I continue this series on Harry Dent from two previous articles, here and here.

Seizing upon his media “celebriy,” (which essentially means you have sheep lining up for your perceived expertise, created solely by being seen on television) Dent formed an ETF in 2009 called the Dent Tactical ETF (DENT). This is one of those actively managed ETFs you may have heard about.

The fundamental problem with actively managed ETFs is that they absolutely defeat the purpose of ETFs; low fees. Actively managed ETFs charge higher fees for management of the holdings.

Although most actively managed ETFs still have lower fees than non-index mutual funds, if given the choice between the two you’re better off paying higher fees and buying mutual funds. Of course that assumes you were only given those two choices, as I am not a fan of mutual funds, especially during bear market periods.

If you don't already know why, click here.

Target date funds offer another false epiphany. Click here to see why.

The logic behind actively managed ETFs is nearly as flawed as active management of mutual funds (like Fidelity’s widely advertised and I should add completely useless program). You cannot provide any real value using either approach. In each case you are paying higher fees in exchange for some decision-maker to essentially throw darts.

When the actively managed ETF holds several ETFs, as is the case with DENT, it’s an even worse situation. Active management is best utilized for managing individual securities because you are able to base your decisions on the fundamental and technical data of each security.

Just by reading the description, it’s obvious to me the Dent Tactical ETF (DENT) is a completely useless investment vehicle, unless your goal is to have fees deducted from your account while losing money.

The objective of DENT is long-term growth of capital. It invests in other exchange-traded funds, and shares of certain exchange-traded products, including but not limited to, exchange-traded notes, exchange-traded currency trusts and exchange-traded commodity pools. It also invests across several assets such as domestic and foreign equities, domestic or foreign fixed-income or commodities.

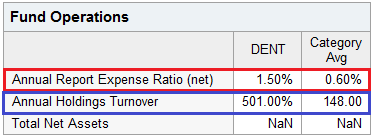

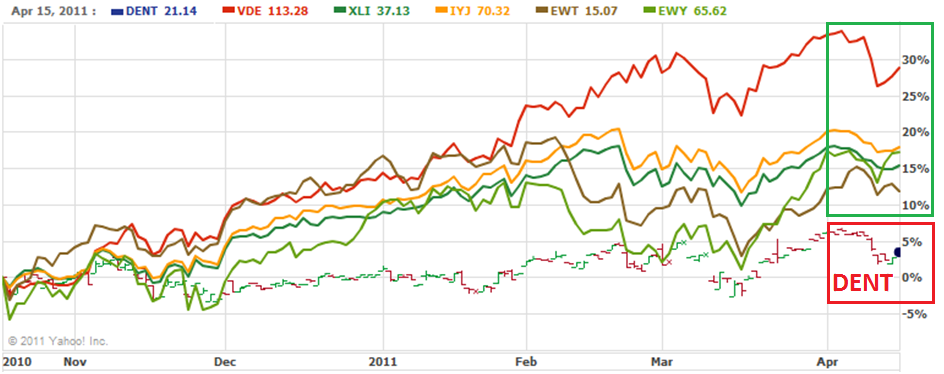

Let’s have a closer look at the Dent Tactical ETF (DENT). As the chart below shows, since inception, DENT has delivered miserable returns when compared to the Dow, Nasdaq and S&P 500. In addition, after deducting the 1.5% annual expense ratio, you’d end up with a nice annual loss.

Take a look at the turnover ratio, at over 500%. A high turnover ratio means the funds asset base is being bought and sold many times over the course of a year. With that much activity, how can Dent’s fund have such terrible returns?

The answer is simple. The fund manager appears to be confused.

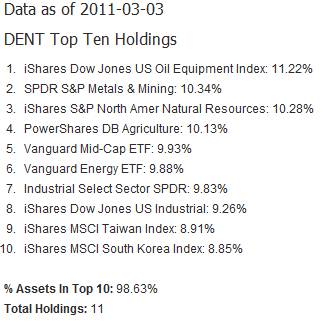

Below is a list of DENT’s holdings. As you can see, rather than individual securities, it holds other ETFs.

Why would DENT hold different ETFs rather than individual securities?

When you cannot decipher fundamentals and technicals of individual securities in a manner that leads to investment gains, you might decide to revert to a macroeconomic approach in order to determine broad trends. This is the basis behind sector funds or sector allocation. In general, this strategy is largely useless. The problem with the sector-rotation approach is that there is often a disconnect between investment gains and macroeconomics, both in time and correlation.

Furthermore, by rotating in and out of sectors, you miss out on the upside offered by strong fundamentals and/or price momentum of individual securities within the sector. Thus, this approach is utilized by individuals with no ability to distinguish between the fundamental and technical merits of individual securities.

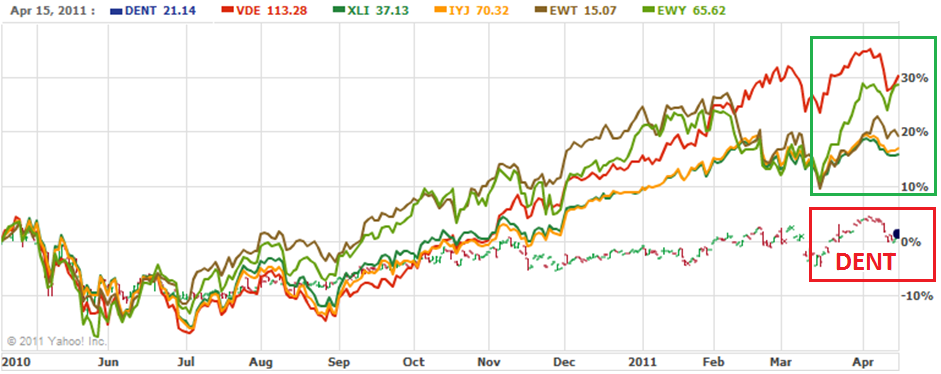

Okay, so the previous chart demonstrated how DENT has been a complete failure. But let’s have a look at the individual ETFs the fund manages and see how each has performed versus DENT. The performance should be fairly close, right?

Theoretically, if you can add value by actively managing a basket of ETFs, you should be able to outperform the ETFs you are managing by an amount greater than the annual expense ratio, right? Otherwise, why would you pay higher fees?

The first chart below shows the performance of DENT versus the first five ETFs in the list above. The second chart shows the performance versus the second five ETFs.

Are you ready to get blown away?

Have a close look at the performance of DENT versus the first five of the March 3, 2011 EFT holdings since inception of DENT.

Now let’s look at the same chart over the 1-year and 6-month time frames.

As you can see, you could have just bought and held any one of these ETFs since inception of DENT over the past year or 6-months and you would have blown away the performance of DENT. This demonstrates the value of DENT’s active management. It’s clearly been destructive.

Okay, well maybe DENT outperformed the second five ETFs managed by the DENT fund. Let’s have a look at the same time periods (inception, 1-year and 6-month).

That’s right. You are reading the charts correctly. Every single ETF listed in DENT as of March 3, 2011 has trounced the performance of the DENT ETF!

Not only does DENT significantly underperform each of the ETFs it invests in, the sheep who own DENT are actually paying 1.5% of their investment each year for DENT to mismanage these individual ETFs to the extent that they have offered essentially no net investment gains (after deducting compounded annual fees) after two years. This is shocking.

In other words, if you had bought and held any one of the ETFs “actively managed” by DENT, you would have made anywhere from decent to a good deal of money depending on which ETF you chose. Furthermore, all you needed to do was to use a buy and hold strategy!

Finally, if you had purchased any one or these funds (or even a basket of your own) your fees would have been significantly lower.

Now, the ETFs held by DENT as of March 3, 2011 may very well be different than the ones DENT has held in the past. But that really doesn’t matter. All that matters is that DENT has been a complete disaster.

Below is the most recent list of ETFs held by DENT.

I never thought I would ever come across anyone who would challenge Martin Weiss’ disastrous performance, but DENT has.

Dent’s Mutual Fund Disaster

The miserable performance of Dent’s ETF is just another chapter in his career of spin, massive marketing, Monday morning quarterbacking, and miserable investment advice. But his terrible track record didn’t stop him from reigning in even more sheep. After Dent became a media whore for CNBC and the fund industry in the late 1990s, he started a mutual fund through AIM called the AIM Dent Demographic Trends Fund (ADDAX). This was a mutual fund ascribing to the Dent “path to riches.”

You see, mutual funds are primarily marketing machines, so AIM wanted to leverage the “brand” name of Dent after he had made countless appearances on CNBC. This also accounts for reason why virtually every one of the so-called experts interviewed by the financial media are all sell-outs, virtually all with terrible track records (I have noticed a strong positive correlation between the frequency of media appearances and the inaccuracy of track records).

These “Wall Street gurus,” “hedge fund managers,” “market mavens” and real estate “experts” realize that the easiest road to riches is to take the path blazed by Donald Trump, Robert Kiyosaki, David Bach and several others; cheese ball branding.

When it comes to mutual funds, it’s all about marketing. The fact is that unless you don’t have much money at all, equity mutual funds are essentially useless due to high fees (which add up over time), lack of risk management, and other disadvantages which assure the fund will be fully invested when the stock market collapses.

See here if you want to learn the truth about mutual funds.

Perhaps the most important thing investors must understand is that CNBC and the rest of the financial media (FBN, Bloomberg, Wall Street Journal, Barron’s, Financial Times, Forbes, Fortune, etc.) interview hacks and/or naïve clowns. And they position them as experts, despite the contrary. The media industry engages in this fraudulent behavior because its objective is to serve those who buy the ads; Wall Street and corporate America.

Thus, the media’s objective is NOT to provide its audience with credible experts with good track records who will guide you. That is merely the perception created by the media. The real objective is to confuse, frighten and mislead its audience such that Wall Street and corporate America are better positioned to take in more money from its naïve audience, whether it comes in the form of steering its audience towards the wrong side of the trade, encouraging more frequent trading activity, or buying into their mutual funds and insurance products.

Here are some examples.

1. Confusion and excitement as delivered by the trash aired on CNBC creates more trading for online brokers who spend huge sums of money advertising in the financial media.

2. Spin, exaggeration, poor guidance leads to more dumb money entering the wrong side of the trade compliments of the media’s audience (the sheep). Wall Street is always on the right side of the trade, but the media makes you think Wall Street is telling you the right side of the trade when in fact they aren’t.

3. Analysts and fund managers are interviewed by the media where they discuss their favorite stocks, etc. After the sheep audience buys them and pushes up the price, the Wall Street firms or fund managers dump them causing the price to drop. Wall Street also helps lure in the sheep through timely block purchases of these securities shortly before, during or after the segment has aired.

The clowns interviewed by the media know that if they give the media what they want, they will receive more interviews which translates into millions of dollars in free marketing. With media exposure you can sell a very large number of books, even if they are useless for investment purposes.

The list of useless investment-related books published over the past few years alone easily exceeds the one thousand mark. And if it’s a best-seller, you can be certain that it’s useless because that means it’s been well-received by the Main Street, which is largely unsophisticated when it comes to the investment process (at the very least).

You can also start a mutual fund that delivers miserable performance and sell it for a few $100 million, like David Tice has done with the Prudent Bear Fund.

It’s puzzling why so many investors would remain in a fund that has a short strategy, yet has delivered no net investment gains over the past 15 years despite the fact that the stock market suffered from two of the most severe implosions since the Great Depression.

In the near future I will go over Federated's Prudent Bear Fund. As you will see, the returns have been bearish since inception.

You should note that Tice, Schiff and the rest of the dog-and pony show are all colleagues. The ways one can become wealthy by serving as a media whore are endless.

Financial marketers understand that the real key to riches isn’t by having a good understanding of what’s going on in the investment markets. The key to riches for these guys is getting as much media exposure as they can because this lures in the sheep who will line up to buy any book, newsletter or fund these guys pitch. It’s amazingly sad that so many people are so lazy, naïve and plain stupid not to do the required due diligence on these clowns.

How did Dent’s mutual fund do?

After raising over $1 billion from CNBC sheep, the fund collapsed due to the implosion of overvalued dotcoms which became dotbombs. The fact is that if Dent had picked some better dotcoms the fund would still be around today.

It should be crystal clear that Dent is no different than others who have been embraced by the media as credible experts - Peter Schiff, Martin Weiss, Robert Prechter, Nouriel Roubini, Robert Kiyosaki and other professional marketers and salesmen. But their track record paints a very different picture.

Perhaps Dent’s greatest achievement has been his entry into the financial media club despite the fact that he is not Jewish. Perhaps his wife is. Most likely, he has some type of connecting into the Jewish media monopoly. As many of you know by now, if you are Jewish you are guaranteed media exposure, regardless how miserable your track record is.

And if you are not Jewish and you don’t have a long list of Jews that you bow down to, you will be completely ignored by the financial media. This is a statement of fact that I myself know firsthand, and I challenge anyone attempt to disprove it.

The problem is that by banning me, the media takes away not only my livelihood, but they dampen my track record because the media serves as official documentation of predictions. Moreover, without an audience I cannot justify the time and expense of publishing books; not useless motivational or generic books, as is the case with the vast majority of investment books published, but books with unique insight.

In the end, I become a voice heard by very few. This too serves to withhold revenues I would have otherwise received. This impacts the cost of services offered by my firm, diminishes the chance of me every being able to write anymore books, and ultimately serves to position Main Street in front of the Wall Street vultures. In the end, Main Street gets screwed. In the end, Main Street deserves being taken by the media, Wall Street and the snake oil sales men because Main Street never wises up to this con game.

If I had just one wish, it would be to have 15 minutes of nationwide airtime to expose the crimes of the media; CNBC and FBN, Bloomberg, the Associated Press, Reuters, The New York Times, the Washington Post and the rest of the Jewish-run media monopoly.

Then I’d like another 15 minutes of live nationwide airtime to confront Harry Dent, Martin Weiss, Peter Schiff, Barry Ritholtz, Marc Faber, Robert Prechter, Jim Cramer, Larry Kudlow, and the rest of the clowns who serve as much better contrarian indicators than anything else.

But of course, this is never going to happen because I would expose the truth. And that would end their reign as snake oil salesmen. I can guarantee you each of them would run for the hills rather than to confront me, because they don’t want to get into an argument they know they cannot win.

From the words of an unknown critic regarding Dent…

“There should be no doubt in any reader's mind the dubious nature of Dent's methodology and therefore his projections. More than anything, Dent is an expert marketer of Harry Dent, genius, forecaster extraordinaire.”

If Dent were to write a book about how to prosper by making the best seller list by publishing books that make people believe you have the answers, he might actually help some people make some money for a change. This is his best money-making skill.

Aren’t you sick and tired of being led into the slaughterhouse by guys the media claims are experts when the fact is they only expertise they have is in marketing and spinning their miserable track record whenever they are confronted?

If you enjoyed this article, you will LOVE our special portal called the ENCYCLOPEDIA of Bozos, Hacks, Snake Oil Salesmen and Faux Heroes.

__________________________________________________________________________________________________________________

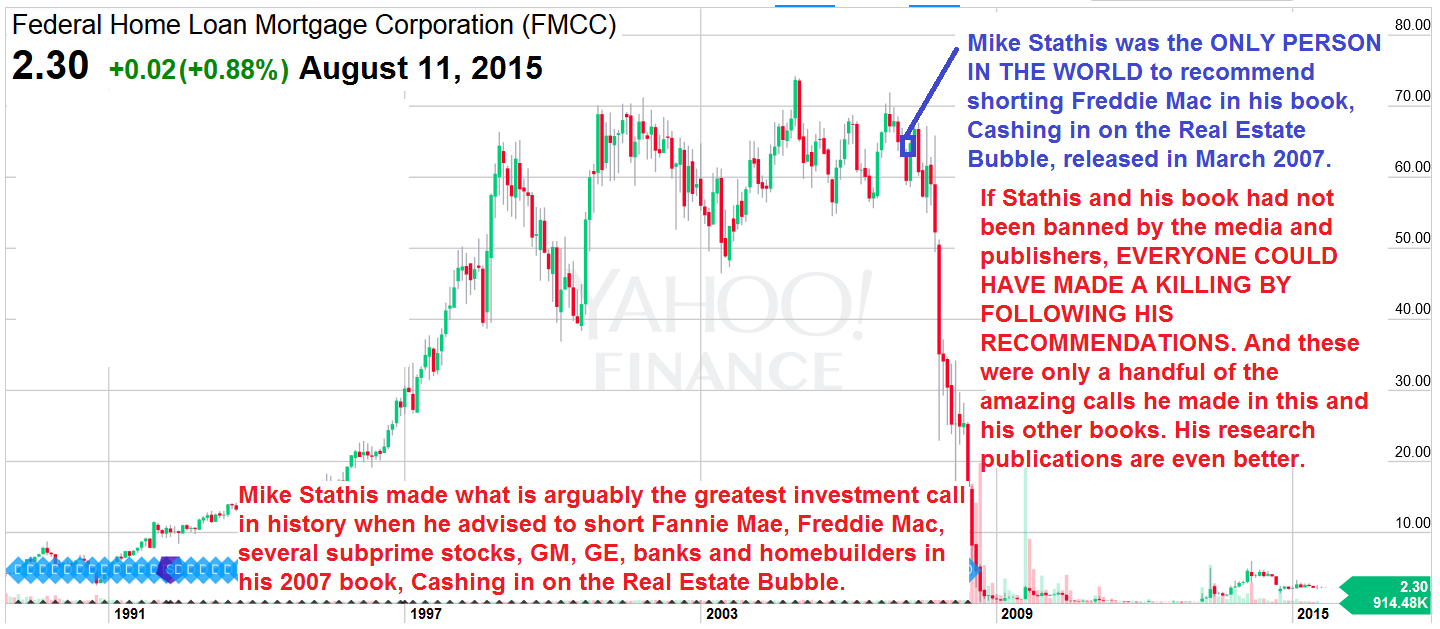

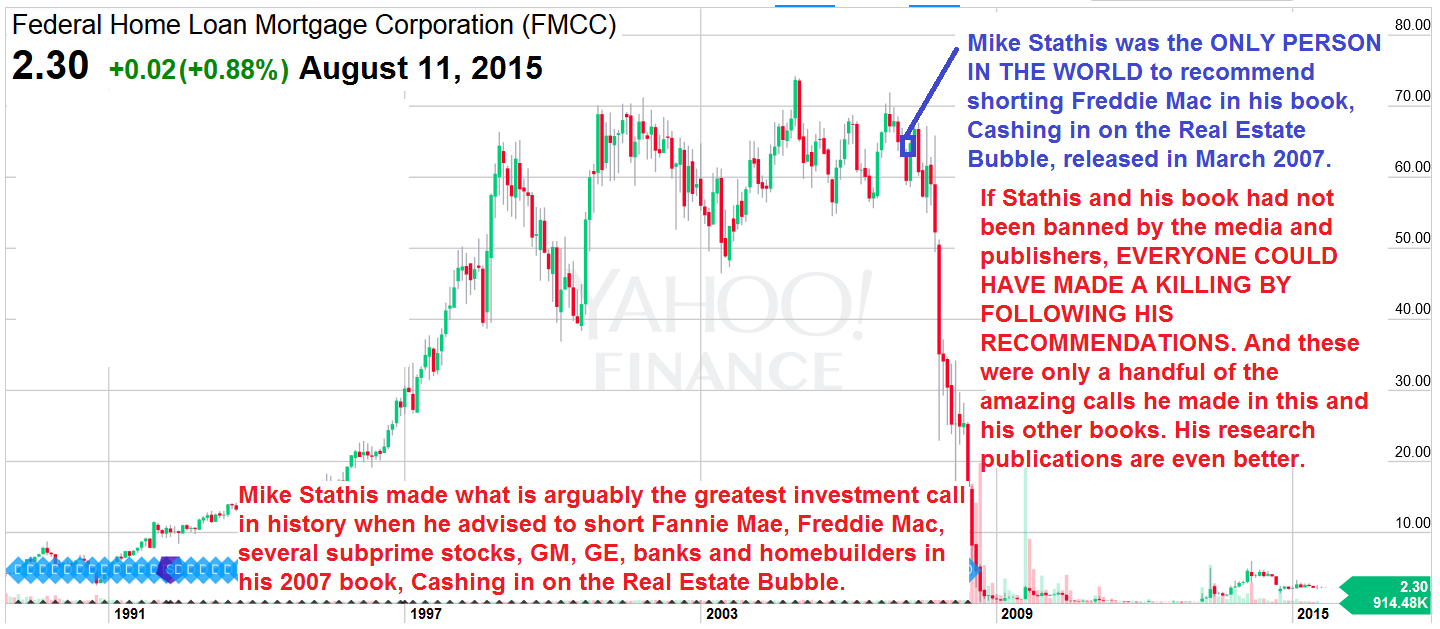

Mike Stathis holds the best investment forecasting track record in the world since 2006.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.png)

.png)

__________________________________________________________________________________________________________________

It is a massive collection consisting of thousands of pages and hundreds of videos exposing hundreds of con men, liars and idiots.

See here for more information.

Remember that Mike is not getting paid to save people from the lies about gold, silver and the economy that continue to be spread by the countless number of charlatans who are always in the media.

He does not sell precious metals and he does not sell securities.

He does not even sell advertisements.

That means he has NO AGENDAS.

In fact, he is losing a great deal of money for speaking the truth and trying to save Main Street.

How often do you hear someone spend so much time at work fighting to get the truth out when they should be focusing on sales? With the exception of Mike’s efforts, it NEVER happens.

But let's not also forget that NO ONE has been more accurate forecasting so many different things over the past several years than Mike Stathis. And his track record is in print.

Many have been fooled by snake oil salesmen to think they are on your side, when they are really looking to hook you into their sales pitch.

Mike could focus on producing videos that always highlight his amazing track record in order to generate sales, but he doesn’t.

Instead, he spends a great deal of time exposing the liars and con men out there who are duping millions of people with their gold-pumping, doomsday delusions, even though these efforts are costing Mike a great deal of lost sales.

Just remember this down the road once you look back at this period as a huge fraud perpetrated not only by Wall Street, but also by thousands of doomsday, gold-pumping charlatans. If you do not already realize they are scam artists, you will eventually if you take their advice. That is a guarantee.

Mike Stathis remains the lone voice of reason and wisdom for Main Street.

Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

.png)

.png)

.png)

.png)

.png)

.png)