Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Opening Statement from the May 2017 CCPM Forecaster

Opening Statement from the May 2017 CCPM Forecaster

Originally published on April 30, 2017

On June 24, 2016, immediately after UK voters approved the referendum to exit the European Union, the global stock, bond and commodity markets sold off hard. By late fall of 2016 many stock and bond markets had mounted an impressive recovery, with some having soared to fresh new highs. In contrast, many commodities were reaching new multi-year lows.

By late-2016 the commodities market was in midst of a strong rally fueled by continued strength in crude oil, gold, base metals and many other commodities.

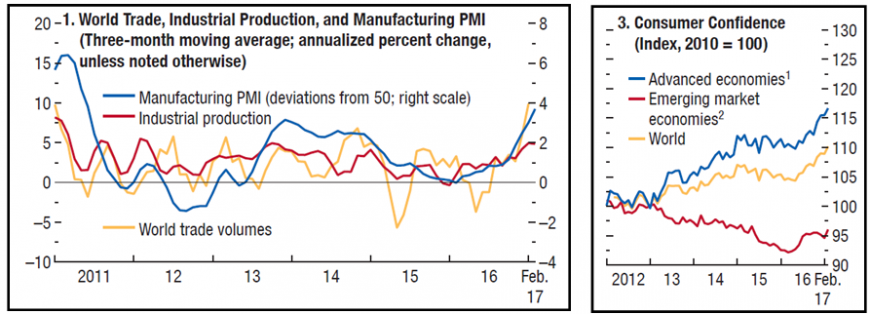

The Federal Reserve hiked interest rates for only the second time in nearly ten years by December. We closed out 2016 with improving economic momentum in the US, EU, China and many other nations. Consumer sentiment was high and rising. Employment data continued to improve, albeit modestly, while manufacturing PMI and global trade were trending upward.

Finally, inflation was moving closer to a healthier level, erasing much of the previous deflation concerns we have been faced with since the post-crisis period.

This broad strength in economic activity continued as we entered 2017. The Federal Reserve raised interest rates by 25 basis points again during its March 2017 meeting, just days before the US stock market made new record highs.

Despite various improvements over the past several months, commodities pricing has weakened since the beginning of 2017. This is particularly odd given improvements to inflation trends in the US, EU, Japan, and, as well as a global boost in consumer confidence and investor sentiment.

One could argue geopolitical tensions have been the main source of the recent weakness in commodities pricing. Given that demand has picked up, it’s a bit strange that investors would emphasize (what we believe to be modest) geopolitical tensions over inflation data.

Although counterintuitive, we believe the US dollar will