Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Charlie Munger's BABA Blunder. Mike Stathis Warned About BABA Well in Advance (Part 2)

I began my mission helping investors steer clear of Wall Street because I learned firsthand how the game was played after having worked in the industry.

Thereafter, I learned how the media helps Wall Street after I was black balled by all media in 2006 and thereafter for trying to warn main street about what would become an unprecedented financial crisis in 2008.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content.

I think I've done quite well in that regard.

As a part of this mission, I have also spent a great deal of time and effort exposing the criminal activities of the financial media, as it works with Wall Street to deceive and defraud main street.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

Examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

--------------------------------------------------------------------------------------------------------------------------------------

You can review Part 1 of this article here.

Over the past several years, AVA Investment Analytics investment analyst and chief investment strategist, Mike Stathis has detailed many of the risks of Chinese securities in his investment research publications and webinars.

The information and discussions in the following article have been derived from research reports and webinar discussions that were published over the past several years. Thus, those who had access to the following information could have avoided investing in BABA.

Only by 2022 had the general public become aware that mainland Chinese companies listed on U.S. equities exchanges were at risk of being delisted due to noncompliance with SEC financial disclosure laws.

U.S. regulators were not asking anything special frrom Chinese companies. They simply wanted Chinese companies to comply with the same laws required by all foreign companies listed on U.S. exchanges.

Specifically, the SEC requires all foreign companies to allow inspection of auditors when the auditors are based overseas.

That makes perfect sense, right?

If foreign companies want to list their shares on the stock exchanges of other nations, don't you think it's reasonable to expect regulators from the nation where the foreign stock is listed to check the auditors of these foreign companies?

Although this is a reasonable requirement, the Chinese government refused to allow SEC officials to examine the auditors of Chinese companies.

Wall Street even helped create a loophole for Chinese companies so they would be excluded from this disclosure.

Due to China's longstanding cozy relationship with Wall Street, Chinese companies were actually exempt from compliance with inspection of auditors until a new law was passed during the Trump administration.

It was of no coincidence that Wall Street helped get Chinese companies listed on U.S. exchanges without having to comply with U.S. securities laws.

This was done because Wall Street knows Chinese companies commit fraud as a normal business practice. And Wall Street is only focused on commissions, knowing that rarely do they get punished for fraud.

This relates to the topic of moral hazard. And it's what was partly responsible for the 2008 financial crisis. If anyone would know, it's me given that I predicted the details of the crisis two years before it happened in a book.

Incidentally, the blatant fraud committed by the U.S. listed Chinese company Luckin Coffee a few years ago probably would not have happened if SEC officials would have been permitted to inspect Luckin's auditors.

After facing pressure from all angles, Chinese officials have only recently allowed SEC officials to inspect the auditors' books of Chinese companies listed on U.S. exchanges.

But there has been no word that these inspections have been successful. In fact, U.S. securities regulators approached this invitation to inspect Chinese-based auditors with pessimism because they understand how the Chinese government operates.

We'll get back to the issue of delisting risk later.

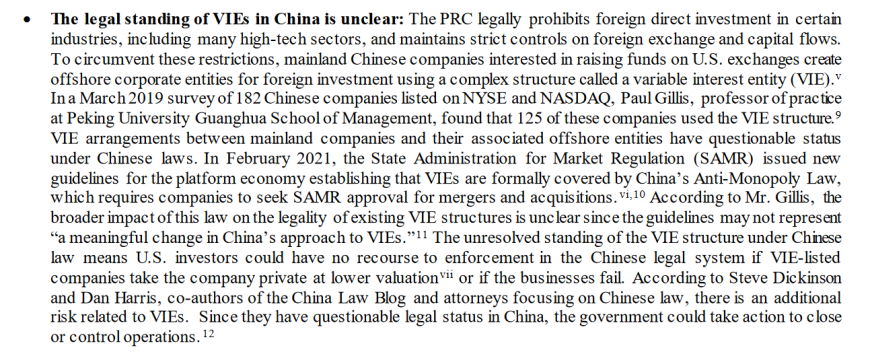

For now, I want to discuss a bigger risk for Chinese stocks that really hasn't received as much attention as it should. The risk related to the legalities of the ViE structure of Chinese companies listed on U.S. exchanges.

Even by 2022, many investors remained unaware of some of the more problematic risks of buying Chinese stocks. Because the media had been recently focusing on delisting risk, most investors thought this was the main risk they faced.

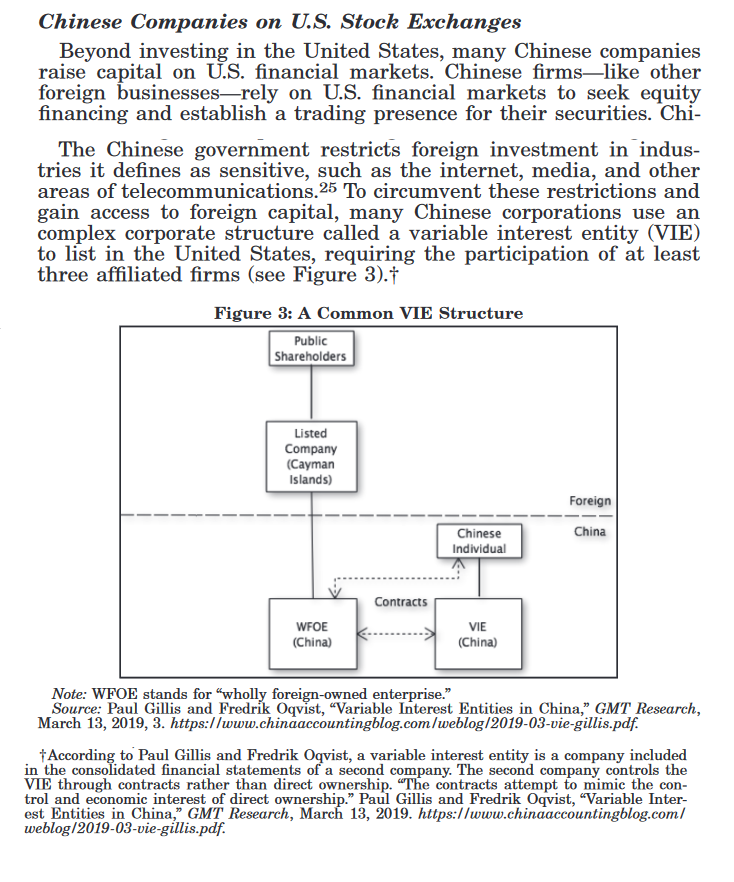

Aside from issues regarding delisting due to inadequate financial disclosure, most Chinese stocks listed on U.S. exchanges are structured as variable-interest entities (ViEs).

This presents a much bigger risk for foreign investors who own Chinese stocks.

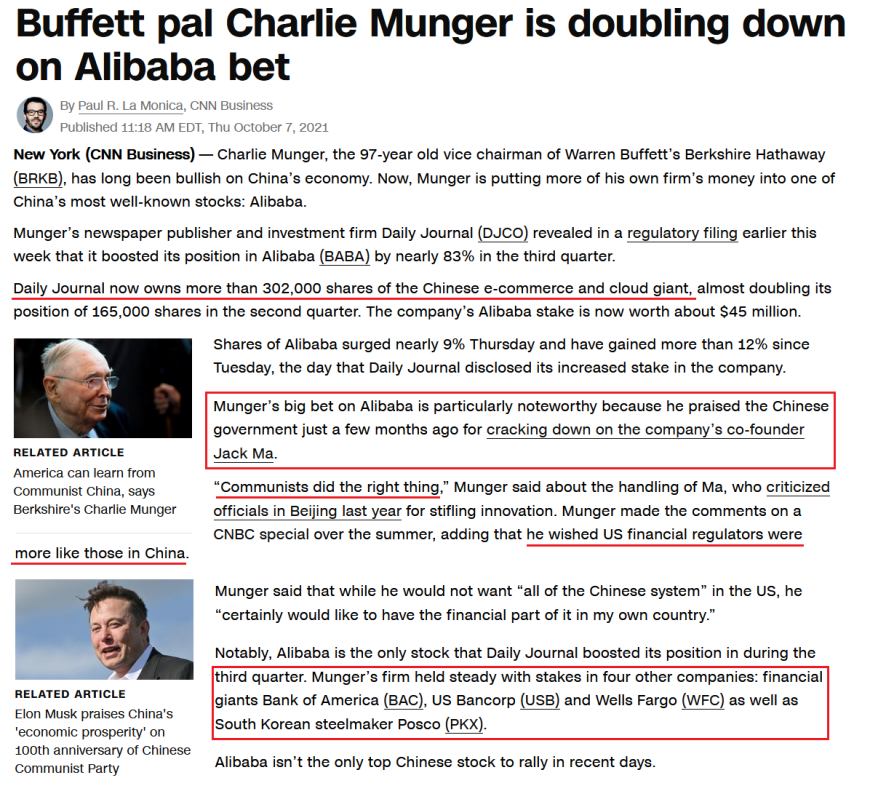

Many investors who make the dire mistake of paying attention to the financial media might have bought BABA soon after Charlie Munger began buying it in Q1 of 2021 because they saw him on TV claiming what a great opportunity it was.

So naturally, because Munger is celebrated as a "great investor" by the financial media, many investors thought it was a great opportunity to by BABA when they heard that the "great Charlie Munger" had bought it.

Apparently, these investors paid no attention to the risks posed by ViE structures, the Chinese Communist Party (CCP), or even the more obvious risk of delisting from U.S. exchanges.

Why would investors disregard such risks?

Take your pick of the two choices below.

1. Because they they trusted the "great investor" Munger.

2. Because they trusted the financial media to provide them with valuable content.

In reality, the financial media led its sheep audience into the slaughterhouse because n no one from the media ever confronted Munger about the risks I've discussed thus far.

At the time, I was warning against investing in BABA and even stated that Munger was a fool for doing so during this problematic period filled with extreme uncertainty.

At the time Munger was loading up on shares of BABA, the Chinese economy was facing a severe collapse due to the insane zero-COVID policy from the Chinese government.

In addition, ongoing trade disputes with the U.S. showed no signs of improvement during a time when China's supply chain remained in disarray.

Finally, China was facing heightened scrutiny over a variety of issues which threatened national security interests of various nations. For instance, the Chinese military were becoming increasingly implicated in intellectual property theft from governments and foreign corporations.

Moreover, China stepped up more aggressive activities in the South China Sea, raising tensions in Taiwan and other nations in the region to high levels.

All of these events caused many large international firms to pull back investments in China. In addition, many of these firms begin the process of relocating at least some if not all of their operations to nations outside of China. This alone would deal a heavy long-term blow to the Chinese economy and Chinese consumers.

Long before these issues surfaced, I had discussed the risks of China's ViE shareholder structure using Alibaba (BABA) as an example during some of my investment research presentations.

And once the risks mentioned above began to surface, I reiterated the relevance of the ViE structrure risks to shoreholders, as well as the risks of western nations decoupling to some extent from China.

Those unfamiliar with my positioning as one of the leading investment analysts in the world replied, "Who are you to think you know more about investing than Charlie Munger"?

Apparently I do know more than Munger because Munger's mistake was too large and too obvious to be discounted. His judgment was so bad that there should be no doubt that Munger has no idea what he's doing, which in fairness is okay since the man is 99 years old.

Meanwhile, as shares of BABA continued to decline, Munger became desperate to get the share price propped up, so he began praising BABA more, hoping that main street would buy into his delusions thereby raising the price for him to exit with gains.

This is a very common tactic used by the media's "experts." In fact, several fund managers use this tactic as their primary investment strategy.

As you can imagine, many of the fake investment gurus littering YouTube and elsewhere were also recommending BABA because Munger bought it. They wanted to prove their value as investment gurus by copying Munger. But proving value has nothing to do with copying someone. They never stopped to consider the risks because these people are simply that clueless.

Let me remind the reader of the following indisputable fact.

You have to be really young (and hence naive as well as ignorant), very stupid, or mentally ill to listen to anyone on YouTube or social media for anything other than pop culture and anything else that doesn't matter and is based exclusively on opinions requiring no special skills or insight.

And when it comes to investment content, if you are paying attention to anyone on YouTube or social media, you need to have your head checked for rocks.

To reiterate the critical point regarding BABA's ViE structure (with rare exception) all U.S.-listed companies based in mainland China are structured as variable-interest entities (ViEs).

So what are ViEs?

ViEs are basically shell companies that are (usually) based in shady off-shore tax havens like the Cayman Islands. These ViEs come with contractual agreements which (claim to) provide shareholders with ownership rights to the underlying security.

So if you buy BABA from an exchange outside of China, instead of owning actual shares of BABA, you own an entity that represents BABA which promises to provide you with the same legal benefits and rights afforded to shareholders who own shares of BABA that are listed on Chinese exchanges.

But legal ownership rights are only as valid as the governing bodies responsible for enforcement of the applicable laws.

So who determines all legal aspects of Chinese companies structured as off-shore ViEs?

It's not officials in the Cayman Islands or wherever the ViE has been setup.

The Chinese government determines all legal aspects of Chinese companies, whether they are structured as ViEs or structure in a more proper way.

The primary reason for setting up off-shore ViEs is that it gives shareholders who buy the stock (listed on foreign exchanges) the impression that the contractual agreements setup through the ViEs are outside of the jurisdiction of the Chinese legal system. But this is not at all in touch with reality.

You might want to ask the Chinese Communist Party (CCP) what they think about that.

I can tell you right now that the CCP won't agree at all. And cases have already been tested in the Chinese court system which confirm this conclusion.

Furthermore, the Chinese government does not recognize off-shore arrangements for companies which are physically located in China. The legality of these contractual agreements tied to ViEs is dictated by the laws of mainland China because the parent companies linked to the ViEs are based in China.

Moreover, any legal matters pertaining to Chinese-based companies are largely outside of the jurisdiction of the SEC because the ViEs are based off-shore.

As you can imagine, this introduces several risks and potentially many problems for foreign shareholders of Chinese stocks structured as ViEs.

Basically what all of this means is that Chinese companies listed on U.S. exchanges can do just about anything they want, and foreign shareholders have very little recourse because they don't really own shares of the company.

Any possible recourse that might materialize is in the hands of Chinese officials.

In addition, Chinese companies listed on U.S. exchanges are not required to comply with some of the most basic and critical securities laws normally enforced by the SEC, such as insider trading (known as Reg FD) as well as other financial disclosure laws.

Foreign investors of Chinese stocks should find this to be quite worrisome.

Apparently, the "great investor" Charlie Munger was either unaware of these risks or else wasn't concerned.

Is that the kind of diligence you'd expect from an "investment legend"?

There are several additional problems with the ViE structure of foreign-listed Chinese stocks.

The most obvious problem with the ViE structure is that it's illegal for foreigners to own Chinese businesses.

Remember, China is a communist nation. Therefore, by law the means of production in China are owned by the state.

While there has been some relaxation in recent years pertaining to property ownership laws in China, with rare exception foreigners cannot own most types of Chinese businesses.

But remember that when you buy a company's stock, you become part owner of that company.

So how is it possible for foreign investors to buy ownership in Chinese companies?

It's not.

But Chinese companies use the ViE structure to make it appear as if foreigners can buy ownership in Chinese companies when they purchase company stock through foreign exchanges.

Therefore in reality, Chinese stocks listed on U.S. exchanges using a ViE structure do not provide U.S. investors with enforceable rights or legal claims to anything.

This is not according to me. It's according to Chinese law which has been confirmed in the Chinese supreme court.

Thus, the ViE structure is essentially a Chinese scam. And all Chinese companies listed on U.S. exchanges are committing fraud because they are misrepresenting claims of legal ownership to U.S. investors.

So how were Chinese companies allowed to even list on U.S. exchanges if the ViE structure is meaningless to investors?

Wall Street lied to investors and the SEC went along with it. That means Wall Street firms involved with IPOs of Chinese companies listed on U.S. exchanges along with the SEC committed massive fraud against U.S. investors who purchased these stocks.

The next problem that should cause investors in Chinese stocks to be quite concerned is that neither the SEC nor the U.S. court system has ability to provide any legal recourse if these agreements are not honored or if something else goes wrong.

And remember, if you are an American or other foreigner who has bought U.S.-listed stock from Chinese companies, you are relying on the communist government of China to protect your shareholder rights. Good luck.

In case you weren't aware, Chinese citizens have very few rights.

And the CCP doesn't exactly have a good track record in protecting what few rights Chinese citizens have.

Do I need to remind you that China has no rule of law?

Similar to most non-democratic nations, Chinese officials regularly enforce laws based on whether or not you've paid a bribe to key officials and/or whether or not you're related to "the right" official.

This is the reality of how things operate in China as well as many other developing nations.

That's not to say that "democratic nations" such as the U.S. are squeaky clean. But they offer greater transparency and accountability than non-western nations and especially China.

All of the risks discussed thus far have not even been the focus in the media. Instead, the main risk discussed has been the risk of delisting of U.S.-listed Chinese securities as a result of noncompliance with SEC rules.

Even by late-2021 when delisting risks began to hit the mainstream, it's safe to say that most U.S. investors were confused if not completely oblivious as to the risks of investing in Chinese stocks because the media kept highlighting that the "great" and "brilliant" investor, Charlie Munger bought BABA and continued to load up on shares even as the price declined.

As shown below and in the PDF attachment located at the end of this article, world-class investment analyst Mike Stathis was warning his research clients about the risks of investing in mainland Chinese companies listed on U.S. stock exchanges through ViEs in a report first written in late-2019. But he warned about BABA's ViE structure even prior to that report.

He also discussed that Chinese securities regulators refused to allow U.S. securities professionals from the PCAOB to audit financial statements of Chinese companies listed on U.S. exchanges which introduced the risk of delisting from U.S. exchanges.

Will BABA stage a come back?

It's possible. But the real question is, will be it worth the risk to invest in it?

BABA might make a turn around in the future. But my analysis of BABA was based on everything I saw a few years ago. And so far, I see nothing that's changed.

Things often change, including investment recommendations. But successful investors understand how to identify and measure risk. They also monitor and reassess risks in an ongoing manner. That's why having access to top investment research is so important.

Regardless of the fate of BABA, investors must always understand all of the risks of all of their investments, or they will make the wrong decisions for the wrong reasons.

Identifying, quantifying and understanding investment risk is a fundamental task of the investment process.

If you aren't conducting an adequate risk analysis, you're throwing darts.

Unfortunately, understanding and meansuring risk is quite difficult.

If you were duped into buying BABA because the "great investor" Charlie Munger bought it, you were fooled into thinking the financial media provides valuable investment insights.

In reality, you were relying on a 99-year old senile man who wears diapers.

If you're going to invest in anything other than an S&P 500 Index fund, you must have a competitive advantage because competition in the capital markets is extremely fierce, so the chances you will do well as an investor long-term are quite low.

Remember, you're trying to compete with millions of professional investors; Wall Street professionals and fund managers who have enormous advantages over main street investors. Wall Street and fund managers have loads of experience, along with vast resources.

Wall Street's competitive advantage is insider information, along with many other forms of securities fraud, most of which go undetected.

Main street thinks the media can give them "an edge" because the media claims they feature "experts" like Charlie Munger.

So if you're going to try to go at it on your own, you need a competitive advantage or else you're better off just buying an S&P 500 Index fund.

Following investment advice from "experts" in the media certainly won't provide you with a competitive advantage. It actually represents the best way to lose money.

We believe our research, headed by Mike Stathis offers the most valuable legal compettive advantage available in the world. And his track record of excellence backs this claim.

See here, here, and here for evidence of Mike Stathis' world-leading track record on the 2008 financial crisis.

More of Mike Stathis' track record is here, here, here, here, here, here and here.

================================================================================

This 2019 report was built upon to create the 2022 China Report which is a 250-page powerpoint presentation and five-hour accompanying webinar explaining the various risks in China.

Understanding China’s Strategy

(The China Report 2020)

- Understanding Chinese Investments

- Wrapping Our Arms Around China’s Colossal Financial System

- Explaining China’s Growth

- China’s Belt & Road Initiative

- Why China is Building Islands in the South Sea

- Why Are Hong Kong Riots So Dangerous to China?

- China’s Long-Term Challenges

- China’s Secret Plan

- Can China Avoid a Long Period of Stagnation?

The following is an excerpt from the first part of this report.

The China Report 2020: Preliminary Writeup

September 5, 2019

Reminder About Risks of Investing in Chinese Equities

I want to remind everyone about the risks of investing in Chinese stocks. China is a communist country. And it’s important to remember that fraud is a large part of Chinese culture.

1. Chinese Stocks Trade on US Markets as ADRs: It’s a violation of Chinese law for foreigners to own controlling interests in China companies in certain sectors that are thought to be important for national security which includes just about every sector you can think of.

And remember that the stocks that trade on US markets are American Depository Receipts (ADRs). ADRs from China are registered under shell companies known as variable interest entities (VIEs) which are registered outside of the US, in places such as the Cayman Islands. Think about why they might be registered outside of the US. To get around US securities laws.

The VIEs establish legal agreements with the Chinese ADR (like Tencent or BABA) to share profits with the VIE shareholders, but the VIE shareholders do NOT have any ownership rights in the Chinese stock. That means Chinese shareholders (essentially the Chinese government) maintain all voting rights while VIE shareholders have no voting rights in company matters. There is also questionable legal recourse against these companies for VIE shareholders.

Finally, if the Chinese government wanted it could at any time make VIEs illegal. And that would immediately severe all rights by VIE shareholders to receive profits from Chinese ADRs. This scenario is not likely right now since China desperately wants access to international funding, but it is still possible. And in the future if US-China relations become hostile, the chances could increase significantly.

2. China’s Stocks Do Not Provide Reasonable Transparency. The Chinese government refuses to allow US regulators to audit financial statements of Chinese firms, so you really don’t know what you’re getting unless you trust the Chinese.

The remainder of this report is available as part of the China Report (2022).

So, the question is, who are you going to for investment research and insight?

Do you really think you can get valuable insight for free?

Good luck.