For some time now we have been emphasizing the growing momentum in the U.S. economy relative to the rest of the world. The recent (preliminary) Q4 GDP growth of 5% year-over-year confirms this trend is alive and well. As you can imagine, it also adds to the already strong bullish trend seen in the US dollar.

The strength seen in the U.S. economy is by no means sufficient to reverse the slide in commodities. With China continuing to show signs of weakness, Japan and Brazil in a recession, with several nations in the EU not far behind, demand for raw materials simply isn’t there.

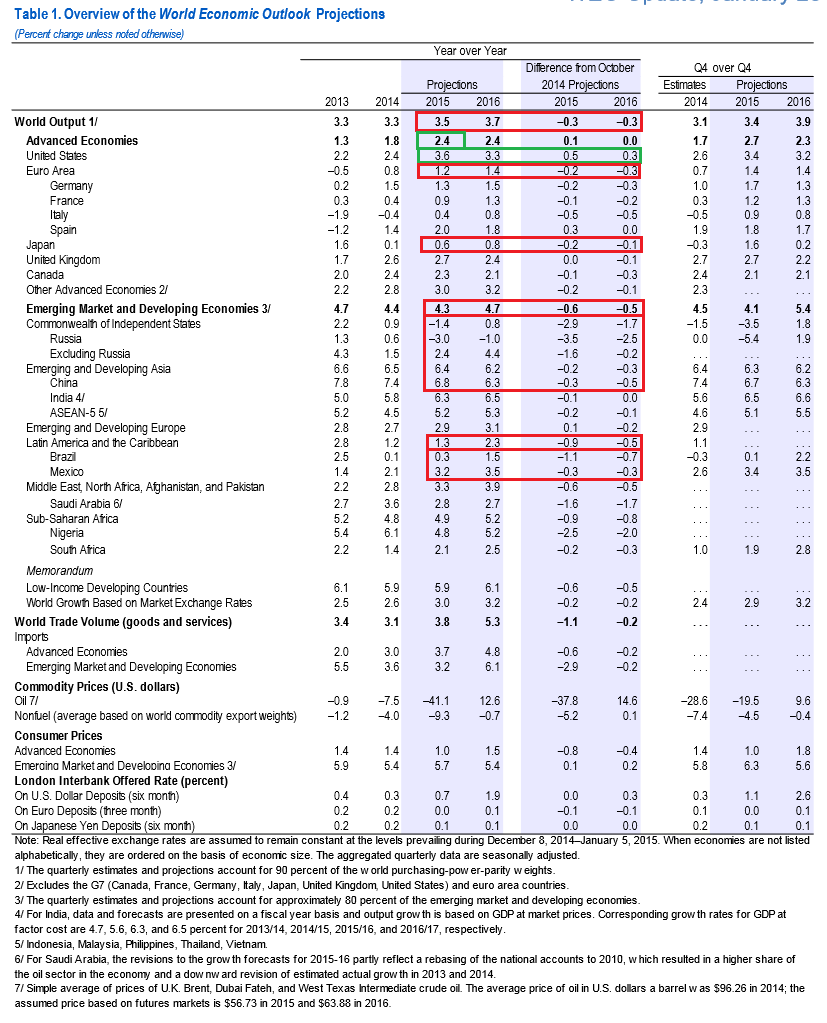

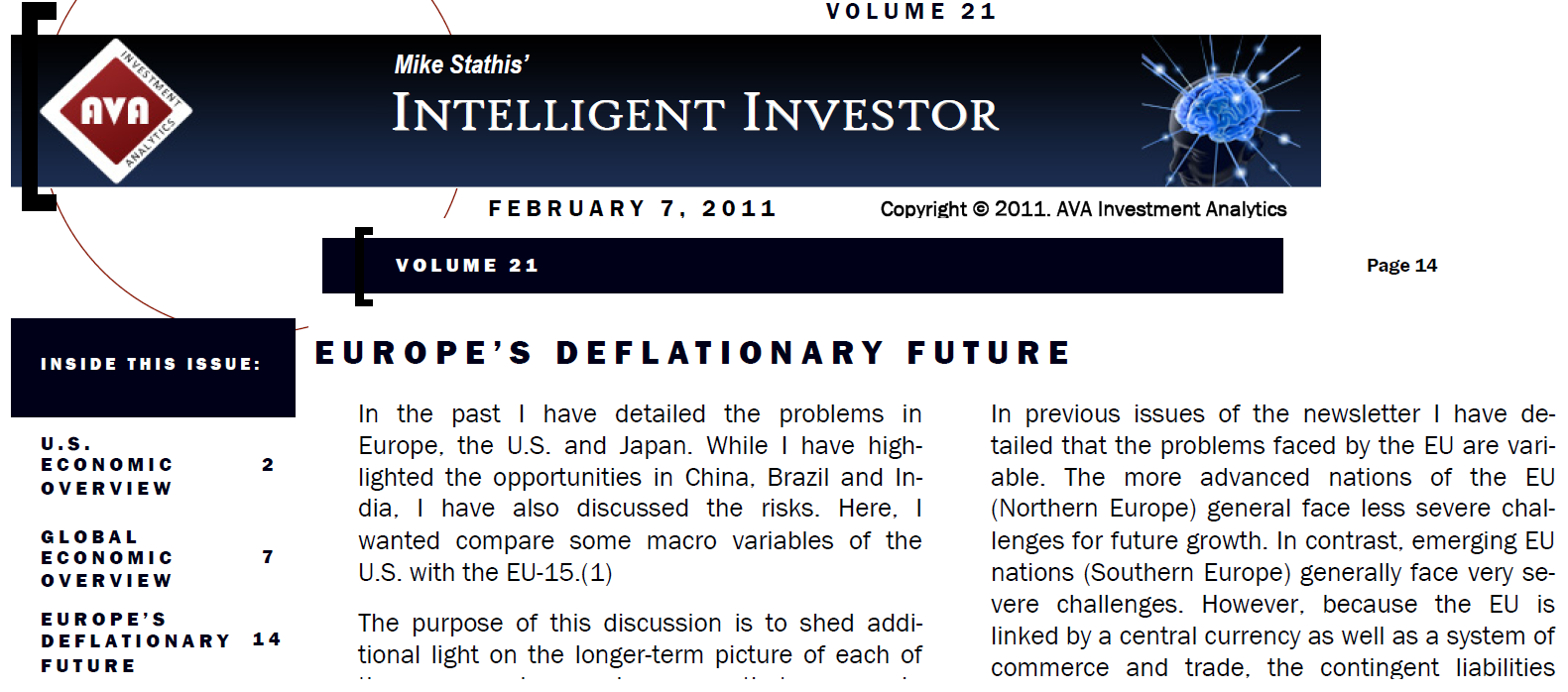

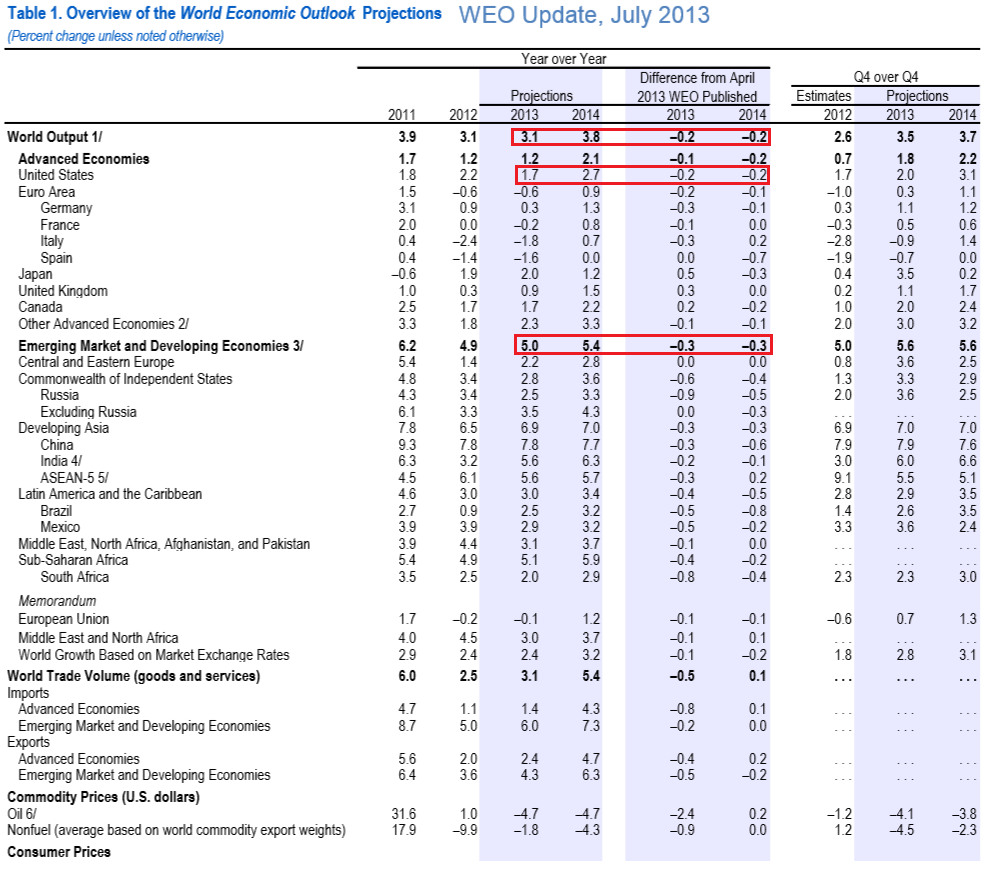

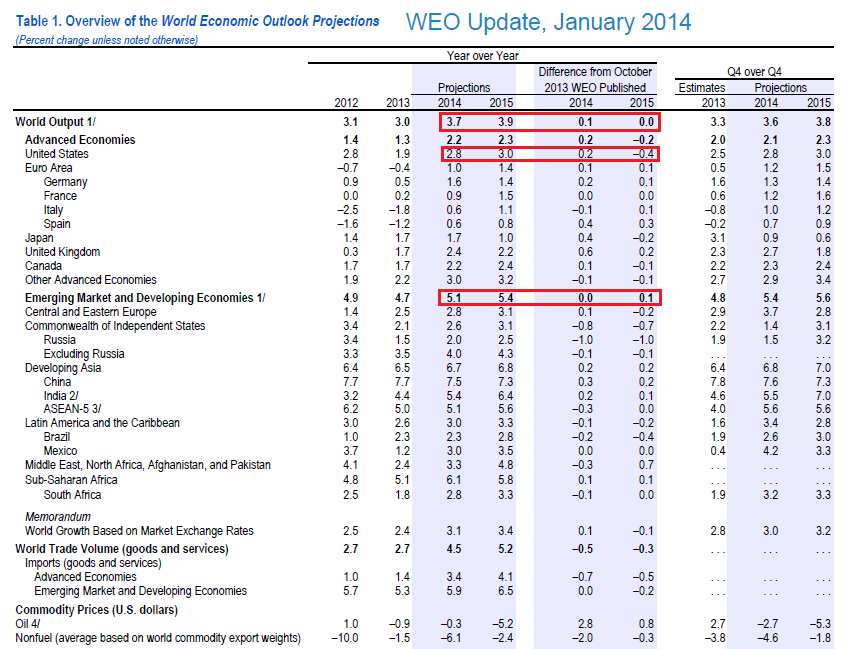

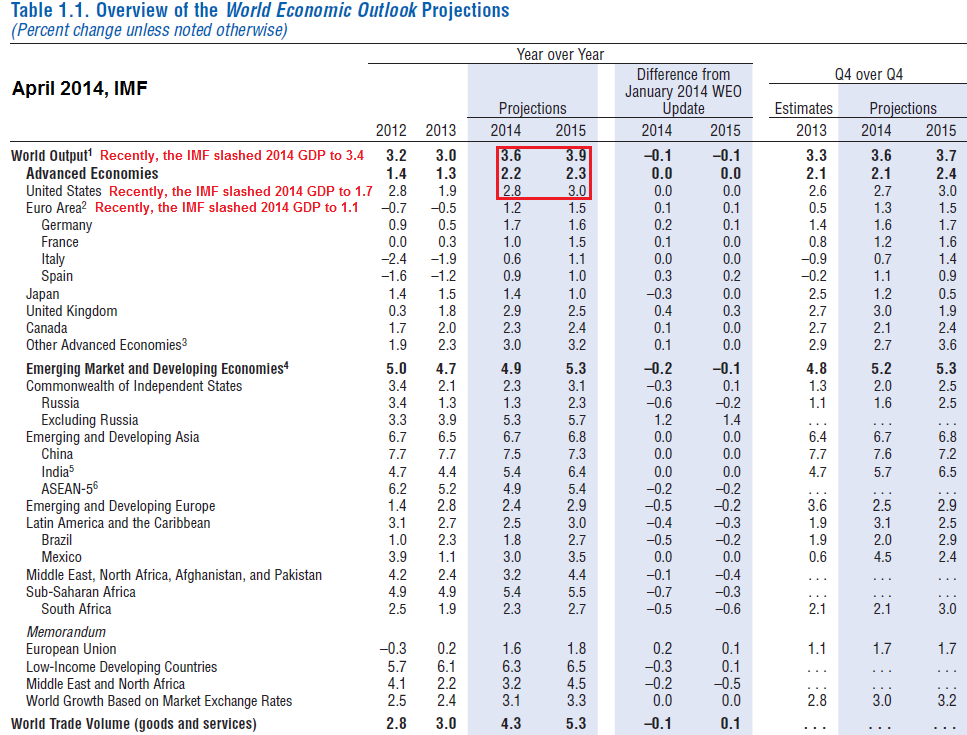

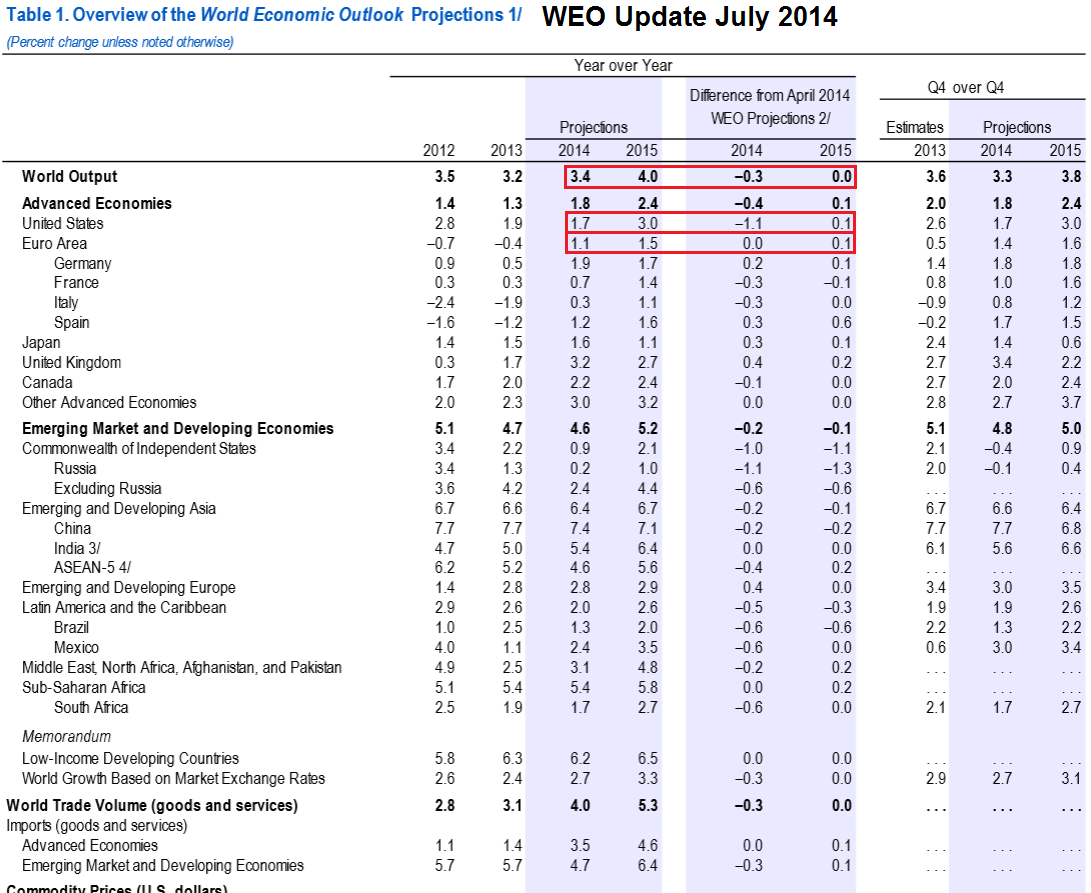

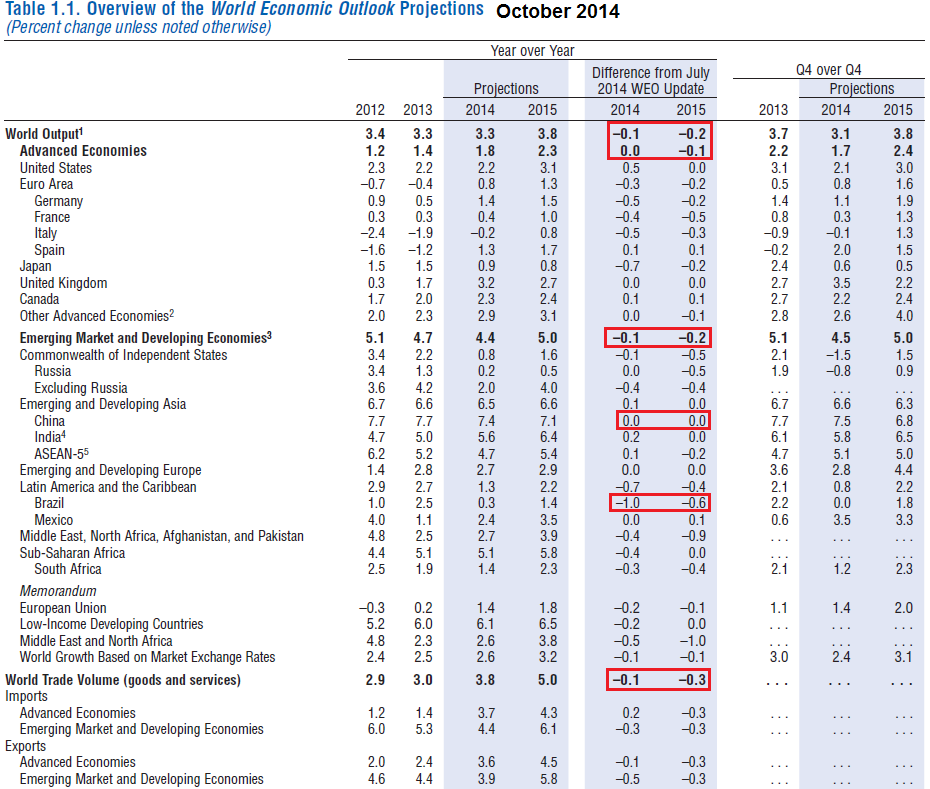

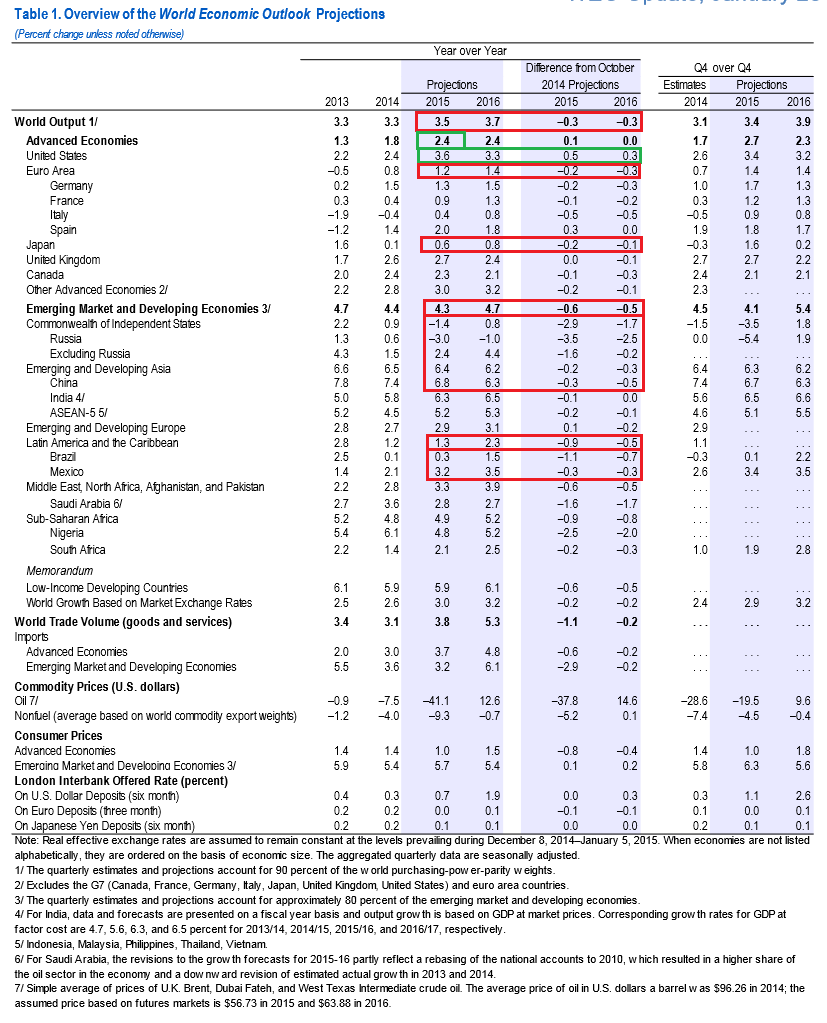

As we have discussed many times in the past, the IMF continues to remain in the dark with its economic forecasts. This is relevant given the fact that this governing body has the best access to global economic data, and is in the driver’s seat to provide economic and financial policy recommendations to virtually every nation in the world.

Over the past several years we have documented countless errors made by the IMF, from its overly optimistic economic forecasts to its disastrous recommendations provided to the EU, UK and Japan. It is a fact that the IMF actually worsened the economic conditions in virtually every nation that has followed its recommendations.

Of course, these downward revisions are not at all surprising to subscribers to the research, as we have been forecasting lower economic growth data than the IMF for some time. As well, we have been illustrating specific examples pointing to the inaccuracy of the IMF’s overly optimistic forecasts.

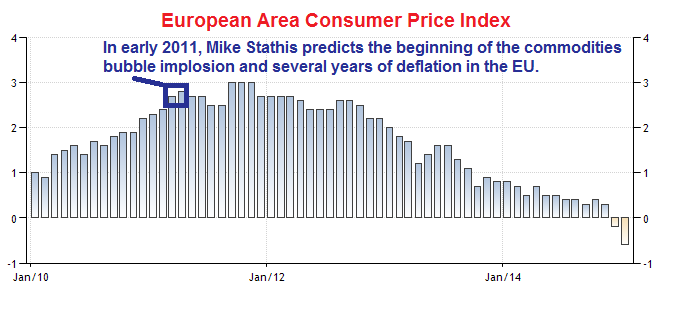

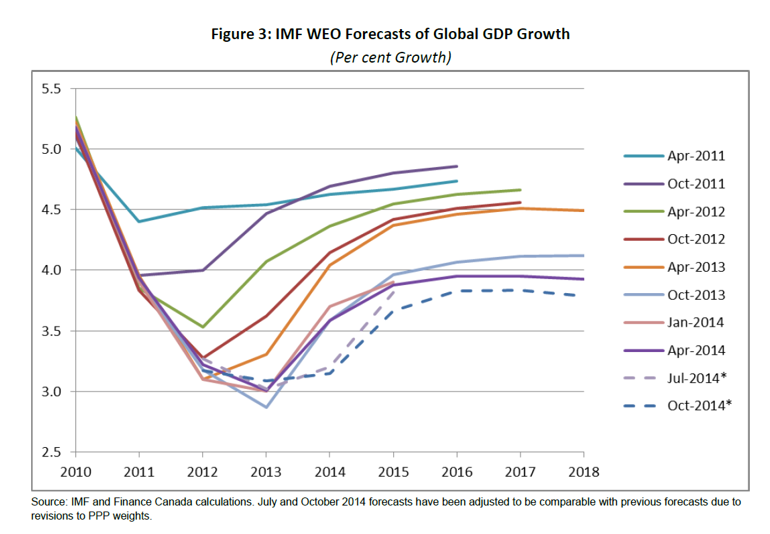

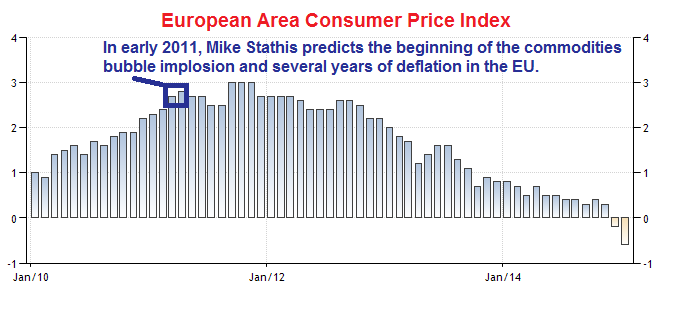

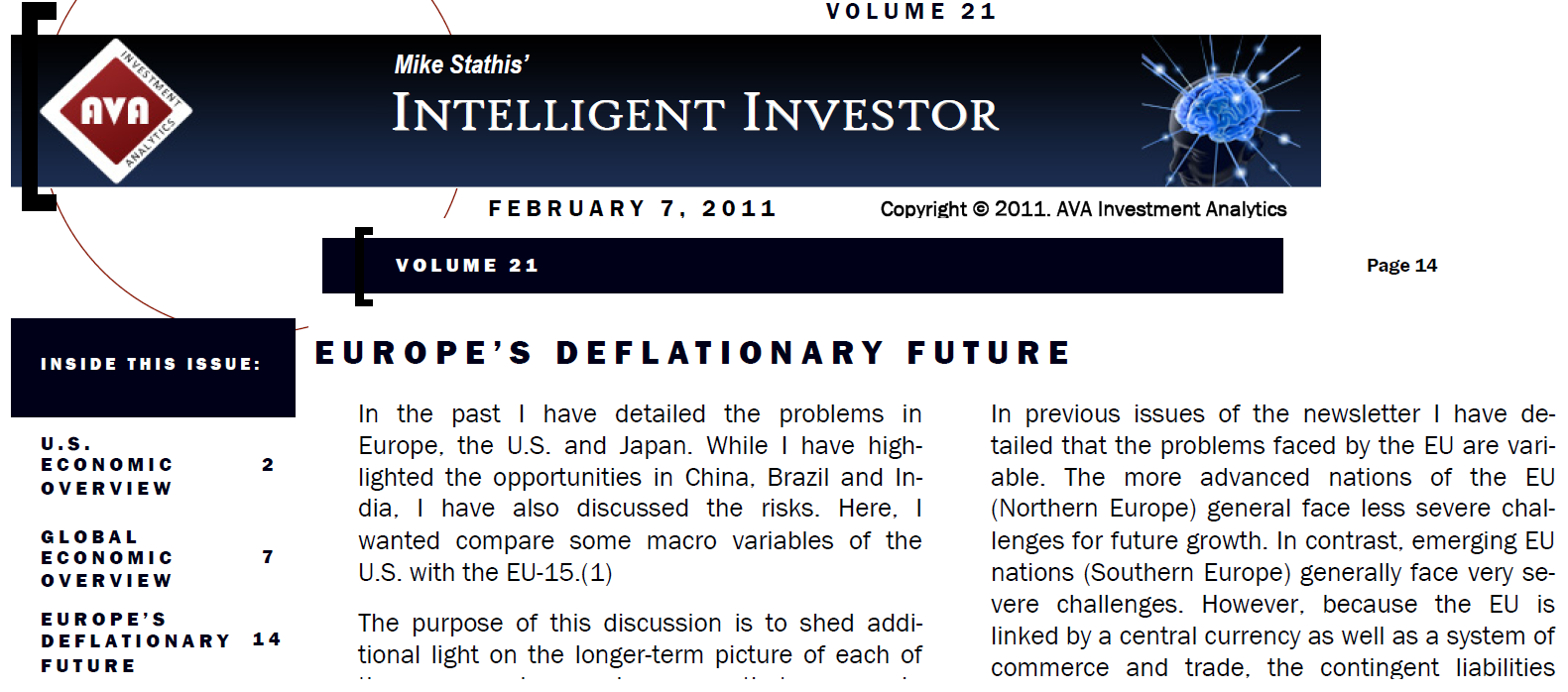

(the charts below were not included in the original Opening Statement but have been previously included in the Market Forecaster and Intelligent Investor video presentations)

Understanding the incompetence of the IMF can go a long way to assist investors and especially traders. For instance, by knowing that the EU faced a long period of deflation well in advance of the ECB, IMF and EC’s acknowledgement of this reality, we knew to take large short positions on the euro once these officials finally realized what was going on and announced it. We did not need any time to analyze what they said or question it. All we were waiting for was the shit to hit the fan and go all in.

.png)

.png)

On the other hand, if we had taken a short position when we first were aware of the fate of the EU, we would not have profited by nearly as much.

We have been emphasizing a similar situation for the euro, real, yen and Australian dollar for several months now. Hopefully, traders have capitalized on what we feel to be some fairly easy profits taking short positions in these currencies.

Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

.png)

.png)

.png)