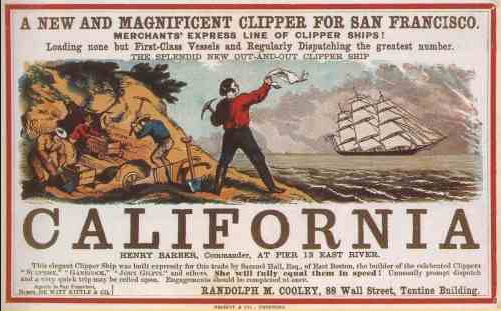

When one draws comparisons between the California Gold Rush of the mid-1800s to the current gold craze, the similarities are striking.

"Many, very many, that come here meet with bad success & thousands will leave their bones here. Others will lose their health, contract diseases that they will carry to their graves with them.

Some will have to beg their way home, & probably one half that come here will never make enough to carry them back.

But this does not alter the fact about the gold being plenty here, but shows what a poor frail being man is, how liable to disappointments, disease & death.

There is a good deal of sin & wickedness going on here, Stealing, lying, Swearing, Drinking, Gambling & murdering. There is a great deal of gambling carried on here.

There is a good deal of sin & wickedness going on here, Stealing, lying, Swearing, Drinking, Gambling & murdering. There is a great deal of gambling carried on here. Almost every public House is a place for Gambling, & this appears to be the greatest evil that prevails here. Men make & lose thousands in a night, & frequently small boys will go up & bet $5 or 10 & if they lose all, go the next day & dig more.

We are trying to get laws here to regulate things but it will be very difficult to get them executed."

A letter from a gold miner, Placerville, California, March, 1850; Holliday, J.S. Rush for Riches: Gold Fever and the Making of California.

Have you ever compared the current gold craze to the California Gold Rush of the mid-1800s?

As you will soon learn, the similarities are striking.

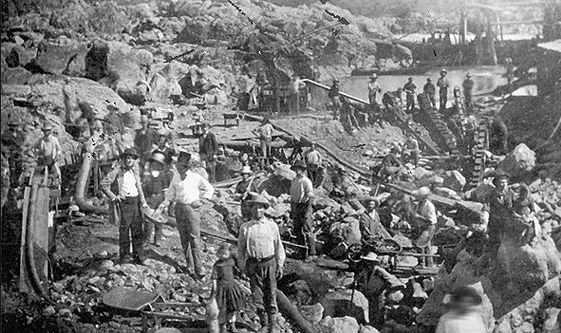

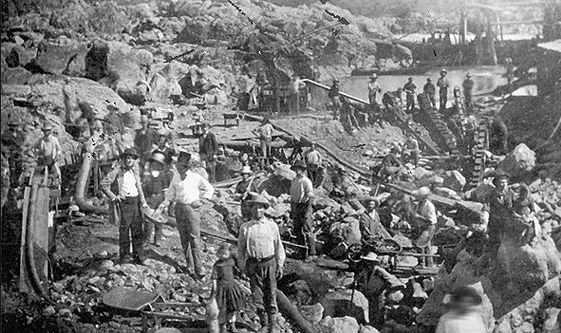

During the California Gold Rush, people came from all over the world seeking the chance to strike it rich by mining gold in northern California.

At first, the gold was plentiful. In the very early days of the gold rush, you could even pick up small nuggets off the ground with ease.

But with people flooding in from all over the world, as you can imagine, the “easy gold” disappeared real fast.

The “forty-niners,” as they were called (in reference to gold miners in California in 1849), began panning for gold in creeks. This too yielded a good amount of gold for a while, so word continued to spread about this great opportunity, bringing even more prospectors into Northern California from many parts of the world.

PLEASE LOG IN TO YOUR ACCOUNT TO READ THE REST OF THIS STORY

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Keep in mind that when you decide whether or not to listen to the ideals of someone, it is critical to determine their credibility and agendas.

So how does Mike stack up in terms of credibility?

In fact, Mike is the only person we know of you have ever attached a $100,000 reward to the first person who could prove that he doesn’t hold the leading track record in the world on the economic collapse.

What about any agendas or bias?

Does Mike get paid by outside interests to promote precious metals or securities?

It is critical to keep in mind that Mike does not sell advertisements, precious metals or securities. Therefore, he has NO agendas.

Mike has also emerged as one of the world's foremost authorities on investment-related and consumer fraud.

As perhaps the sole voice of reason pertaining to precious metals…that is to say, having accurately predicted the bull market and having warned investors about gold dealers and the gold bubble…Mike has revealed the layers surrounding this fraudulent scheme for several years now.

Ask yourself why you never see Stathis' work discussed on any gold websites.

[remember, Mike was recommending gold as early as 2001 and he even recommended it in his 2006 book. Where Mike differentiated himself from the gold-pumping con men is that he advised investors to buy the gold and silver ETFs because fees were low, and this made it possible to trade the price volatility which was something Mike stressed was necessary in order to reduce risk. He also pointed to a top in gold and silver at around $2000 and $50, after which he suggested pricing would collapse and remain low for many years]

Ask why you will never hear him being interviewed by gold dealers.

Ask yourself why very few if any gold pumpers or gold dealers have any credibility.

Ask yourself why some gold pumpers even refuse to give you their real name.

Ask yourself why some gold pumpers have moved to second and third world nations while carrying out their "business," and/or have appeared on the scene only around the time of the financial crisis.

Ask yourself why every gold pumper always says the same thing, always makes excuses when gold and silver decline, never provide you with an exit strategy, and always insist you buy physical metals.

Of course the answer to each of these mysteries is a bit different, but you can pretty much sum it up with the following...

Mike is an unbiased credible financial expert who has no agendas. And such a person poses the most dangerous threat to the precious metals pumping scam.

All precious metals dealers and promoters are lying con men and idiots who are being paid to pump gold and silver to sheep.

Mike is a real investment professional with excellent credentials, an excellent track record, no agendas (he does not sell gold, silver, advertisements or securities) and he has worked in the financial industry as a professional since the 1990s.

Most important of all, Mike Stathis holds the best investment forecasting track record in the world since 2006.

Wake up and smell the coffee. All sources that discuss and publish material about gold and silver are NOT legit sources of unbiased info.

They are providing you with cheap infomercials!!!!

Stop being taken for a fool.

For those who insist on remaining skeptical despite Stathis' world-leading investment track record, his absence of agendas and his results-based research and insights, it is important to keep in mind that he was recommending gold investments as early as late-2001 while working on Wall Street.

Below Mike has released Chapter 12 of his own 2007 book showing that he was the only one to not only have predicted the financial crisis, but also showed specific ways to land huge profits.

Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

There is a good deal of sin & wickedness going on here, Stealing, lying, Swearing, Drinking, Gambling & murdering. There is a great deal of gambling carried on here.

There is a good deal of sin & wickedness going on here, Stealing, lying, Swearing, Drinking, Gambling & murdering. There is a great deal of gambling carried on here.

.png)