Today, I point to one example of what I call phantom advertising.

I don't think anyone else caught this and I certainly have never seen anyone write about it, so I wanted to alert the public to this type of deceitful trick used by media.

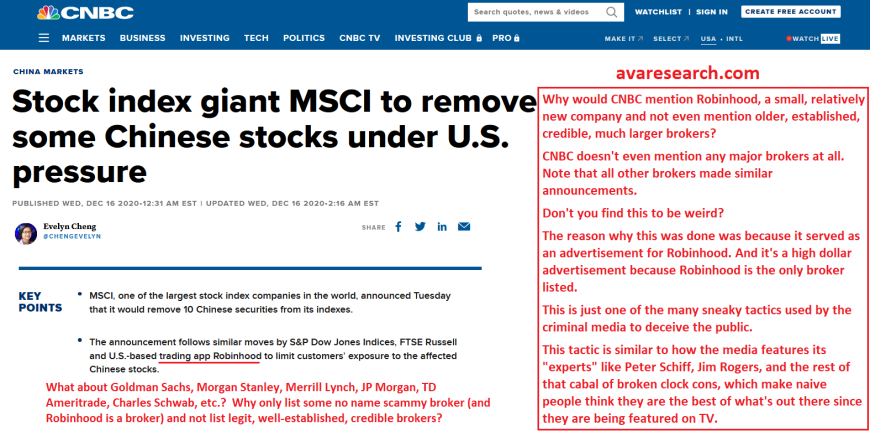

As you can see from the red text I have written to the right of the image below, CNBC only reports Robinhood as a broker that has made similar announcements regarding Chinese stocks being removed from indexes.

The article makes no mention of large, well-established, credible brokers like JP Morgan, Merrill Lynch, Morgan Stanley, etc. It doesn't even mention discount brokers such as Charles Schwab, TD Ameritrade, Fidelity, all of which have trading apps.

Some might be asking, "What does it matter? It's not hurting anyone."

The reason why this type of deceitful "phantom" advertising is detrimental to the public is because it demonstrates that CNBC is willing to deceive its audience in exchange for money.

And when you're talking about a financial network that focuses on reporting about companies and stocks, it's not difficult to see how this kind of behavior (deception in exchange for money) can create a very dangerous situation for people foolish enough to watch CNBC.

As you might recall, Robinhood would later be fined by the SEC for failure to disclose that it was receiving payment for sending customer orders to private market makers (payment for order flow) who continue to defraud the public such, as Ken Griffin's Citadel.

Today I'm not going to discuss why payment for order flow opens up all kinds of opportunities to defraud investors, or that it threatens to cause huge problems in the stock market. I've previous talked about this.

Mike Stathis Exposes Robinhood as a Criminal Operation in 2018 and Tips Off the SEC

GameStop Reddit Crew Should Launch a Campaign Against Robinhood

How Sheep Progress into Hucksters. Case Study from YouTube Kid Pumping Robinhood

E Trade Crooks and Michael Lewis HFT Scam

Several years prior to Robinhood being fined by the SEC, I pointed out that it was selling order flow. It was obvious to me.

But CNBC also must have known.

How else can a trading app make money of it offers free trades?

What this means is that CNBC participated in helping Robinhood defraud customers.

Let me be clear. Payment for order flow is a criminal business being permitted by the SEC because the same cabal who runs the SEC is also involved in defrauding investors through payment for order flow. This includes media companies like CNBC who advertise for Robinhood.

Finally, like all trading apps that offer free stock trades and therefore rely on selling order flow for revenues, Robinhood is a crooked company that's ripping off its investors.

The real customers of Robinhood are hedge funds that buy its order flow.

Those who use Robinhood to buy and sell stocks are pigeons who are unknowingly sacrificing their money to fuel a criminal operation.

This annotated image is an example of the kinds of images we upload to our IMAGE LIBRARY, which is reserved for Members and Clients.

The library contains more than 7000 images, with another 3000 waiting to be uploaded (we always have a backlog of images not yet uploaded because we categorize the images and this takes time).

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.