Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

More Misguided "Forecasts" from Peter Schiff

In the past, I have addressed the errors made by Peter Schiff's analysis of the economy and healthcare.

For those of you who are still behind the curve and actually think Schiff knows what he is talking about, (i.e. being more right than wrong) you should question how a man who has no expertise in healthcare thinks he knows how to fix the problems.

Now if you think he does have a clue about healthcare, you obviously have not read my book, America's Healthcare Solution. This is a book that (I feel) positions me as a healthcare expert.

[I think anyone who has read my books will agree that they don't contain fluff. And they are written by me, as opposed to some ghost writer. They are filled with an enormous amount of data. And they provide a good deal of education as well as unique insight. Unlike the vast majority of investment-related books on the market today, the books I have written are not marketing tools that have been dumbed down so as to appeal to the largely unintelligent masses, otherwise known as sheep.]

You should not assume I'm claiming to be a healthcare expert only after doing some research and writing a book. This is what most people do. I actually work with healthcare venture capital firms. This is why I have accumulated a good understanding of the industry over the years.

Needless to say, due to the fact that I held nothing back in this book, I stand to lose a good deal of business since venture firms want to stay away from any criticisms of the industry, much in the same way as Wall Street.

But as you may have realized, I cannot be bought off. That is specifically why the media has banned me. People like me are viewed as a threat to the lies, fraud and corruption delivered by the media.

I have been banned for the same reason that most Americans have lost a great deal of money in the stock market over the past decade; the media works for corporations, NOT you. And the last thing they would want is someone with no agendas, and someone who is unwilling to sell out. The last thing the media wants is to air someone unafraid to tell the truth because you would be positioned to avoid losses. And your losses become Wall Street's gains.

By now, you should realize that no one you see or read in the media can be relied upon for valuable insight. On the rare occasion the media interviews an expert with credibility, it is likely that this person is playing to the sheep in order to profit. This is the reality based on my own observations spanning well over a decade, so if you trust me and you trust my judgment, you need to accept this as fact. Otherwise, you stand to suffer.

Here, I continue with Peter Schiff's latest extreme analysis. Make no mistake, I could spend all of my time picking apart many of his forecasts if I wasn't involved with research and helping investors make money. However, part of the way I can help investors make money is to show them how the guys in the media club are more wrong than they are right, and how the media specifically works to deceive you. I have addressed this in many publications in the past.

In fairness to Mr. Schiff, despite the fundamental weakness of many of his views, the fact is that he is more right than the other members of the media club. However, in an absolute sense, Schiff is more wrong than he is right. That tells you just how atrocious the media is.

In the end, no matter how much more right you are than your misguided, highly ignorant, agenda-laden peers, the bottom line is that you are not likely to help investors unless you get the fine details right. Schiff has, by my analysis, failed to do that. Hence, I do not see how his views provide any real value. In fact, some of them are, in my opinion, potentially dangerous to investors.

Now, before I begin what might seem like some kind of personal vendetta against Peter Schiff, (and I have none) I want you to understand that much as the same with every other member of the media club, Peter Schiff’s views are subject to much scrutiny because he reaches a large audience.

Thus, when Schiff makes what I feel to be ridiculous claims, even if a small percentage of his audience believes him, it could adversely affect millions of investors. As such, I feel these claims need to be addressed.

As one can verify, it is a rare occasion to see Mr. Schiff matched up against anyone with real credibility. Instead, he faces extremists from the other side of the spectrum; usually liars and hacks, if not complete idiots. So what you get are two extremists going back and forth, both lacking real value.

The result is that the audience is led astray, all while thinking they have been provided with valuable insight because there is always a winner to each debate, right? The problem is that most people fail to realize that even the winner can be a loser.

This has been an intentional move by the media. For if Schiff were to face scrutiny by individuals who have no agendas and who possess a superior understanding of things, such as me and many others, his views would not provide the drama sought out by the financial media.

More important, it would not accomplish the real agenda of the media; to air the views of extremists so that in the end, investors flock back to Wall Street’s perma-bull market myths after the views of the doomer extremists failed to pan out.

If in fact Mr. Schiff truly believes what he is saying, it would appear that his sense of reality has become a bit distorted, perhaps due to his motives, which are to sell you gold, or to get you to buy it so as to raise the price. This too aids the media's agendas, as gold dealers also include Wall Street firms.

After all, in addition to being a stock broker, Mr. Schiff is also a gold dealer. And he has a sales pitch. Any good salesman will tell you that the best way to sell something is to repeat the same thing over and over. And there can be no in-between. You must hold firm with an extreme view of things, so as to make your pitch most convincing.

Similar to other gold bugs that have a financial stake in pumping up gold, instead of discussing the pros and cons, you'll only get the pros from Schiff when it comes to gold.

Understand that, just like everyone else you find in the media, Schiff's mission is to market himself, his firm, and his investment "philosophy." It's a sales pitch and Schiff is a salesman. He's a good saleman too. Unfortunately, this often conflicts with reality.

When you place financial agendas at the top of your priorities, you become a marketer, not a forecaster. And rather than provide valuable insights, you generate sales. This is always good for business, but often bad for those who have been sold the illusion created by the marketing campaign.

Let's take a look at some of Schiff's investment strategies.

According to Schiff, all U.S. stocks should be avoided. He even held firm with this view when the Dow hit 6400. Although I warned of a collapse to these levels in America's Financial Apocalypse and several times thereafter, I advised investors to start buying when the Dow reached 6500.

Even then, I did not come out and say "buy like you never have before." I warned that the market could go lower because it was a possibility.

I'm not an extremist, and I realize that there is no white and dark, up or down, on or off. There is always a shade of grey to everything. At some point, you have to realize when to act. I think I did well to realize when that time came.

Thereafter, I kept investors in the market all the way through the tremendous rally, as subscribers of my newsletter can confirm.

Meanwhile, most investors have been left out of the largest stock market rally since the Great Depression because they have allowed themselves to become brainwashed by the gold pumpers scattered throughout the Internet and media.

According to Schiff, the dollar is headed to zero as the result of hyperinflation, despite the fact that the vast majority of dollars created from the Fed’s printing frenzy have not reached consumers, and despite the fact that the dollar is backed by oil. This by itself means that it is absolutely impossible for the dollar to go to zero (which is the result of hyperinflation) or anywhere close to zero.

Apparently, Schiff (and virtually everyone else) is unaware of the dollar-oil link as I first discussed in America's Financial Apocalypse, and many times since. I would advise Mr. Schiff to read my book. His clients should insist on it. In fact, he might consider contacting me for investment strategies and market forecasting.

According to Schiff, Chinese, Australian and Canadian stocks are gems, despite the fact that globalization has all but shattered the decoupling myth, at least for now. Furthermore, these three nations are experiencing a real estate bubble that is likely to burst at some point.

While I like the future prospects of the Chinese growth engine, (and have since discussing it in America's Financial Apocalypse) I have remained cautious for several months, as discussed in my newsletter. China represents several potentially lucrative investment opportunities. However, it has some unique risks not found with U.S. investments.

Furthermore, regardless how good you think an investment might be, you must always manage risk because the buy-and-hold philosophy preached by Schiff and others on Wall Street ultimately leads to disaster. Surely by now you realize this.

The bottom line is that one cannot buy-and-hold. You must be nimble. Things change, often on a daily basis, so you must focus on active management. That is the foundation of risk management.

On the other hand, Schiff is not stupid, unlike many of the others in his doomer, gold-pumping circle. Schiff sticks to a buy-and-hold philosophy because he runs a brokerage firm. Brokerage firms typically do not practice active management due to the restrictions placed on them by FINRA. This is something very few who have never worked in the industry are aware of.

In addition, it is a very difficult task to manage accounts. Most stock brokers do not possess these skills. They are merely salesmen.

Now, if you think you are better off investing in mutual funds, you obviously haven't read my analysis; an analysis that no financial professional would dare mention even if they understood how funds work because this provides a portion of their revenues.

When the global markets were near collapse in late 2008, China’s economy led the way down after the commodities correction. As a result, the Shanghai stock market collapsed to what we now know were the lows, plummeting by some 70%. At the time, I released a report into the public domain that advised readers to buy Chinese equities.

The point I am trying to make is that there will be times to be in Chinese equities and times to be out of them. The same is true of U.S. equities and equities from other nations. Schiff's sales pitch is in opposition to this common sense investment strategy.

Rather than U.S. equities, according to Schiff, investors should own gold, commodities, short the dollar, and avoid real estate and banks. While I agree with some of these conclusions, I strongly disagree with others.

Clearly, the banks and real estate-related stocks are characterized by poor risk-reward characteristics, so we agree there. But this should be obvious to every investor. If it isn't, you shouldn't be investing. I feel that I argued my case for the risks in real estate and the banks more convincingly than anyone else in America's Financial Apocalypse. I'd like to see any other analysis readers might think can match it.

When assessing whether Mr. Schiff really knows what's going on, you need to ask yourself whether he made specific written predictions for real estate in any of his books. I don't even think he has made any specific forecasts on any of his thousands of broadcast media appearrences.

By the way, how can you be an investment strategist if you are managing a brokerage firm and giving interviews to the media every day? Think about it. Is Schiff a real strategist who does extensive research, or a marketer in disguise?

Did Schiff predict real estate values would decline by 30-35% as I did? Although I'm willing to bet that he didn't, I cannot say if he did or didn't because I don't waste my time reading books with generalizations, backed by very little data. And I know this characterizes Schiff's book because I picked it up and scanned it, and put it down after 60 seconds. In my opinion, it is a useless book. Rather than providing specific forecasts, it served more as a marketing tool to promote his once tiny brokerage firm (which has now grown due to the CNBC sheep) more than anything else.

Has anyone bothered to count how many times he mentions EuroPacific Capital in his book?

Did Schiff mention that a decline in real estate prices usually leads to a decline in the stock market twice the magnitude of the decline in real estate? I know I did.

Did Schiff advise his readers to short Fannie and Freddie and other mortgage stocks? I certainly did.

If Schiff REALLY thought the banks were in trouble, why didn't he recommend shorting them as I did?

Does Schiff REALLY know what he is talking about? Or is he merely taking a contrarian approach as a way to appeal to the market of investment skeptics. This is a common sales strategy used by some stock brokers.

If so, why hasn't he laid down specific forecasts in print? Perhaps Schiff is just a salesman.

Now, there's certainly nothing wrong with being a salesman. They are an important part of every economy. The problem arises when you are a salesman disguised as an investment strategist.

In fairness to Schiff, Wall Street does the same thing. The big Wall Street firms position their investment strategists as experts, when the reality is that they are usually very clueless. They are nothing more than salesmen.

Gold and commodities are also in a bubble. While the economics of the commodities bubble are somewhat justified (at least for the present time), there are no economics that can justify the price of gold.

Unlike silver, gold has no intrinsic value or industrial use. Gold is priced exclusively on desire rather than demand. Investors desire gold because many have been led to believe hyperinflation myths propagated by Schiff, Faber and many others. The size of their agendas dwarfs that of their credentials.

On the other hand, I agree with Schiff on commodities. I am bullish on commodities, especially oil and have been for some time now.

However, I have emphasized the need to manage risk because commodities can be quite volatile. As I first warned in America's Financial Apocalypse, investors must actively manage their portfolios. One example that illustrates the need to manage risk can be seen from my forecast that the commodities bubble would face a severe correction. I told readers that would be the time to buy. As we now know, it was an accurate call.

In contrast, everyone else who has been bullish on commodities (like Jim Rogers, Peter Schiff and the rest of that crew) only knows one direction; up. They never talk about the possibility of huge corrections when they are addressing the sheep who watch CNBC. By the way, Jim Rogers would do well for himself if he also read America's Financial Apocalypse.

The problem with Rogers is that he actually believes the hype CNBC attaches to him. But I am willing to bet that his own portfolio has been blasted apart, and only salvaged by his ability to average down. Guys with a lot of money who know what's going on don't waste time being media whores.

If Rogers really knew what he was doing, he would focus on managing his investments. But you see, when you are as clueless as everyone else, you can make money if you lead the sheep into the dark.

Before you place any seriousness to anything Schiff and others say, you had better consider the big picture. First, look at agendas. Second, look at track records.

Finally, look to see if they are in the media, (or if they are merely followers of others in the media) because if they are, you can bet that what they say will be wrong or so generic that it won't help you.

When screening for extremists, you should look for individuals who only know one direction. The perma-bulls will always claim the stock market is headed up, while the perma-bears will state the opposite. In both cases, they will never help you navigate the ups and downs, where the real money is lost and made. Their purpose is to sell you their pitch.

We cannot forget that Schiff continues to place the majority of the blame for this mess on Washington, so as to minimize Wall Street’s involvement. What else would you expect from a man who works in the industry.

Schiff has also defended Goldman Sachs, and has insisted that Washington is to blame for their fraud. It is clear to me that Schiff has agendas. It is clear that he is an extremist.

Is this a man you want in the Senate? Don't we already have enough pro-Wall Street Senators as it is?

Always remember that you will never get anywhere with your investments if you listen to extremists. Moderation is the key. Without moderation, one cannot exploit the actions of the herd. Schiff is a salesman for a brokerage firm, so having a buy-and-hold and extreme view of things fits well with his sales pitch.

In the past, Schiff has made many vague predictions. Some of them have come true; mostly the ones that many were already aware of. But vague predictions don’t exactly do much for investors. Unless you get the details right, you can suffer as much if not more than others who miss everything, especially when you denounce the U.S. capital markets as an investment alternative.

While I am bearish on U.S. stocks, that does not mean you cannot make a good deal of money with these investments. As long as you can forecast the market, you will do quite well. Unfortunately, market forecasting is one of the most difficult tasks of the investment process. Fortunately, it is one of my strengths, as subscribers to my newsletter can confirm. But there are other opportunities as well if you are able to select the right industries.

Regardless whether you are able to forecast market movements or select securities and industries that outperform, active management is critical.

Many of Schiff’s predictions have been dead wrong. As far as I’m concerned, if you’re going to be dead wrong, you'll have more credibility if you were wrong after having made specific predictions because it demonstrates you actually conducted extensive research and you laid your reputation on the line.

In the past, Schiff has likened the fate of the dollar to the Zimbabwean currency. This could be the most ludicrous analogy I have ever heard. Come on people; can you take this man seriously? If so, God help you.

Furthermore, it has recently come to my attention that Schiff is forecasting a similar situation for America as that seen in Greece. This too is ridiculous.

Those of you who are familiar with my forecasts know that I predicted gold to soar. I predicted commodities to soar. I predicted real estate to collapse. I predicted the stock market to collapse. I also advised investors to keep a good deal of cash and wait for the storm.

Why? Because I saw what was coming and I was not encumbered with the need to generate securities or gold sales. I only sell research and analysis. Unlike Schiff, I do not sell securities and gold.

In contrast, Schiff was telling people to load up on foreign investments, unaware that the globe would be affected. I specifically mentioned that the collapse of the MBS market would lead to a sell-off in the global markets.

More important, I provided specific estimates. Most of my forecasts thus far have been spot on.

But I know when to ease up. For instance, I have never discussed hyperinflation as a possibility in the U.S.

Anyone who thinks hyperinflation will occur in the U.S. (at least in our lifetime) might also be diagnosed with paranoia or schizophrenia. Others have agendas or have been brainwashed.

In my May newsletter, I mentioned that America was digging a huge crater for itself that could end up being much worse than the situation in Greece. However, I explained that it would manifest differently due to the vast differences between the two nations. I didn’t go into much detail, but I will add to this analysis so that you can see where Schiff is wrong.

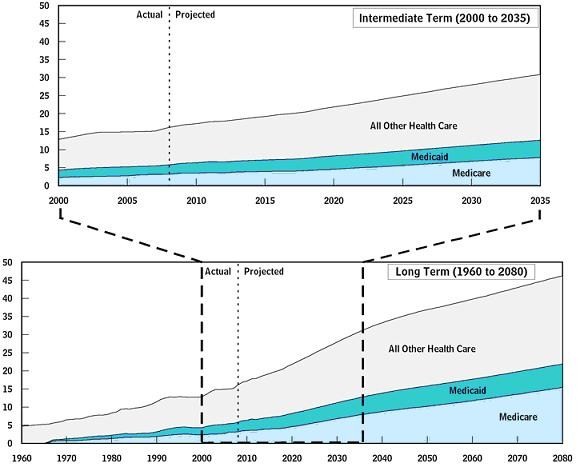

First, I mentioned the fact that America’s biggest problem lies with unfunded liabilities for entitlements. I explained that instead of a default, the American people would feel the effects in the form of drastically reduced benefits and much higher premiums for Medicare and Medicaid. Let's have a look...

“I have warned about the ramifications of national debt in the U.S. since writing about the problem in AFA. I have continued my discussion of this problem, providing updates since 2008. Most recently, I summarized the extent of the problem in the past few issues, after adjusting for recent budget estimates. The charts on this page tell the full story.

The first chart shows the percentage of GDP attributable to Medicare, Medicaid and other government healthcare spending such as the VA and public medical assistance. Without some difficult adjustments, the economic growth of the U.S. will face severe problems starting around 2020. These problems will get worse each year for many years.

Up through 2020, the U.S. economy will at best go through a period of malaise. It will be a silent depression, masked by massive debt-spending. But even that will require several more stimulus packages.

Can one make the claim that a depression has been averted if trillions of dollars of borrowed money are used to create false demand, only to push the problem into the future?

That is precisely what Washington is doing. But still very little progress has been made even with the benefit of the printing presses in overdrive.

If Washington does not respond adequately and in a timely manner, the U.S. will face the high risk of another economic implosion; this time due to the government rather than Wall Street.

You might liken this scenario to the current situation in Greece, with a magnitude 100 times greater, but played out in a potentially different manner, since much of the U.S. debt is found within liabilities for entitlements.

Rather than go to creditors, Americans will be faced with a long period of benefit cuts and higher taxes. The implosion will play out differently, but the impact will have equally devastating consequences. National debt could be a major issue in twenty years. By that time, it will have swelled to eye-popping levels.

Most likely, continuous cuts will be made to discretionary items—education, defense, transportation, research, etc. I discussed this in detail in AFA. Swift adjustments to U.S. tax rates, budget cuts, and cuts to Medicare and Medicaid will help contain the risk of insolvency. However, this will impact consumers for many years to come.”

Hopefully, you see the difference between my own analysis and that presented by Schiff. The U.S. faces the threat of a meltdown in consumer spending more so than a potential bankruptcy due to the national debt, which like Greece, would ultimately require a bailout by the IMF. After all, the IMF is really run by the U.S., as is the World Bank.

While Schiff and I agree that the U.S. faces a very difficult road ahead, in the end everything is relative. It is important to understand the nature of the challenges that lie ahead.

Unlike my analysis, which serves more as a call to action, as well as something to consider when managing risk, Schiff's analysis serves to create panic, prompting investors to buy gold and dump the dollar.

I find it ironic that the dollar is approaching a HUGE turning point. If it continues to gain on the Euro, the dollar's long-term downward trend will have reversed. This will have many global ramifications. You might be surprised to know what they are.

Subscribers to the AVAIA newsletter know that I mentioned this recently (correct me if I am wrong). I will continue to address the opportunities and risks as a result of the dollar's strength in future issues of the newsletter.

It would appear that Mr. Schiff does not understand how things really work. You see, the U.S. is able to export inflation due to the fact that you must have the dollar to buy oil everywhere around the world. This anchors the dollar as the universal currency.

It also explains the mysterious good relations with Saudi Arabia, a nation known for human rights violations, a ban on religious freedom and many other policies that the U.S. would under different circumstances, erect economic sanctions.

Since the dollar is required to buy oil, this means that inflationary effects within the U.S. are spread throughout the globe. This explains why oil is such a good hedge against inflation; even better than pure commodities.

What I did not bother to mention in the above excerpt was something that seems obvious to me, but apparently not so obvious to Schiff. Greece is not America. Greece is a second-world nation without its own currency. Unlike the dollar, the Euro is not the universal currency and will probably never be. If so, it certainly won’t become the universal currency in our lifetime, despite what you may have heard.

And as you might imagine, Europe is in worse shape than America. Moreover, regardless how strong the emerging markets are, the fact is that much of the gains have come from the effects of the global bubble, which, as I have discussed in my newsletter, has reflated.

As you can appreciate, all bubbles eventually pop. Until that time comes, I plan to exploit the confusion from the herd. And when the house of cards comes tumbling down again, I plan to be on the sidelines, as in the past.

In contrast, Schiff is likely to continue his one-way investment strategy, which does little to manage risk and extract gains from the up and down volatility that promises to continue for many years to come.

Remember, you should listen only to those who have excellent track records. And just because someone might have established a good track record twenty years ago doesn’t mean a thing.

On Wall Street, there is a saying…“you’re only as good as your last call.”

Of course, that’s a bit extreme, but it serves to highlight the point that it doesn’t matter so much how well you did a few years ago so much as how well you did recently.

Schiff has made some analogies and predictions that go well beyond the deep end. It would appear as if he is stuck into his sales pitch.

I don’t care what kind of fairy tale Schiff wants to create. You need to understand when he goes overboard. Alternatively, you're better off not listening to anything he says; not just Schiff, but the rest of these guys. Whether they are the perma-bears or perma-bulls, extremists offer nothing of value.

I don’t care how much China’s economy is growing. I addressed the China growth story in much more detail than Schiff, so I know well about China. The more important difference is that I am not an extremist because I am not a salesman.

The fact is that the global markets are linked. What happens in China affects the rest of the world much in the same as what happens in Europe or America affects the rest of the world. It should be clear that even the problems in Greece affect the rest of the world because it implies problems for the rest of Europe.

This of course implies problems for the U.S., the UK, China and the rest of the world. We are seeing this now and will continue to see it for many years to come. Furthermore, the global bubble has reflated without having provided any real benefits. This has enormous ramifications.

Over the next few years, the focus of the problems will shift to the UK, back to the U.S., then back to Europe. China will enter the picture as well. This will be the theme over the next decade if not beyond. Thus, investors need to manage risk. And they need to remain ahead of the curve. Otherwise, they will be part of the herd that gets slaughtered.

In closing, if in fact Schiff believes everything he states, I would like to invite him to enter the world of reality by listening to my forecasts. His clients are likely to fare much better if he does.

If you are interested to see what Mr. Schiff says to this, I encourage you to ask him. Perhaps you might even call in on one of his weekly podcasts (if he takes callers) and ask him. I would be very surprised if he responds. What can he say?

On the other hand, I would never discount the response of a great salesman, especially when he isn't placed in a position to reply to me directly in a live debate. And I know a debate would be out of the question for Schiff. Why would he risk being schooled by a real expert when he has his sheep drooling every time they hear his sales pitch?

You see, Peter realizes he does not need to respond to anyone lacking media exposure, because the masses have their brains hooked into the media, despite the fact that the media continues to screw them over and over.

Instead, he can continue his sales pitch to millions of sheep who have no perspective or understanding of things, many of which probably shouldn't be investing in the first place due to their ignorance. These people are merely sheep from a different flock. Sadly, they actually think they are ahead of the curve.

Ask the media why they have black-balled the person with the best track record on the collapse, and thus the person who best knows what to expect and how to recover.

Remember, it's you who suffers as the result of me being banned by the media, not me because I don't cater to retail investors. That is why I spend my time researching instead of marketing. It's also why I cannot be bought off with promises of media exposure if I agree to hold back the full truth.