it's too late.

If you don't already know why Mike is the world's leading investment analyst, we encourage you to take some time to examine his track record.

See here, here, and here for Mike's world-leading track record on the 2008 financial crisis.

More of Mike's track record can be seen here, here, here, here, here, here and here.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

For the 15th consecutive quarter, dividends per share (DPS) for the S&P 500 has grown at double-digit rates.

Can anyone offer any evidence that there is someone who is any better than Mike? If so, you would have already landed our $100,000 prize. The fact is that no can because...

Mike Stathis is simply the best. If you aren't aware of that, then you just don't know his track record. Perhaps you're spending too much time listening to charlatans.

Originally published on July 13, 2014. Once again, Mike Stathis nailed the most recent market sell off in April, having warned readers that the Dow Jones would almost definitely sell......

Opening Statement from May 2014 Intelligent Investor (Part 3) First published on May 7, 2014 for subscribers to the Intelligent Investor Moving past this period, we feel there is a good chanc...

Originally Published on April 17, 2014 from the Opening Statement of the April 2014 issue of Dividend Gems The harsh winter season has put a dent in the earnings of some retailers. But the bi...

Opening Statement from April 2014 Intelligent Investor (Part 3) First published on April 4, 2014 for subscribers to the Intelligent Investor In the Market Forecasting section (Part 2...

Originally Published on March 16, 2014 from the Opening Statement of the March 2014 issue of Dividend Gems Last month we discussed that the US stock market continued to rise almost irrespecti...

Originally Published on March 5, 2014 in Part 3 of the March 2014 Intelligent Investor Although we successfully navigated the most recent correction in the US stock market, we are faced with...

The release of this video is part of a new series we have recently launched for the purpose of helping the public become more familiar with the track record and insights of Mike Stathis. Those who a...

We will be making more of these videos in the future so the newer guests of the website can see that no one can come close to the track record of Mike Stathis. We hope to make 20 or more videos in 201...

Today, WellPoint (WLP) announced a $4.46 billion buyout offer for Amerigroup (AGP), causing shares to soar by 38%. Since being added to our recommended list just over two years ago, shares of AGP have...

We have received several inquiries recently from investors wondering whether it’s “too late” to purchase the video series we have been highlighting because they have seen how we nailed so many of thes...

Here, we provide readers with a glimpse of our market forecasts between February and April 2012 demonstrating once again that we are the best market forecasters in the world. As many of you recall,...

Originally Published on March 13, 2012, Dividend Gems Opening Statement In late January the Federal Reserve Bank announced that it intended to keep short-term interest rates at current...

Last week, we showed how the Dividend Gems Recommended Securities List was holding up through the current market correction, from the time the May issue was released, through June 2. The performance o...

The winners keep on rolling in. The chart below shows the past 12 months of a stock I have loved for several years. Like many of my past small and mid cap growth stories, this one was un......

On April 5 before the U.S. market opened, we released the monthly issue of the Intelligent Investor; about 70 pages discussing everything from domestic and global economics, to currency, gold, silver,...

What is you knew when to sell the stock market in May and when to buy it back? If you knew this information, you wouldn't even need to know a thing about securities. All you would need to do is sell w...

Over the past several months we have been publishing the spectacualr outperformance of the securities in the Dividend Gems Recommended List. Here, we show the performance of each of th......

How much more will the stock market decline? Should you sell? When should you buy?

While the 10-year U.S. Treasury Note continues to languish in a sea of global uncertainty, all while short-term interest rates remain at dangerously record-low levels, more than 200 U.S. listed securi......

Approximately three months weeks ago the U.S. markets began to correct. We warned about this first correction in the May issue of our firms paid research publications.

On Friday, Amerigroup (AGP) reported disappointing earnings partly due to an account error. However, after adjusting for this issue, earnings still came in considerably lower than consensus. The...

I'll be short about this because I have better things to do than devote my time to useless companies who boast a basic website as their main asset. For several years now, LinkedIn has blatantly v...

As the market has sold off over the past month, the Dividend Gems Recommended List has once again outperformed. Below are charts representing EVERY security in the Dividend Gems Recommended List so yo...

The market has been boosted recently by strong earnings from INTC and others. This latest round of earnings has largely dampened any negative sentiment that may have been rising due to so-so earnings,......

We wanted to take this opportunity to remind you about our newest investment newsletter, Dividend Gems.

Just some quick thoughts, nothing set in stone here. Earnings are starting to come in a bit "ify;" not so great, but not bad. Expectations are key. Starting to see a few m...

Wednesday, March 2nd: US (Fed’s Beige Book, MBA Mortgage Applications, Challenger Job Cuts, ADP Employment Change); EuroZone (Euro-Zone PPI); Latin America (Brazil rate decision). Thursd......

In the November 2010 issue of the Intelligent Investor newsletter, our Chief Investment and Trading Strategist, Mike Stathis added Atheros Communications (ATHR) to his recommended list. At......

(website issues are being addressed) Funds Flow Out of EM Equities and Into Bonds Emerging market (EM) assets showed mutual fund outflows of $1.4 billion in the week to 23 February 2011, with inflow......

As many of you know, we just launched the first issue of our newest investment newsletter in February called Dividend Gems. Given the recent correction in the market, we wanted to show the perf......

We will be releasing a commentary written by our Chief Investment Strategist, Mike Stathis some time this evening for subscribers of the Intelligent Investor and Market Forecaster newsletters. Mike......

Mike has added 2 new stocks to his recommendations contained in the Intelligent Investor, one soft line retailer and the other from high-tech. Subscribers who did not receive this brief report, pleas......

A couple of days ago I showed you how a stock I had been in and out of for over a year had performed since recommending another entry point in the January 2011 newsletter.

Just a note to those who haven't signed up yet for the newsletter. In just three days since the newsletter was released, one of Mike's most highly recommended stocks soared by more than 25%. Hav......

I'll be brief here. If you retrace the events over the past two years and you are familiar with the market activity, you will come across one recurring trend; the timeliness of bailouts and other meas...

Buy you ask? Yes. Not stocks, unless you’re talking about oil. And unless you’re the best of the best of traders you’ll probably want to buy the oil trusts, but only if you b...

I want to warn those of you who have accounts with Charles Schwab to close your accounts immediately. The situation involves errors in order entry for which Schwab refuses to acknowledge or correct.

Early last month, the Commerce Department released the latest GDP data. For Q2 of 2010 the GDP growth came in at 2.4%, missing the consensus estimate of 2.5%. The Commerce Department also released it...

Effective immediately, and for a limited time only, we are offering readers a transcript of a recent interview given by Mike Stathis, the Chief Investment and Trading Strategist of...

Today, the criminal PR arm of Wall Street, CNBC, interviewed Alan Greenspan hoping to draw a big audience of sheep using the "big name" tactic. Forget Greenspan is the single person most r...

I hate repeating myself over and over. Who doesn't right? Well, it's especially cumbersome to repeat oneself when the only form of communication you have is writing (albeit with extr...

I'll be concise here. The White House's recent 6-month ban on deep water drilling could send ripples throughout the industry, specifically for oil exploration firms that have a large amount of ul...

I've added this question to the website poll to the left, so I want to encourage you to take a stab. Before you place your vote, I will go ahead and tell you the answer is NOT Greece. So y...

I wanted to give you an overview of what I see today and explain how you should view things, emphasizing the need to understand your own investment strategy, because I know that those who read th...

As subscribers to the AVAIA newsletter know, the special report released on May 9 was quite accurate. In short, anyone who had access to the special report could have avoided up to an ...

A couple of weeks ago, I released a report discussing how I was able to get in on Merck for big gains, while virtually everyone else left the company for dead after the Vioxx scandal played out. /arti...

In the past, I have addressed the errors made by Peter Schiff's analysis of the economy and healthcare. For those of you who are still behind the curve and actually think Schiff...

Subscribers to the AVA Investment Analytics newsletter will be receiving a special report that discusses forward direction of the market, as well as analysis of selected securities. Thi...

In the Wall Street Investment Bible, I discussed other securities I that had a good chance of bankruptcy down the road (e.g. Blockbuster and Sirius Satellite). Regardless what ultimately happens...

Rather than a sigh of relief, Greece's bailout signals more to come from Eastern Europe. And rather than a more peaceful Greece, it the EU-IMF bailout is likely to result in major riots and...

Okay folks. I've been working on the May newsletter over the past few days and one of the securities submitted for analysis was Monsanto. I've actually meant to do some write-ups on the controversial...

I don't want to waste anymore time on this than I have to. Let me just say that the SEC's latest bogus attempt to prevent another securitized asset blow up is a complete joke. The SEC ...

Before I begin, I would like to say that most of you will need to actually study this article. You will need to read it and reread it. You will need to look at your own charts of the Dow.....

Here's an article discussing the fact that JP Morgan and Citigroup escalated the collapse of Lehman Brothers by increasing the collateral and altering terms and conditions for lending.

The past six trading days has not been kind to the market, despite some rather good earnings reports from AMD, GOOG, and many other companies one might expect to not be faring so well. However, one of...

This is just a reminder to those who don't know about me.

A couple of weeks ago, I wrote a piece discussing allegations of insider trading and illegal naked short selling of Washington Mutual, involving the banking cartel and potentially their hedge fund cli...

For years, investors boasted what a great company General Electric was. Even CEOs marveled at the company's ability to consistently deliver strong earnings growth despite its massive size....

This September 25th 2009 marked the one-year anniversary of Washington Mutual’s seizure, by the Office of Thrift Supervision (supposedly) as a result of insolvency (supposedly). Last year, on O...

Hopefully, you have read my recently released SEC complaint alleging insider trading and illegal naked short sales involving the banking cartel, as well as criminal involvement of former SEC ...

My advice is to find some people who you trust; those with proven track records, those who are not tied to the television shows. Figure it out. You are only going to be misled by the mainstream med...

It’s extraordinarily rare to find a book that provides specific securities analysis, enabling investors to profit based upon the recommendations. One of the reasons this is such a rare event is...

Just off the press, UK Prime Minister Gordon Brown has warned about the critical juncture of the economy and has warned about spreading the propaganda of a recovery. http://finance.yahoo.......

I don't know if anyone read the two posts I made on Monday about healthcare and HMOs, but they were lost when the site was hacked since I did not have a backup that recent. Anyway, in cas...

That's right, I said free. I'll even pay for shipping. All you have to do is help yourself. Okay, so what does that mean?

I've been working feverishly trying to complete my healthcare book. It's been a very difficult challenge juggling this project off-and-on for three years.

To those of you who say it's impossible to time or forecast the market; to those of you who keep wasting your time reading and watching the clowns positioned as so-called "experts" by the me...

Despite a big boost in shares in after hours trading, Wednesday's (disappointing) earnings for the online auctioneer represent a continuing trend that will not be broken anytime soon. Yes, t...

Today after the bell, Intel's only major competitor AMD reported disappointing earnings, missing by a large mark. This confirms what I discussed in the recent report released to newsletter subscribers...

I ran across this ridiculous headline on Yahoo! Finance (which is nothing more than the CNBC of the Internet) and I wanted to make a few comments.

An article from the Huffington Post today claims that Ford is "secretly" in talks to sell Volvo. First, let me say that this is another example of the media trying to create the perceptio...

The following report was released on June 10th as a follow-up to subscribers to the June newsletter.

ATTENTION TRADERS: Options go on sale next week! Starting June 15, Bernie Schaeffer is releasing 10 hot trades targeting gains of +100% or more. And each trade will close by June 19. 5 Days 10 HO......

I ran across an interesting announcement that bodes well for Fidelity and KKR. But I’m willing to bet it will be a bad deal for unsuspecting Fidelity investors. Kolberg Krav...

Early last year, I made a prediction that seemed obvious, given what I knew about the banking system and the fate of the stock market. I predicted there would be thousands of hedge funds shutting down...

Just a note about my postings. Some of you may be wondering why I have been making so many posts about the media, while ignoring the market and economy. The reason is two-fold. First of all, u...

In the recent past, I have cautioned investors against becoming prey to the vultures seeking to exploit your desperation, panic, fear and in some cases, ignorance of what the future of the capital mar...

Many of you who have followed me and read my most recent books (The Wall Street Investment Bible/2009 and America’s Financial Apocalypse/2006 & 2007) know that I feel the SEC is beyond...

I'm getting quite bored watching the latest economic headlines surface. Bored you say? Yes BORED.

The stock market (the DJIA) is now very close to fair value from a long-term perspective (if that even means anything to an individual investor, which it may not). Those who read America’s Finan...