Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Opening Statement from the March 2015 CCPM Forecaster

Opening Statement from the March 2015 CCPM Forecaster

First published on March 1, 2015 for subscribers to the CCPM Forecaster

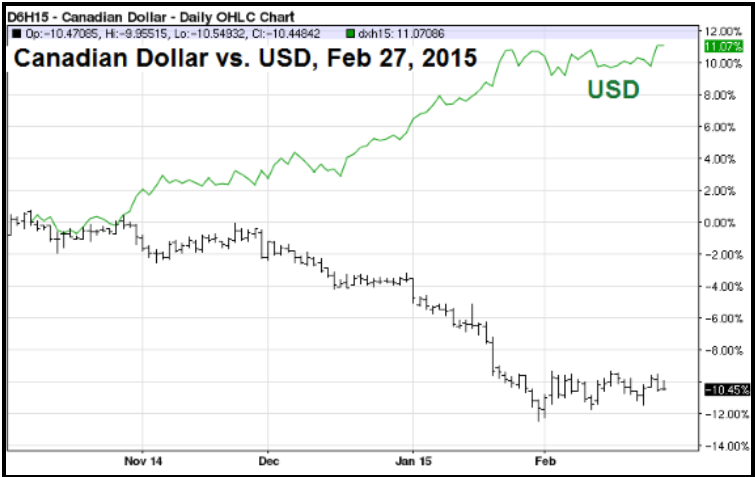

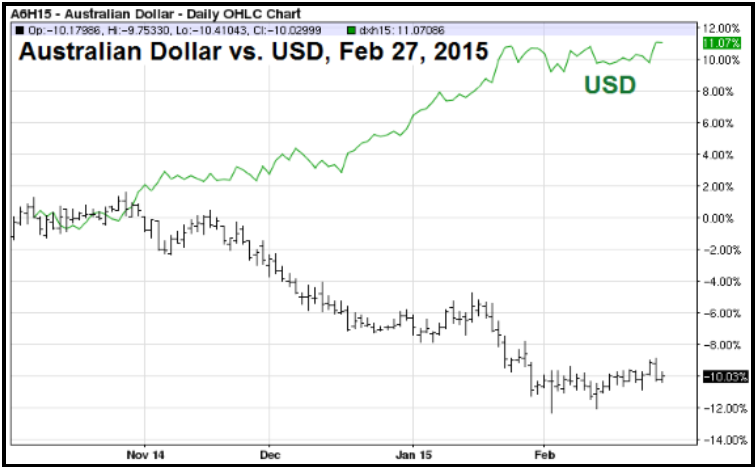

After soaring for months, the dollar has recently experienced some price consolidation. The dollars’ current resting stage has enabled the Canadian and Australian dollars to form a short-term bottom.

The dollar’s relative weakness has also impacted crude oil pricing. Rather than improvements in supply-demand, we believe crude oil pricing has rallied largely due to recent dollar weakness. Thus, unless adequate measures are taken to reduce output, oil pricing could experience much lower levels from here. This is especially the case with WTI.

On the other hand, we believe that the supply-demand relationship will better support higher oil prices in the second half of 2015.

Moving forward, traders should monitor the dollar with more vigilance in order to help determine trade entry and exit especially for oil, natural gas, and the Canadian and Australian dollars.

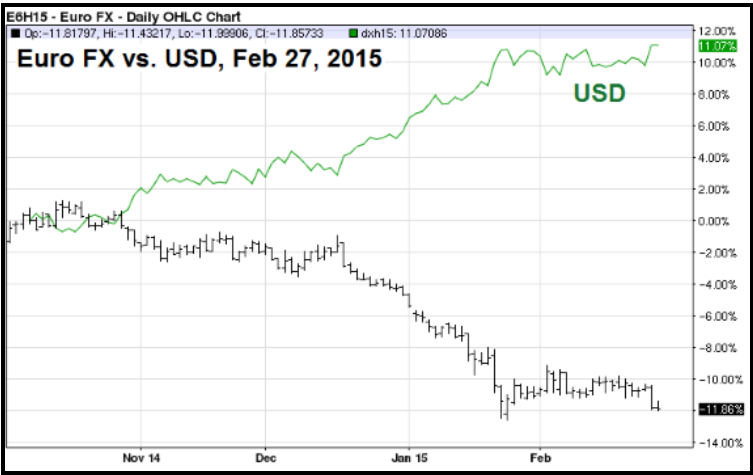

Despite fundamentals that might seem counterintuitive (lower rates across the globe with increasing pressure to raise rates in the US; a modest period of economic gains in the US relative to much of the globe), it is entirely possible for the dollar to enter a short-term bearish trend which could eventually turn into an intermediate-term bearish trend. If this happens, it is likely to