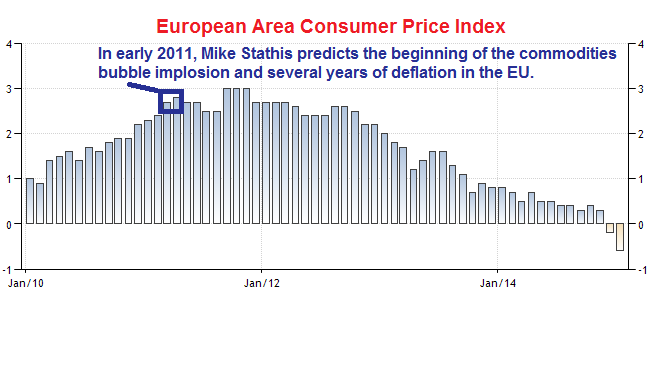

Do you remember back in 2010 and 2011 when every gold-pumping con man and their minions were claiming that commodities would soar?

Do you remember how they were still insisting hyperinflation was just over the horizon?

CNBC's king of broken clocks, Peter Schiff even released a book around late 2010 whereby he urged people to buy commodities because he expected them to soar.

Isn't this the same guy who keeps telling everyone to be worried about hyperinflation?

Isn't this the same guy who keeps telling you that people are no longer worried about the euro and the EU , but they are most worried about the dollar and US?

.png)

.png)

Folks, if you already haven't figured it out by now, you probably never will. The fact of the matter is that you will never do well with your investments if you listen to anyone in the media.

Of course, this should be no surprise to anyone who has been paying attention, as Schiff has served as one of the best contrarian indicators ever, as he has consistently been wrong virtually everything he has predicted. Blast From the Past - Peter Schiff Was Wrong.

Recently, some of the doomsday douche bags have tried to weasel out of the hyperinflation mantra as an attempt to not look like idiots (Martin Armstrong and Jim Puplova are just two of several chumps who have retreated from hyperinflation fear mongering as of late). Sorry guys, it's too late. A tiger never changes its stripes.

Don't think any of the other clowns in the media are any better either. The financial media is designed to screw you by providing you with idiots, clowns, broken clocks and con men.

.jpg)

The list of accurate forecasts made by Mike Stathis continues to add to his world-leading track record and unprecedented streak of excellence.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

View Mike Stathis' Track Record here, here, here and here.

.png)

Don't you think it's way past time you stopped being fooled by broken clocks, con men and morons and started patching into one of the very top investment minds in the world?

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.

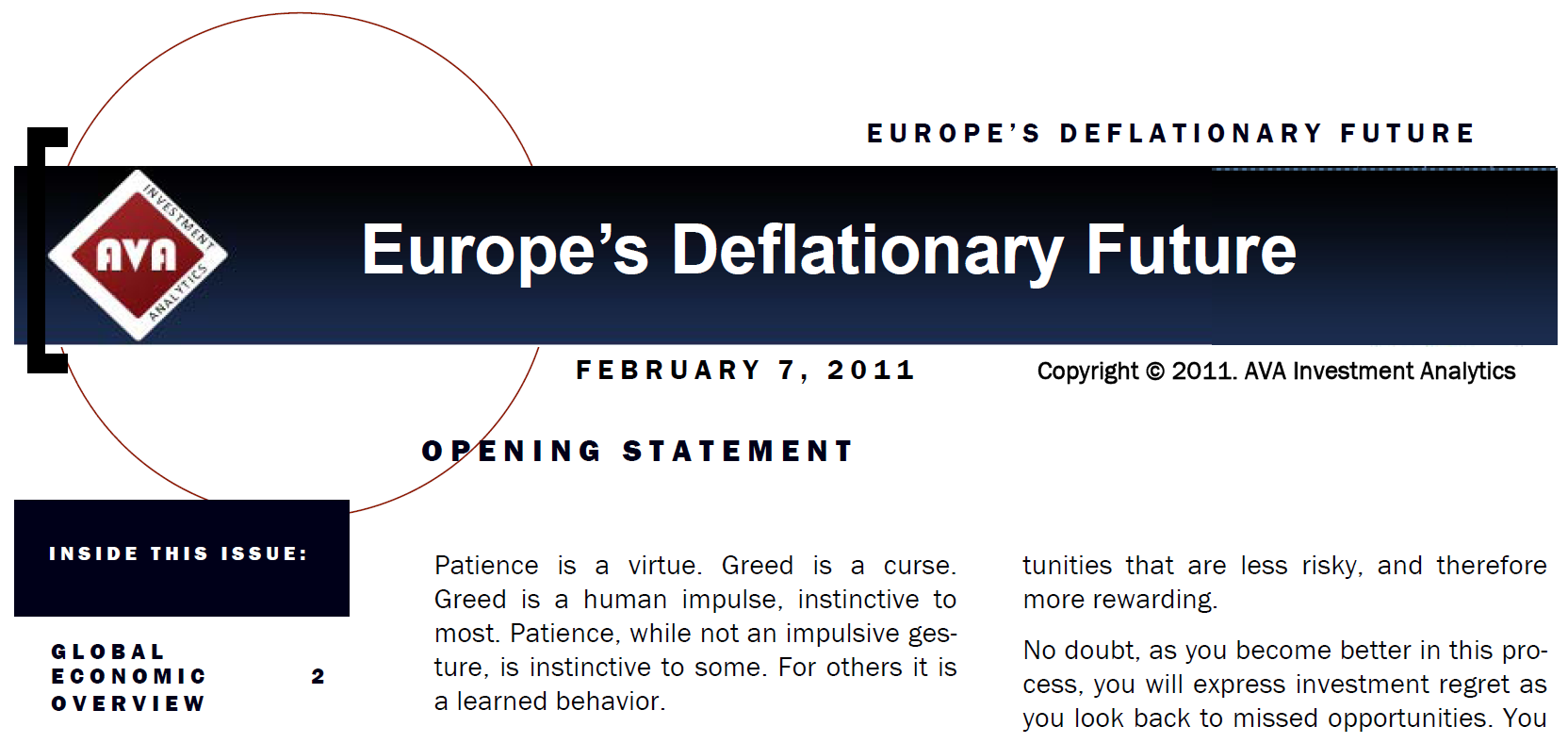

Just released is an 18-minute video presentation discussing some points about the EU.

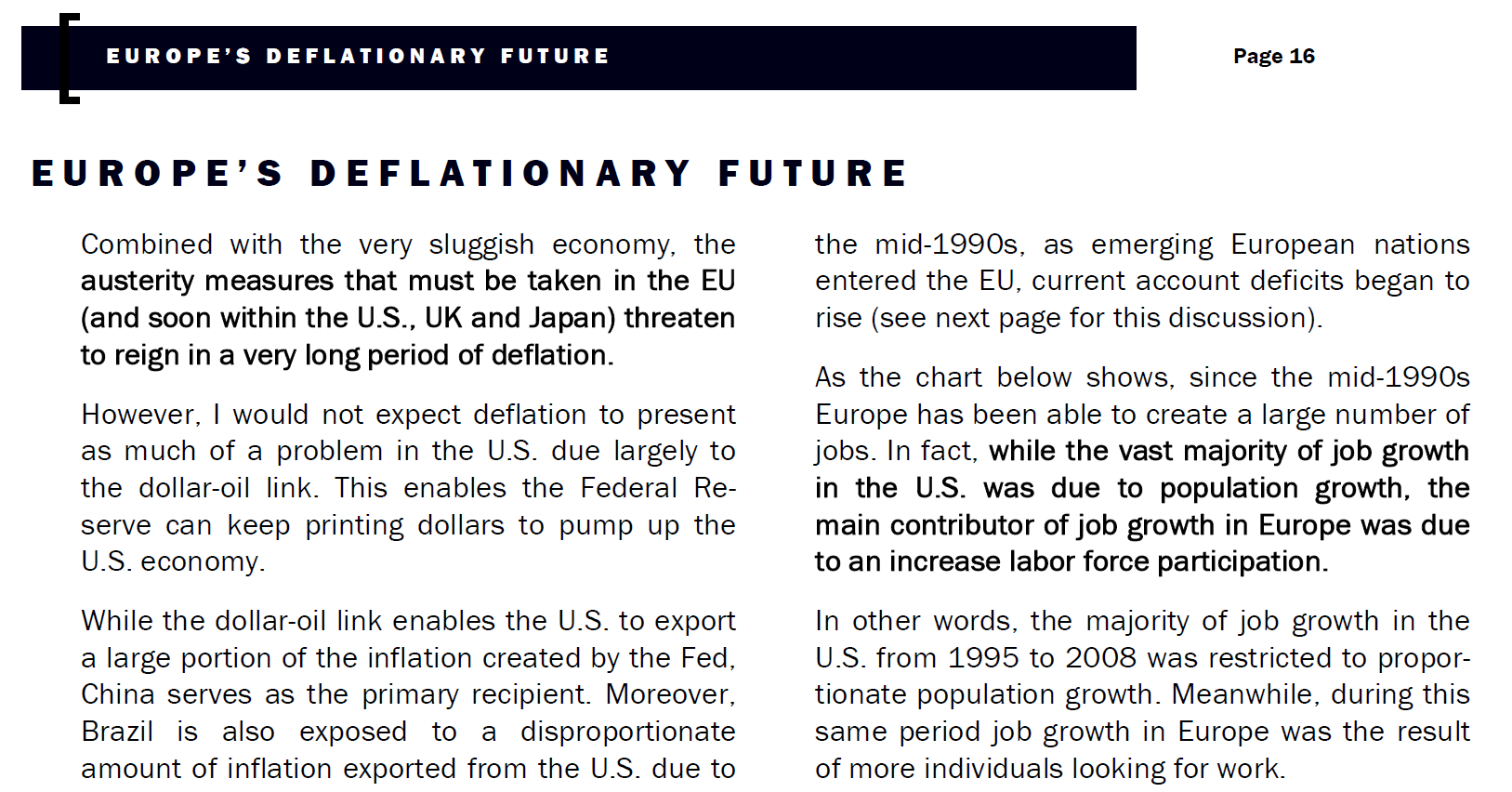

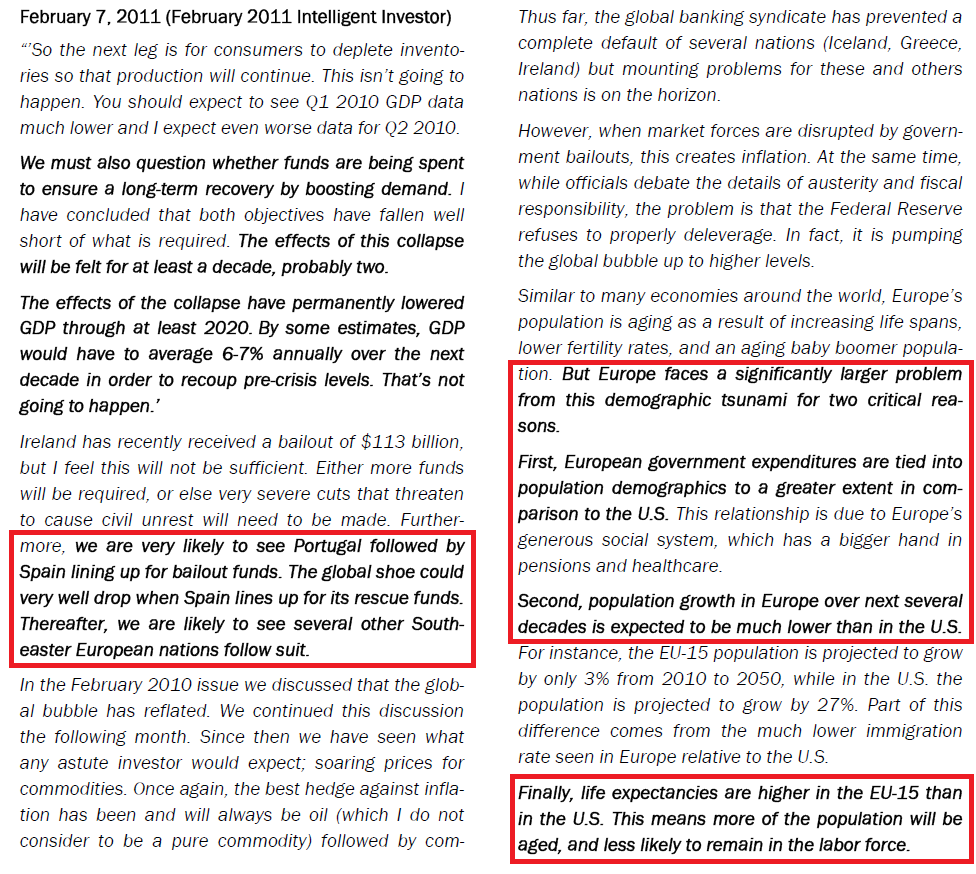

Recently, Europe reported some upbeat economic numbers, prompting many analysts to take a more optimistic stance on the region. Specifically, the region’s composite PMI was revised to a 35-mon...

It has been more than three years since leaders from the G20 gathered in London to discuss solutions to the financial crisis and global recession. This meeting also called on experts to devise ways to...

As time moves forward, while my own forecasts and recommendations continue to serve as a crystal ball, many of those made by Peter Schiff of Europacific Capital continue to form an emba...

Just released for subscribers of the Intelligent Investor is a 30-minute video presentation discussing the risks of an additional housing market correction, as well as the risks posed to the global fi...

As the sovereign debt crisis continues to worsen due in large part to incompetent leadership, more attention is being given to France. Similar to the case seen in the U.S., the decline in domestic d...

While we have certainly seen commonalities such as high unemployment, reduced output, and fiscal stress, the economic collapse has also forced the leaders of each nation to take a good look at their n...

In the very first issue of the Intelligent Investor (June 2009), I discussed problems in Europe that became a reality several months later. “It is likely that America will end up on the hook fo...