Remember folks. It's our "wonderful and honest" media industry that constantly makes false claims about its guests.

I’ve previously debunked the nonsense from an entire army of Jewish charlatans.

For instance, do you remember how the media made the hilarious claim that Meredith Whitney predicted the financial crisis in order to make her seem credible when she predicted her ridiculous state and city defaults?

I tore her part with reality.

I did the same with Peter Schiff, Marc Faber, Jim Rogers, Jim Rickards, Harry Dent, Jim Cramer, and many others that the media have afforded endless promotion as "experts."

Ask yourself is it a coincidence that they're all Jewish?

Ask yourself is it a coincidence that they all have horrendous track records?

Obviously, anyone who has followed their guidance has lost big time.

Am I the only person who has identified a very strange pattern?

It seems that only Jewish individuals predicted the financial crisis, according to the media.

Is it a coincidence that the media happens to be 100% controlled by the Jewish mafia?

Not a single gentile I can think of has been attributed with having predicted the financial crisis.

The big problem is that none of the Jewish hucksters that the media claims predicted the financial crisis actually did.

By now, everyone who is anyone knows that I predicted the details of the financial crisis unlike anyone else.

And if you didn’t know that, consider yourself a “nobody” as far as I’m concerned because it means you’ve had your head so far up the media’s ass that you’ve missed out on the truth.

Moreover, I’ve even argued that I was the only person to have predicted the financial crisis.

See here to understand why I have made that conclusion.

And I’m willing to debate this claim against anyone in the world.

To ensure they’re not some mentally ill moron living in mom’s basement seeking attention, they must be willing to put up $100,000 as a prize for the winner of this debate. I’ll do the same.

Do yourself a huge favor and STUDY my track record.

So until someone proves me wrong, it is a fact that I am the only person in the world to have truly predicted the financial crisis. And I'm not Jewish.

Ask yourself how many people in world history have backed claims of having the leading track record with large sums of money. I’ve been a financial professional for more than two decades and I can tell you I have never seen or heard anyone doing this.

Again, ask yourself why I continue to be banned while hucksters like Roubini continue to get promoted as experts while padding his ridiculously pathetic track record with fake accolades.

By now, if you’ve been following me for some time you know the answer to this question.

The media’s objective is to extract as much money as it can by any means necessary. And they best way to do this is to appease its advertisers.

Now if you’re thinking that the financial media would best appease its advertisers by providing top notch financial and investment insights, you’re have no idea how the media business models operates.

Modern media isn’t just a way to mention a company name or post a logo. It goes well beyond that. You see, running an ad for let's say Bank of America does nothing to drum up business. All it does is puts the company in your mind, so these ads don’t cost much because you can rent out a billboard that does the same thing.

The big money comes in when you can generate demand for business services.

But how do media firms generate demand for business services?

Imagine you want to get some insight on the stock market so you turn to CNBC. That would make you a sucker; no ifs, ands or buts. If you waste your time on CNBC, you are a certified sucker.

But you’re not likely to realize you’re a sucker. Instead, you'll actually think CNBC is providing you with expertise from clowns and failures from the financial industry such as Jim Cramer, Josh Brown, the Najarian knuckle heads and many others.

The same situation exists on Bloomberg TV and in Bloomberg articles.

Have a look at the brokercheck of Josh Brown for instance and you can see he comes from a very suspect background. The same goes for his partner Barry Ritholtz.

So after you’ve listened to CNBC, Bloomberg and read the Wall Street Journal and other trash, you’ve blown up your portfolio or else you've missed out on the longest bull market in history because you were fed nonsense from clowns promoted in the media as experts; bull shit artists like like Peter Schiff, Jim Rogers, Jim Rickards, Harry Dent and countless others.

Guess what? At some point you’re going to get desperate. You’re going to see ads for Merrill Lynch and JPMorgan Chase as you watch CNBC or read Barron’s.

At some point you WILL contact these firms because you feel incompetent.

In reality, most of your investment losses are likely to have come as a result of paying attention to the media. But you won’t realize that because you didn’t document everything you read and heard. And you didn’t systematically think about why and how you formed your conclusions prior to making your investment decisions.

The media crime bosses understand this basic manner by which human behavior operates.

There are even many smaller tricks used by the media which I have previously exposed such as having female hosts with big breasts, etc. which releases dopamine. And this causes people to act more irrationally based on impulse.

You see, the trick is for the media to create the perception that it’s providing its audience value. If it can’t pull that trick off, it won’t attract an audience. And if fails to attract an audience it won't make money.

Thus, the media relies on a pool of poorly informed and naïve people who aren’t likely to catch on that they’re being duped by “experts” who are at best, blowing hot air and at worst, providing terrible guidance and predictions. And you had better believe the media makes sure to keep its audience poorly informed so they won't ever wake up and figure out that they're being played.

At the end of the day, the objective of media is to boost the amount it charges for advertisement slots. And when it comes to the financial media, this is accomplished by airing clowns and cons. And the media does this while creating the illusion of perceived value. This is why the media commonly lies. The media also frequently engages in other tactics such as cherry picking, which qualifies as lying because it creates a false impression about the track record of its “experts.”

That’s how the media boosts the amount it can charge for ads. The more its audience is misled by clowns, the more the audience loses money. This increases the demand for financial services advertised in the financial media. And the kosher media crime bosses figure they may as well promote their own tribesmen to enrich their bank accounts.

.png)

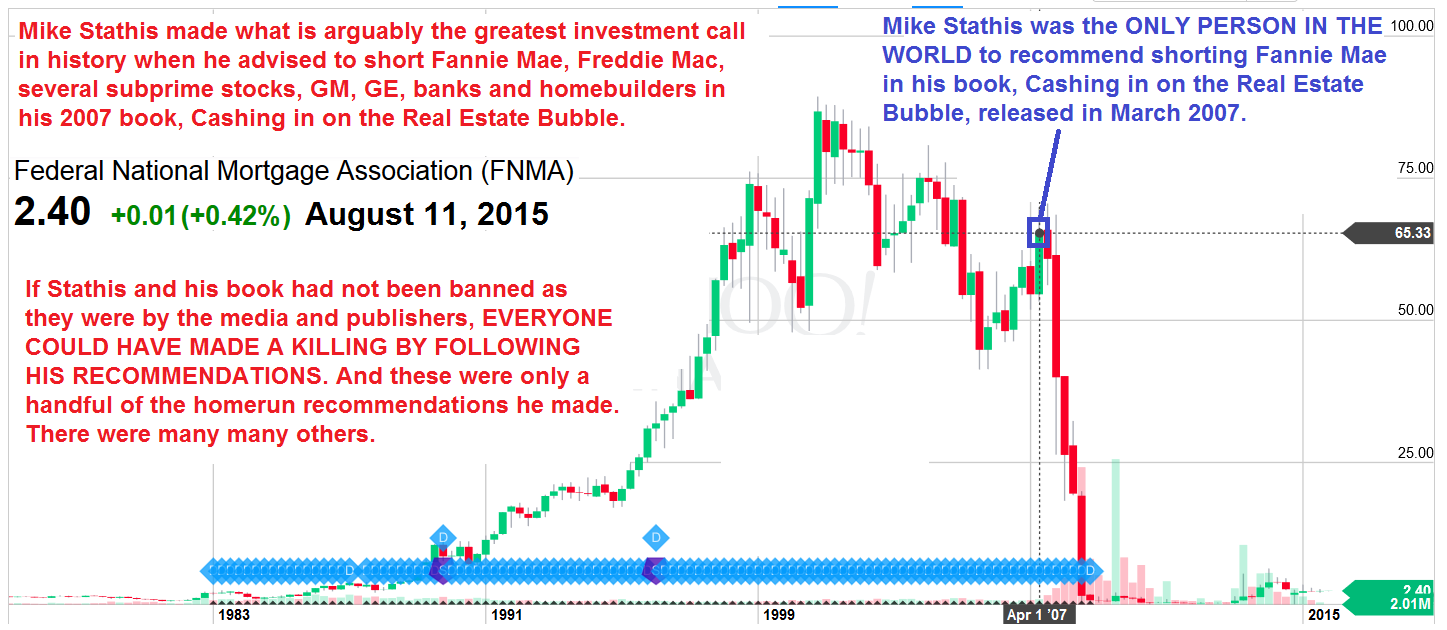

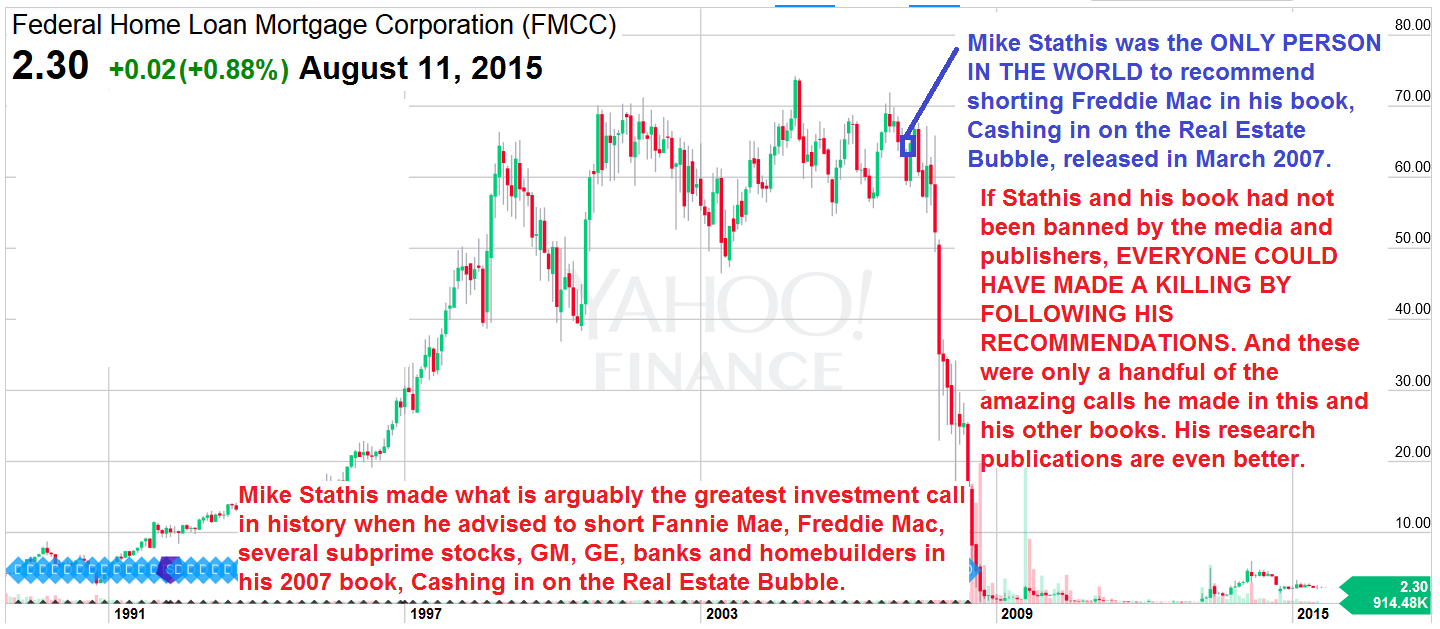

Mike Stathis holds the best investment forecasting track record in the world since 2006.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.png)

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.