I began my mission helping investors steer clear of Wall Street because I learned firsthand how the game was played after having worked in the industry.

Thereafter, I learned how the media helps Wall Street after I was black balled by all media in 2006 and thereafter for trying to warn main street about what would become an unprecedented financial crisis in 2008.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content.

I think I've done quite well in that regard.

As a part of this mission, I have also spent a great deal of time and effort exposing the criminal activities of the financial media, as it works with Wall Street to deceive and defraud main street.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

Examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

-------------------------------------------------------------------------------------------------------------------------------------

Were you holding shares of Alibaba (BABA) or other Chinese stocks when they collapsed?

If so, you'll want to read this article.

If not, you'll still want to read this article because (like all of our articles) it contains quite a bit of educational material you aren't likely to find elsewhere.

And you certainly won't ever get such valuable investment education for free.

And when I say free, I truly mean free because we DO NOT SELL and have NEVER SOLD advertisements or made paid endorsements.

Why?

As we have been proving for well over a decade, the fact is that ALL CONTENT tagged with ads and/or endorsement deals is always useless and most often dangerous.

And if you don't realize this, you're truly in deep trouble.

I first began my mission helping investors steer clear of Wall Street because I learned first hand how the game was played after having worked in the industry.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content. I think I've done quite well in that regard.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments and reviews and heresay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

The reader can examine my track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, and here.

Not long after I began on this journey, I realized that in order to be effective helping investors avoid information and advice that's often designed to mislead them, I needed to include the role of the financial media. Together, the financial media works with Wall Street to steer investors into the gutter.

Thus, another component of this mission involves demonstrating why investors are much better off if they avoid the financial media.

But this is a very difficult task to achieve due to the various tricks used by the media to fool its audience.

For over two decades I've done my best to help investors take direct control of their investments so they won't make the mistake of relying on the financial media and its long list of so-called "experts."

Some of these "experts" are from major Wall Street firms. But the majority are not. It's the latter category of "experts" that do the most damage to investors.

To accomplish this ambitious goal of showing the dangers of consuming content produced and published by the financial media, I have thus far released more than one thousand articles and videos dedicated to this topic over a fifteen-year period.

These publications reveal various tactics used by the financial media for the purpose of misleading and even lying to its audience, while helping Wall Street take their money.

Execution of the media's deceitful strategies explains how "successful" financial media firms are able to command top dollar from Wall Street and other financial firms from advertisement revenues.

These publications also explain why investors who pay attention to the financial media usually end up making bad and/or excessively risky investments without even knowing it was the media that led them into the poor house.

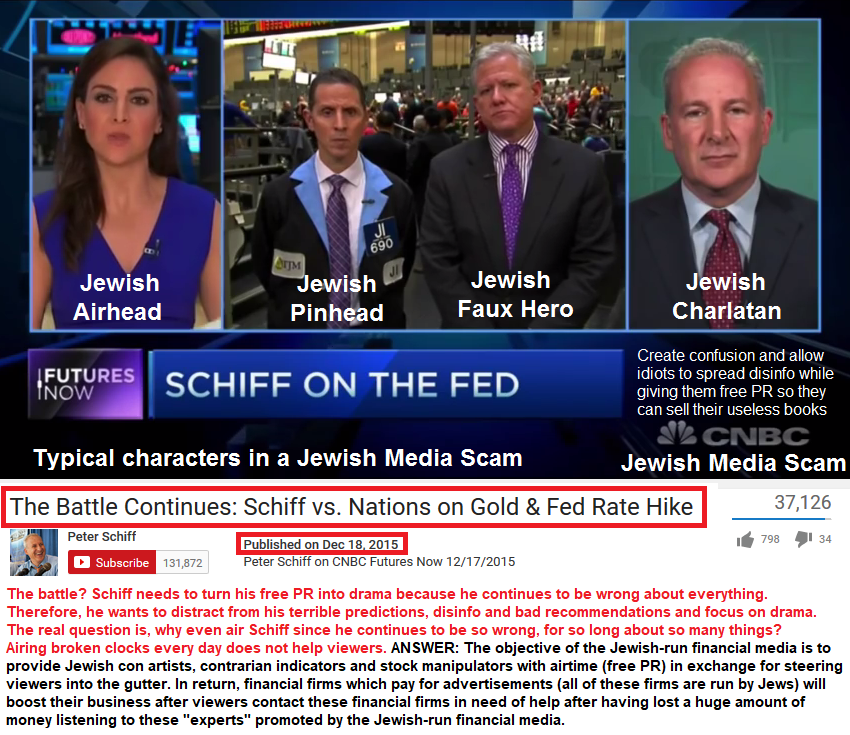

Moreover, in many of these publications I expose the reality about the financial media's so-called "experts" by explaining why many of their claims are either partially or even completely wrong.

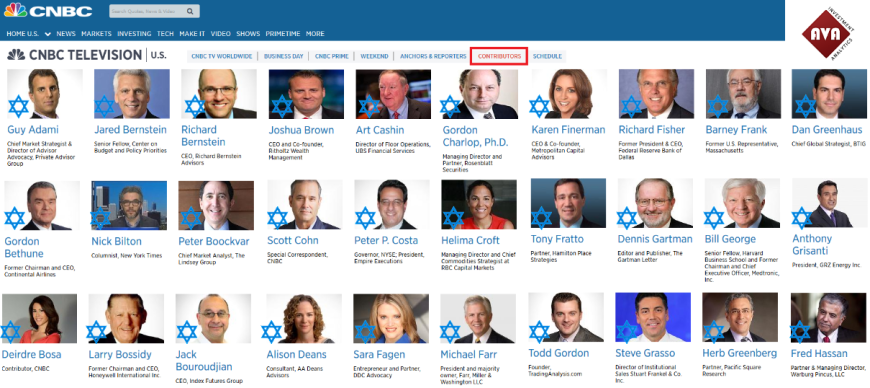

A brief list of these "experts" is likely to illustrate my point. For instance, consider the consistently terrible calls, poor recommendations and wrong predictions from Jim Cramer, Peter Schiff, Harry Dent, Jim Rogers, Marc Faber, Jim Rogers, David Stockman, Doug Cass, Dennis Gartman, Kevin O'Leary, Mark Cuban, Jon Najarian, Pete Najarian, etc.

By the way, all of these "experts" just so happen to be Jewish.

If you really think that's a coincidence, I suggest you take a junior high school statistics course.

Finally, I have also documented the track records of these "experts" in order to further my case against the financial media.

Investors who fail to examine the track records of those they listen to are the same kinds of people who trust online reviews without knowing who wrote the reviews, whether the reviewer has good judgment, and whether the reviewer has an agenda, such as having been paid to write the review.

In case you weren't aware, most online reviews are about as legit as the likes you see on social media. They're FAKE. And that's a fact. If you did not already know that, you're in deep trouble.

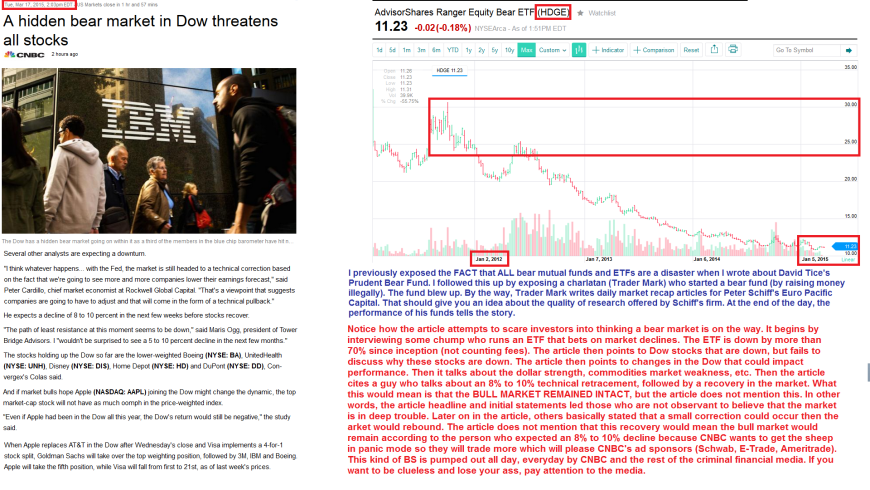

When you turn to the media, you're getting low-yield (i.e. useless) content at best, and most often dangerous disinformation at worst. This is precisely the type of content the media delivers to its audience due to its business relationships with advertisers.

In a nut shell, the financial media's objective is to transform its audience a "pigeon" so that its advertisers (Wall Street and other financial firms) make out at their expense.

For quite a long time investors have been exposed to various dangers that arise after listening to and reading content from the financial media. As previously mentioned, I have documented many of these dangers which can be found on this website.

But in recent years, financial and investment disinformation have become much more widespread and detrimental to those who consume it due to the explosion of Gen Y and Gen Z fraudsters posing as investment gurus online.

Each of the fake investment guru YouTube scam artists you see above is Jewish. If you think this is some wild coincidence, you have a great deal to learn. Pictured from left to right, Meet Kevin (Kevin Paffrath), Jeremy Lefebvre, Andrei Jikh, Graham Stephan and Tom Nash.

Fortunately, each of these fraudsters has been named in a $1 billion class-action lawsuit which I will discuss in the future.

I have recently begun to expose this army of scammers and fake investment gurus from YouTube and social media.

See here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, and here for a few examples of publications on this topic.

There are many more on this topic that have already been published and many more on the way.

An excellent case illustrating the dangers of listening to the financial media and fake investment gurus for investment advice and/or investment "education" can be seen by examination of Charlie Munger's purchase of Alibaba (BABA) which began in 2021.

As you might recall, investors only began to weigh in on the chances of Chinese stocks being delisted from U.S. exchanges in late-2021.

In short, if you got stuck holding the Alibaba (BABA) bag when it emptied, you should strongly reconsider where you go to for investment and economic insights.

For instance, please answer the following questions...

1. Do you watch CNBC, Bloomberg or FOX Business?

2. Do you read investment periodicals like the Wall Street Journal or Barron's?

3. Do you read content from investment websites?

4. Do you listen to idiots and con artists (i.e. influencers and fake investment gurus)?

If you answered "Yes" to any of the above questions, I regret to inform you that you're in deep trouble.

In 2021 after BABA entered a significant sell off, "investment legend" Charlie Munger claimed it represented a great "value," so he loaded up, buying more than 165,000 shares at an average cost basis of around $240 per share.

A few months later, Munger doubled his position to more than 300,000 shares after the share price collapsed even more. At that time, Munger was clammering all over the financial media how great of a bargain BABA was.

And many people followed his lead because, well "he's Charlie Munger" of course.

As you can imagine, most fake investment gurus on YouTube followed Munger's lead because they lack neither the ability nor motivation to think on their own since their focus is to pump out as much useless clickbait content as possible. These fraudsters make money by pumping out content. It's quantity over quality.

At least an experienced investor can sometimes find some quality content in the financial media. YouTube contains absolutely NO quality investment or financial content.

And that's a fact. If you think otherwise, you're in deep trouble.

Perhaps you came across articles and interviews with Charlie Munger praising BABA, the Chinese government, and the Chinese economy.

That in itself should have raised a red flag when you consider that his praise of BABA, the Chinese government and economy came at the worst possible time.

Oddly enough, right when Munger was loading up on shares of BABA, the Chinese economy was facing a severe collapse due to implementation of the insane zero-COVID policy from the Chinese government.

The reality is that this policy was enacted by the Chinese Communist Party (CCP) in order to demonstrate its authority over Chinese citizens. But this show of power came with some unintended consequences.

First, China's zero-COVID policy decimated the economy.

More important, it gave rise to something China had not experienced in decades. We are talking about social unrest through numerous riots that occured throughout the nation.

Incidentally, in case you weren't aware, social unrest is the biggest fear of the Chinese government.

In addition, ongoing trade disputes with the U.S. showed no signs of improvement during a time when China's supply chain remained in disarray.

China was also facing heightened scrutiny over a variety of issues which threatened national security interests of various nations. For instance, the Chinese military were becoming increasingly implicated in intellectual property theft from governments and foreign corporations.

Finally, China stepped up more aggressive military activities in the South China Sea, raising tensions in Taiwan and other nations in the region to high levels.

All of these events caused many large international firms to pull back investments in China. In addition, many of these firms begin the process of relocating at least some if not all of their operations to nations outside of China. This alone would deal a heavy long-term blow to the Chinese economy and Chinese consumers.

Long before these issues surfaced, I discussed the risks of China's ViE shareholder structure using Alibaba (BABA) as an example during some of my investment research presentations.

And once the risks mentioned above began to surface, I reiterated the relevance of the ViE structrure risks to shoreholders, as well as the risks of western nations decoupling to some extent from China.

I even discussed the possibility of a "cold war" between the U.S. and China in the not so distant future, which would devastate China's economy.

What about these events did Munger fail to see as a problem for BABA?

Does Munger even undergo a reasonable risk analysis prior to piling into stocks?

Maybe you weren't interested in Chinese stocks before. But you might have become convinced BABA was a great buying opportunity after hearing Munger's praise for the company and the Chinese government.

If so, you probably got stuck holding the bag when Alibaba (BABA) and other Chinese stocks collapsed when the risk of delisting surfaced in 2021.

Many investors failed to pay attention to the cold, hard facts that were right in front of their face. Instead, they were seduced by the media's praise for Charlie Munger as a great investor.

So they bought BABA because they thought Munger was an investment genius. This is what they were told by the financial media. The same message was repeated by fake investment gurus on YouTube and social media.

If you followed Munger's lead into BABA, a full examination of what happened will serve as a great learning opportunity.

In other words, you need to understand who you listened to that was advising you to blindly follow Munger's lead.

And then you should consider why you chose to cast aside the obvious risks of investing in BABA and Chinese stocks during this very dangerous period.

I find it quite ironic what Buffett recently stated (see the image below) at Berkshire Hathaway's annual meeting without mention of Munger's Alibaba blunder.

So sit back, relax, and read what I have to say carefully so you won't make the same mistake ever again.

To be continued in Part 2.

It is critical to understand and always remember that no legitimate source that provides credible content sells advertisements or provides endorsements. These are the kinds of shady activities that charlatans and influencers are involved with. If you do not fully understand why this is the case, we invite you to examine the more than 500 articles, videos and audios explaining why, providing specific examples.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

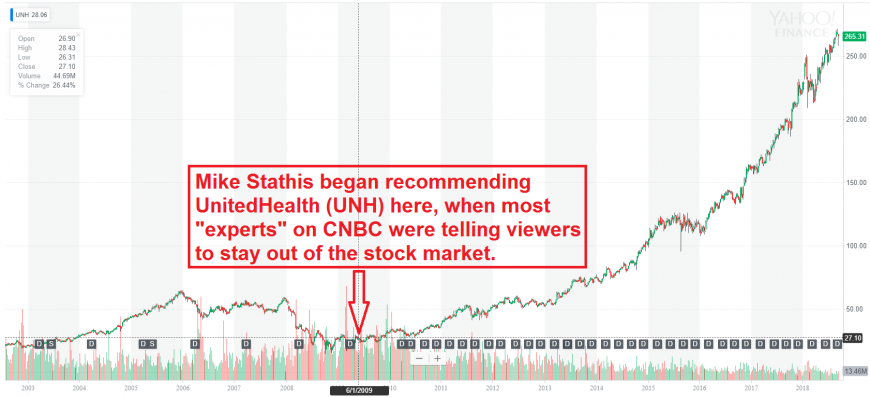

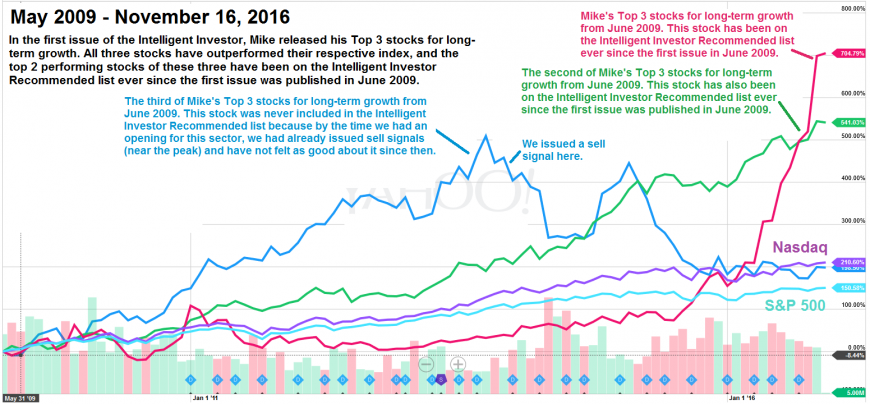

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

We have documented, time stamped publications backing the results in the following charts.

Most of the material shown in the following charts can be found in our track record links (see the links below).

.png)

We publish four (4) monthly research publications which provide the highest quality analysis (without any of the BS) found anywhere:

Stathis Shows Ackman, Soros And Bass Who The Boss Is

INTELLIGENT INVESTOR (track record links)

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Excerpts Of The October 2014 Economic And Securities Supplement Audio 2

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Stathis Nails the Gold & Silver Trade Again

We Predicted The Market Selloff Yet Again

More Proof Wall Street Research Is Useless

ANOTHER Security From Our Recommended List Gets Bought Out

We Predicted The Market Correction AGAIN

Does AVA Investment Analytics Have Insider Information?

We Pin-Pointed the Past Two Market Tops And Bottoms

Does AVA Investment Analytics Have Insider Information?

4-Day Gains of 30% for 2011 and 2010 Performance

Another Huge Winner in a Few Weeks

Newsletter Stock Recommendation Soars More Than 25% in Just 3 Days

Can a Book Serve as a Crystal Ball?

Since The Market Lows, Only One Man Continues To Shine

Mike Stathis' Near-Perfect Market Forecasting Record

Another Security from the Intelligent Investor Soars

How to Short Stocks: Critical Lessons from the Intelligent Investor

Mike's Top 3 Stocks for Long-term Growth

Where Is The Stock Market Headed?

DIVIDEND GEMS (track record links)

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Dividend Gems Subscribers Are Treated To Yet ANOTHER HUGE BUYOUT - Kraft

Dividend Gems Scores Another Huge Winner

Dividend Gems Scores ANOTHER Huge Payday

We Sold CenturyLink BEFORE It Collapsed

Warren Buffett Follows Our Lead On Heinz

Did You Own The BEST PERFORMING Stock In 2011? WE DID

Dividend Gems Destroys The S&P 500 Index AGAIN

Dividend Gems Holds Up As The Stock Market Collapses

Dividend Gems Continues To Smash The S&P 500 Index

Dividend Gems Outperforms Again

Dividend Gems Shines As The Market Corrects

The Impressive Performance Of Dividend Gems

MARKET FORECASTER (partial list; see this link for more)

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Who Do You Think Nailed the Latest Market Selloff AGAIN?

Stathis Nails the Market Correction in April 2014

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

Market Guidance: Past, Present And Future (pre-newsletter, also see America's Financial Apocalypse)

A Lesson In Market Forecasting

Where Is The Stock Market Headed?

We Pin-Pointed The Past Two Market Tops And Bottoms

We Predicted The Market Correction AGAIN

Mike Stathis' Near-Perfect Market Forecasting Record

Since The Market Lows, Only One Man Continues To Shine

AVAIA Market Forecast And Recommendations SPOT ON, AGAIN

We Predicted The Market Selloff Yet Again

COMMODITIES, CURRENCIES & PRECIOUS METALS FORECASTER (track record links)

WTI & Brent Crude:*

Henry Hub Natural Gas:*

Gold & Silver:*

Mike Stathis Nails The Gold And Silver Trade Again (Oct - Nov 2015)

Guess Who Nailed The Most Recent Gold Trade AGAIN

Mike Stathis Nails The Latest Gold & Silver Trade (Jan-Feb 2015) Updated

Stathis Nails The Gold & Silver Selloff AGAIN - Jul - Sep 2014

March 25, 2013 Gold Analysis & Forecast

The REAL Precious Metals Expert Shows You How it's Done

Stathis Nails the Gold & Silver Trade AGAIN

August 2012 - We Nailed The Gold Breakout

Mike Stathis Sets The Record Straight And Cleanses Your Mind

Other Videos Showing Stathis' Track Record

Proof That Mike Stathis Has The Leading Track Record On The Economic Collapse

Stathis Nails The Dec 2014 Market Selloff With Stunning Accuracy

The Media Has Banned The World's Leading Investment Forecaster

World's Best Market Forecaster Continues To Be Banned By The Media Crooks

Mike Stathis MUST Have A Crystal Ball. He Nailed The Market Correction AGAIN (excerpts only)

Mike Stathis Nails The Stock Market Correction AGAIN, Top To Bottom

Where Is The Stock Market Headed? Let's Ask The World's Best Market Forecaster

FACT: Mike Stathis is the leading expert on the economic collapse.

He has enabled his clients to profit BEFORE, DURING and AFTER the collapse.

No One in the world can match his track record from 2006 to current and he has backed that claim with a $100,000 guarantee which was expanded to a $1 million guarantee.

The first thing you might want to do before continuing is to watch the video on this page. CLICK HERE.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

The following list contains only a tiny portion of accurate macroeconomic forecasts and predictions made by Mike Stathis (verified by published research):*

* these forecasts do not include the accuracy of market forecasts and securities guidance provided in the research.

Newsletter Performance Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] [21] [22] [23] [24] [25] [26]

Video Presentation Highlights:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10]

The links discussing the results of the video presentations above pertain to two video series published in April 2012 – “20 Stocks Over $100” and “60 Stocks Poised for HUGE Moves”

Note: several additional winners from these presentations that have not been included here for lack of time.

In the past, we also gave away some nice freebies as well:

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19]

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.