Where did Alex Jones ever get the idea that Schiff "manages billions" of dollars?

If it was a one-time error, okay.

But it wasn't.

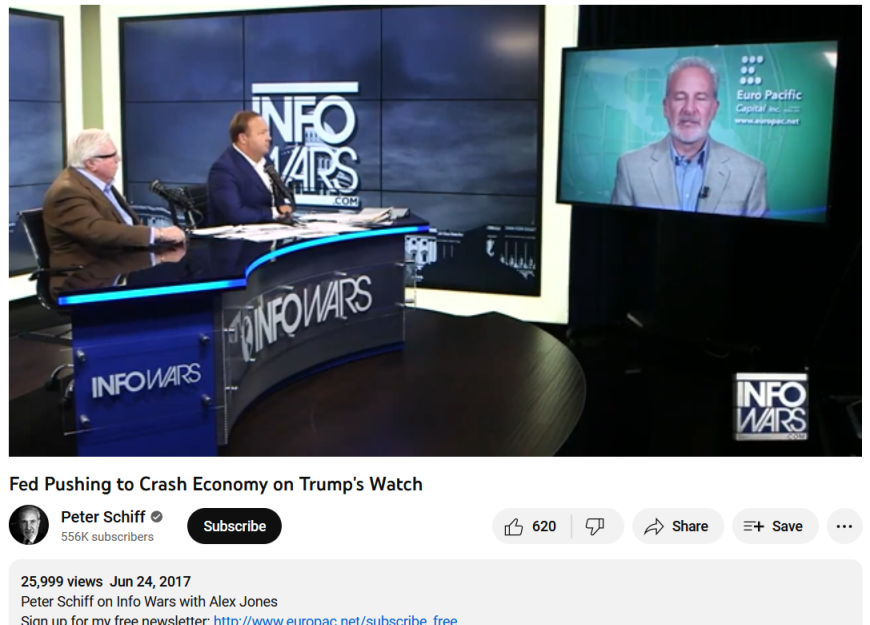

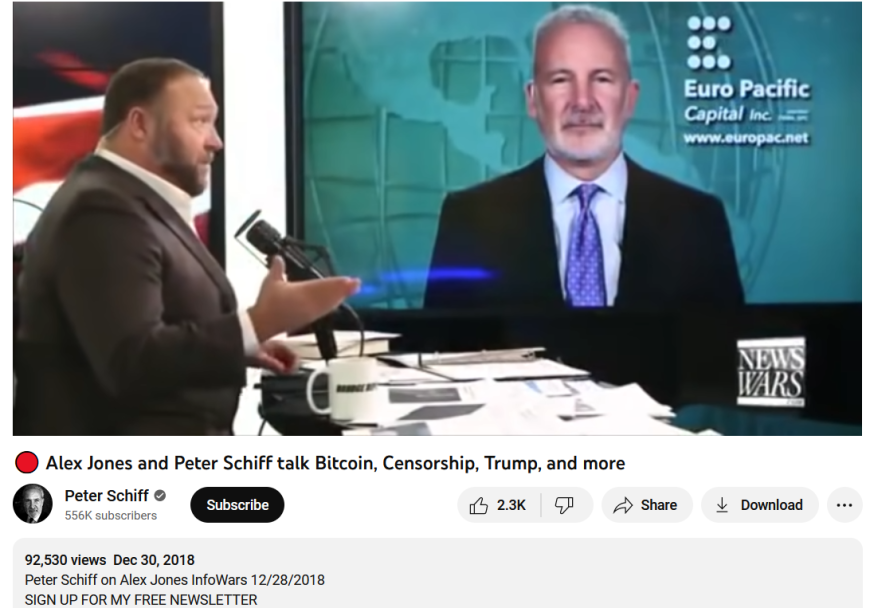

Jones made this claim dozens of times over the span of several years.

From memory, I believe Euro Pacific's assets under management (AUM) surpassed $1.5 billion for a few months.

If I'm wrong, I'm sure Schiff will reach out to me.

And if I'm wrong I will publish a correction/retraction.

Obviously I do not believe I'm wrong or I wouldn't bother wasting my time on this topic.

But this was not long after the financial crisis and before people began to realize Schiff didn't really predict anything, and is nothing other than a broken clock, gold peddler.

Once people began to realize Schiff is nothing more than a broken clock carnival barker, with a long history of poor investment recommendations, investors began to transfer assets from his firm as investment performance continued to sour.

I'm pretty sure that by 2015 and certainly by 2016, Schiff's firm was no longer managing $1 billion dollars or more.

For several years now, Euro Pacific's AUM has been well under $1 billion.

But I have come across video footage of Alex Jones claiming Schiff manages billions of dollars as recent as the end of 2018.

But nearly all of this is in his mutual funds, which have performed miserably.

Incidentally, today Schiff's firm manages roughly $550 million. Although this is a very small AUM for a man who has received constant exposure in all media for nearly two decades, I still don't understand how his AUM could be this high after all of these years of wrong forecasts and poor performance.

I suppose many of Schiff's customers are old and senile and don't pay much attention to their investments. Others might be so deep into the Schiff cult that they still fall for his nonsense, so they keep hope alive and/or are scared about the "crash" that never seems to materialize despite Schiff's constant warnings for years as the U.S. stock market has soared.

You can check the performance of his mutual funds for yourself.

Here's an overview of Schiff's mutual funds I published a few years ago.

Some of you might recall I was the only person who revealed the reason Schiff switched his business from a pure brokerage firm with separately managed accounts, to one focused more on mutual funds.

My guess was that it was to avoid lawsuits from customers who lost large sums of money.

As I explained not long after Schiff made this switch several years ago, it's extremely difficult to sue a mutual fund. But it's not so hard to sue a broker if you lose money.

Clearly, Jones was given a script to read by Schiff and/or one of his lackeys everytime Schiff appeared on Jones' boiler room fake news broadcast.

In fact, you can even see Jones reading a script when he introduces Schiff in some of the videos.

The script includes what I believe were false claims regarding the amount of assets Schiff's firm Euro Pacific Capital was managing.

Many of you may not realize this, but making false statements about your investment firm such as the assets under management (AUM) can cause your firm to be shut down.

You could also be barred from the industry for life.

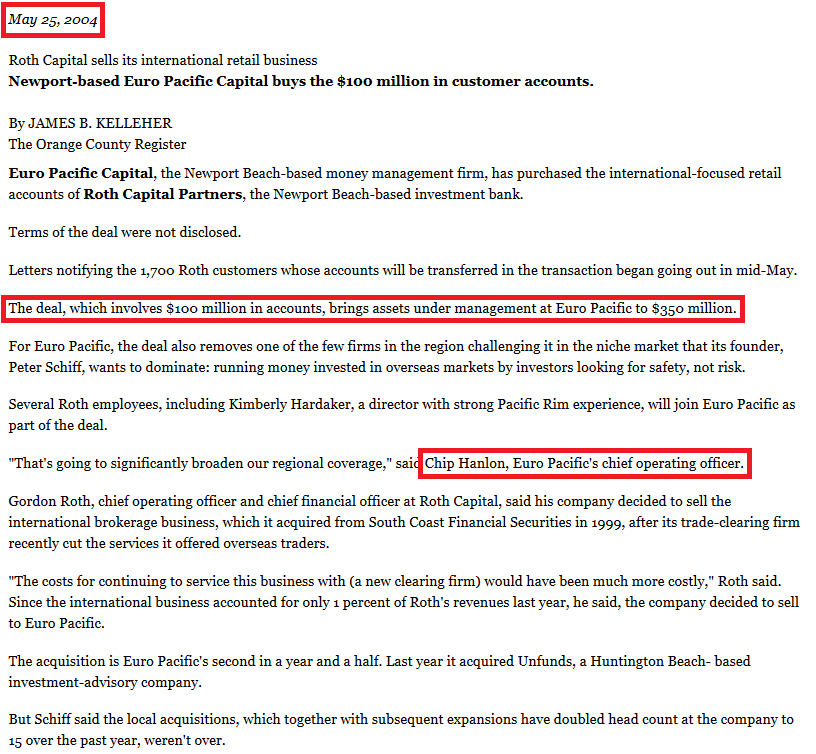

That's exactly what happened to former COO of Peter Schiff's Euro Pacific Capital, Chip Hanlon.

Hanlon left Schiff's firm a few years after the dotcom bubble to start his own investment shop called Delta Global Advisers.

It was basically a three or four man operation (similar to Schiff's own firm at the time) consisting of Hanlon, Mike Pento, some other clown whose name I cannot remember (I think he was one of the cons from Cramer's TheStreet). But I believe he was only associated with the firm by name and not an active participant.

And then there was an IT guy who ran the company website, including (what I was told was) a "pet project" website of Delta Global called Greenfaucet.

Hanlon and others lured leading contributors from was at the time the top alternative financial and investment commentary website, Seeking Alpha.

I have previously discussed the fact that Seeking Alpha (based in Israel) promoted Jewish contributors while shunting Gentiles, irrespective of their qualifications. This happened to me many times to the degree that I considered it as being censored to a large degree. Ultimately, the unfair treatment I received by Seeking Alpha led to me leaving the site by 2011.

After several additional missteps, all of the quality authors left Seeking Alpha by around 2010. Thereafter, it became a complete boiler room, used to manipulate penny stocks. Today, Seeking Alpha is one of the worst sources for anything related to investments.

I will go more into Seeking Alpha in the future because I have been wanting to tell the full story for years, but keep forgetting to do so.

I was one of the contributors to Greenfaucet that was lured from Seeking Alpha, along with Zero Hedge. I left Greenfaucet several months later once I realized what was going on.

I'll save the rest for another time.

I've already told parts of this story a few times over the years.

See The Schiff, Pento and Hanlon Connection

So the critical question is this.

Should Peter Schiff be held liable for allowing Alex Jones to inflate his company's AUM?

I do.

If I'm correct, it appears that Schiff passed the buck.

This is a common tactic used by the media.

I call it "passing the buck," although it's not what you're thinking because the beauty of the tactic is that no one gets blamed for doing anything wrong.

The media "passes the buck" all the time so that the person for which the false claim has been attributed is never held accountable for making false or misleading claims because someone else (the media host) made the claim. People assume media personalities and journalists are credible and have carried out the proper fact-checking process. In reality, they're not credible. Moreover, media talking heads will argue that as part of the media, they have a right to exercise "professional discretion."

What it all boils down to is that media executives know they can lie and promote scam artists because they are protected by Section 230 of the Communications Decency Act.

I see this tactic being used regularly with copywriting con artists and liars like Jim Rickards.

As far as I'm concerned, if you heard a false claim that unfairly benefits you or your business in some manner, it's your responsibility to correct it, or else you're complicit.

And if you or one of your colleagues provides media personnel with a script containing false or misleading information in your bio or elsewhere, that's as good as you making the claim yourself.

I captured screen shots of videos on Schiff's JewTube channel showing video titles and dates, so you can check them for yourself.

Fortunately, in nearly all cases where Jones makes the dubious claim that "Schiff manages billions," it occurs within the first 10 or 20 seconds. This spares you from having to listen to these quacks peddle their ridiculous conspiracy rhetoric.

At the bottom of this article I have posted a video with clips of Jones making these false claims about Schiff managing "billions of dollars."

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.