Note: This article remained dormant in the editing bin for several months awaiting completion. It was only completed a few of weeks after Byrne resigned from his CEO and board spot at Overstock.com as a result of statements he made about the "deep state" and other things pertaining to what appears to be an FBI investigation related to his potential involvement and/or knowledge of Russian spying.

This latest development confirms what I have thought about Byrne all along; namely that he's a shady egomaniac who appears to be more concerned with extraneous nonsense as opposed to doing what's need to run a successful company. Alternatively, perhaps his misaligned focus serves as an intentional distraction away from his inabilities as a business leader. And then there's the topic of ethics. See here.

Once all investigations have been completed Byrne may turn out to be an even bigger disaster than even I had imagined. As I previously discussed in an audio discussion, I view anyone who mentions the term "deep state" is a complete moron. There is no "deep state." It's fictional nonsense. These are the same types of people who believe in ridiculous conspiracies like chem trails and pizza gate.

I have some advice for anyone who fell for the "deep state" or "pizza gate" nonsense. I suggest you focus your efforts on screening your sources. At the end of the day, some of you need to stop listening to wackos and gatekeepers. But of course if you lack critical thinking skills you will never be able to detect the fakes.

This "deep state" and "pizza gate" nonsense emphasizes my claim that nearly all (99%) of the "news, information, insight and commentaries" found on the internet can be categorized as complete bull shit or disinformation.

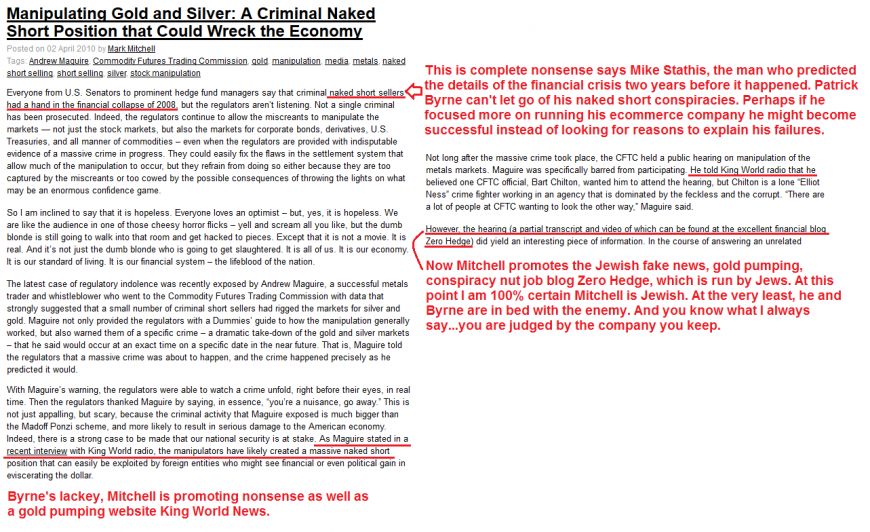

Credibility and accuracy don't seem to matter much to Patrick Byrne, as he allows his paid stooge Mark Mitchell to promote the fake news, gold pumping, conspiracy blog Zero Hedge.

You might recall Patrick Byrne, CEO of the persistently struggling ecommerce company Overstock.com. For many years Byrne has been on a mission to label naked short selling as some dangerous monster that needs to be stopped.

According to Byrne, naked short selling is the single biggest fraud on Wall Street. Oddly, Byrne rarely if ever mentions insider trading and the other sources of securities fraud ultimately responsible for the theft of hundreds of billions of dollars every year. He never talks about the endless fraud committed by hedge funds, the hedge fund compensation scam, the hedge fund bench marking scam or the fact that working class pensioners are being defrauded by these scams.

Surely Byrne knows about these types of fraud. After all, Byrne seems to know it all, right? At least this is how he has come across in his many media interviews.

But instead of pointing out many of the most damaging categories of securities fraud that remain largely unaddressed, Byrne opts to focus on naked short selling.

Byrne has even claimed that naked short selling was the cause of many financial calamities, most notably the collapse in the share price of Overstock.com on numerous occasions.

So is naked short selling such a huge problem as Byrne claims? Or perhaps it's just a red herring.

In this article I'm going to answer this question and reveal many other things you're probably unaware of.

After the financial crisis of 2008, it would appear that Mr. Byrne reached out to fake news Jewish gatekeeper Matt Taibbi of Rolling Stone Magazine in attempt to convince him that naked short selling was the main cause of the financial crisis.

Most likely Byrne promoted his (ridiculous) naked short narrative in order to inflate its importance.

In reality, naked short selling as described by Byrne does not exist.

But if Byrne's naked short selling narrative could be sold to the public as something that occurred with the ease, frequency and severity claimed by Byrne, it would account for the poor performance of Overstock.com stock shares. Perhaps Byrne thought that widespread acceptance of his naked short narrative would absolve him from the longstanding poor performance of his company.

In reality, Overstock.com has been a lousy investment because the company basically sucks. And it's run by a man who focuses more on conspiracies than running his company. It's almost as if Byrne has treated Overstock.com as hobby business.

Before I continue with my focus on Byrne and his naked short selling narrative, let me begin by explicitly stating that naked short selling did not cause the financial crisis. To suggest that naked short selling was the cause of the financial crisis is quite hilarious.

Moreover, naked short selling was not involved in the collapse of Bear Stearns or Lehman Brothers.

Says who?

Says me, Mike Stathis; the only person in the world to have truly predicted the financial crisis, as well as a Bear Stearns insider.

On the other hand, naked short selling may have played a role in the collapse of Washington Mutual, as I previous discussed. But even this was speculation on my part. Regardless, WaMu was headed down the tubes for a variety of reasons (also previously discussed).

Byrne certainly isn't a dumb guy, but Taibbi is far from being a genius (putting it politely).

My guess is that Byrne sold Taibbi the idea that the financial crisis was caused by naked short selling knowing that Taibbi would be an easy target to fool. My guess is that Byrne viewed Taibbi as a guy who cared more about generating drama rather than getting to the truth.

So Taibbi ran with Byrne's naked short selling premise because he knew it would generate drama, which translates into advertisement revenues. After all, generating ad revenues is the primary responsibility of all reporters.

So what is naked short selling anyway?

First I'll give you an overview of what's involved when one shorts a stock.

Many traders prefer to use the phrase "taking a short position" when they short a stock.

Regardless which phrase you might want to use, when you take a short position in a stock or any other tradable security you're betting that the security is going to decrease in price. So when you short a stock, you're only going to make money from the bet if the stock price declines. Typically, when someone says they're going to "bet against a stock" they're referring to some type of short strategy.

Besides shorting a stock you can also buy put contracts on the stock in order to profit if the stock price falls.

If you want to bet against a stock (or any other publicly traded security) you need to determine the number of shares short you want to short. There are many other considerations to make as well when you plan to take a short position (e.g. entry and exit signals, hedging strategies, etc.) but we won't get into that here.

First you need to obtain the shares that you have selected to short. Retail investors are limited to checking with their broker to locate shares to short, while institutional investors have many other options.

When you are able to locate the shares you want to short, you need to borrow them from the lender which we will assume to be a broker in this case. After your request to borrow the shares has been approved, you sell the shares into the open market. All of this takes place behind the scenes and often within seconds after you click the "short" button and enter a stock ticker. However, other securities are more difficult to obtain and the process can be lengthy.

Because you do not own the shares and you are merely borrowing them, and because you have sold the shares, it's referred to as shorting the shares.

When you short a stock or any other security you must pay fees and margin interest based on the time period you wish to borrow the shares. The margin rate can change at any time. You're also responsible for paying all dividends that might be declared to the owner of the shares if you remain short during the ex-dividend date.

Most brokerage firms have shares of most stocks available for shorting. Some exceptions might be penny stocks and thinly traded stocks. It depends on the broker.

And then there are securities that are not available to retail investors such as exotic derivatives. You need to jump through many hoops to borrow shares of these securities for a variety of reasons.

In order to exit a short position you need to close the position. Once you close a short position you will no longer earn profits if the stock declines, nor will you be responsible for dividends or losses should the stock rise.

When you decide to close your short position you need to purchase the same number of shares you shorted (i.e. sold short) in the open market. Once you have bought the number of shares you shorted, these shares will be returned to the source that lent them to you and your short position will officially be closed. At that point you will no longer have any exposure in that security.

As a reminder, you can only short a security if you can find a source that's willing to lend shares to you.

Now that you have a basic idea what it means to short a stock, let's talk about naked short selling.

The premise behind the naked shorting claims made by Byrne and Taibbi goes something like this. You can short any security by any number of shares even if the lender permitting you to short the securities does not have a sufficient amount of shares available in its inventory to be lent out.

In other words, if you want to bet against a stock you can short the shares on an unlimited basis if you can find a lender who will agree to this illegal activity. On the other hand, you might find a lender that will claim to have shares available to lend you to sell short, but the shares are not available although you may not realize this. All you care about is being able to short the security of your choice by the amount and duration of your choice.

If the premise described by Byrne and Taibbi is accurate, it means that any investor can take down any stock they want by as much as they want because they will be able to short as many shares as they want. If this were possible, it means you can short a stock down to $0 per share which would lead to the bankruptcy of the company.

This notion is so ridiculous I feel bad for Taibbi because it provides evidence for one to argue that he's a clueless monkey.

The most ludicrous aspect of Taibbi's mischaracterization of naked short selling is that he does not even understand it sufficiently to fool a person with average intelligence and/or an understanding of the capital markets. Instead, Taibbi created his own version of how naked short selling operates (most likely with the assistance of Patrick Byrne).

The formal definition of the term "naked shorting" is much different that the one Taibbi described.

Naked short selling actually occurs when you short a security without hedging the position. It's similar to a naked option contract such as selling a naked call or put. These transactions are very risky.

Taibbi went so far as to show in an alleged "live demonstration" how he could naked short any stock by any amount in attempt to convince the public that his fairy tale was real. I will bet anyone any amount of money that this demonstration was staged.

Not only are Taibbi's claims regarding naked short selling untrue, many of these claims are in fact impossible. Once you see the monitor in the video below it should be obvious it was a complete scam.

The only question is whether Taibbi was involved in staging the demonstration.

So the real question here is whether Taibbi is stupid enough to believe this staged demonstration or is he such a criminally insane lying piece of trash that we went along with it or even devised it himself. Either way, Taibbi completely destroyed any credibility he may have had from then on. I would never trust anything Matt Taibbi says or writes because he's either easily fooled or he's a lying piece of trash.

Byrne even allowed (if not commanded) Deep Capture lackey Mark Mitchell to report on this and show the video on his Deep Capture website. Once I saw that, I knew Byrne was not to be trusted or relied upon for anything.

Take a look at the video Taibbi posted in attempt to convince the public that naked short selling was a real and dangerous weapon that caused the financial crisis.

I found the video so ridiculous it's shocking that anyone took it serious.

So let's revisit the question. Did Taibbi realize the video was BS and perhaps even participate if not orchestrate the fake demo, or is he really that stupid?

Both. While I believe Taibbi to be a moron, I also believe he intentionally created this naked short selling hoax in order to drum up publicity for what would be at least one book he planned to release after the financial crisis. I pointed out this motive many years ago shortly after he began his disinfo campaign.

And because Taibbi cashed in on this hoax (via larger viewership after which he "coincidentally" released at least one book) it constitutes fraud by deception and misrepresentation. Welcome to the media.

So does naked shorting (as Byrne and Taibbi have defined it) occur?

Yes, in my opinion to some degree on occasion, but mostly with penny stocks. And certainly not on the scale or frequency claimed by Byrne and Taibbi.

Remember, Taibbi is one of the guys Main Street relied on for insight to explain the financial crisis even though he has no experience working on Wall Street.

He doesn't even have a decent understanding of the capital markets. Yet, Main Street stooges ran with his bogus claims.

Taibbi's media tribesmen even promoted his bogus claims.

Doesn't that seem a bit strange considering that Wall Street controls the financial media?

Why bite the hand that feeds you?

Why would the financial media promote the narrative of a reporter who blamed the financial crisis on naked short selling?

Are things starting to make sense now?

Let me spell it out for you. The media used Taibbi as another Ponzi to deflect the real cause of the financial crisis from the public eye. By promoting his bogus naked short selling claim, the perpetrators of the financial crisis became unidentifiable. Because naked short selling had no role in the financial crisis, there was no trail to follow.

I have previously discussed how Michael Lewis is not much different than Matt Taibbi. Neither of them really understands Wall Street. They write fictional accounts and label them as non-fiction. Thus, they serve to forward the version of events Wall Street wants people to accept and remember down the road as opposed to what really happened. They play the game which is the only reason why their books get promoted by the establishment as gospel.

Think about this and you will begin to understand how important events are being misrepresented in history books.

People need to wake up and stop trusting reporters when it comes to providing insight on complex and highly important matters for which they lack sufficient qualifications and expertise.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.