Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Top Six Questions to Ask BEFORE You Trust Investment "Experts"

Always remember that all content is not created equal.

Just because something is published in print, online or aired in the broadcast media does not make it accurate or valuable.

In fact, more often than not the larger the audience, the more likely the content is either inaccurate or slanted.

Most people associate credibility with name-recognition. But more often than not, name-recognition serves as a predictor of bias if not lack of credibility because the more a name is recognized, the more the individual has been plastered in the media. And every intelligent person knows that individuals who have been provided with media exposure because they are either naive or clueless.

The media positions these types of individuals as “credible experts” in order to please its financial sponsors; Wall Street.

Before you even think about subscribing to an investment newsletter or sending you hard-earned money to a financial firm or fund, you need to ask yourself a few questions:

1. What is their track record?

It is critical to know the track record of anyone you plan to trust for insight and recommendations. The problem is that most investors do not know how to analyze a track record.

Always examine the track record of your source in depth, looking for accuracy and specific forecasts rather than open-ended statements.

Although the process can be detailed, you should at least do the following:

-Determine their hit/miss ratio; how many times are they wrong versus right?

-Determine whether they have been preaching the same lines for years; if so they have no credibility since a broken clock is always right once a day. Timing IS important (virtually every doom and gloom clown you can imagine - Schiff, Faber, Weiss, Prechter, etc.)

-Determine the source of the track record; was it in a form that cannot be altered?

-Determine their full track record; many financial professionals who specialize in marketing and virtually all newsletter publishers cherry-pick their winning calls while neglecting to show you their losing calls.

They also like to extrapolate their claims. For instance, most of these charlatans may have stated that “Bear Stearns was in deep trouble” only later to have claimed that this was a prediction that it would go bankrupt. Without examining their full track record, you cannot determine their accuracy.

2. Does the head person have Wall Street experience?

Instead of name-recognition or media celebrity status, you must determine whether your source has relevant experience on Wall Street as opposed to being self-taught.

This is an extremely important consideration for a variety of reasons. But keep in mind that I view it as only a minimum requirement one should meet, and by no means ensures the source is competent or credible.

First, former Wall Street professionals have had the POTENTIAL opportunity to manage a large number of client accounts, funds, dealt directly with analysts, know how the dynamics of the market really works, and many other considerations. Accordingly, they are likely to have knowledge that is extremely difficult to obtain elsewhere. If they were directly involved in managing separate accounts, they are also likely to have developed their skills and insights at an accelerated pace.

Finally, they understand risk and suitability. While we do not offer personalized investment advice, we do understand risk, so we factor this into our strategies and securities selection process. However, you should not assume that every individual who has worked on Wall Street knows what they are doing because most of them do not.

Mike worked at UBS and Bear Stearns, where he learned (on his own) much of what he knows today.

3. Are they ahead of the curve?

Or are they just riding a bull market or asset class (gold or commodities) bull market wave?

Are they skilled in valuation analysis, securities analysis, fundamental analysis, technical analysis, economic analysis? Are they capable of integrating all of these tasks into a prudent and successful investment strategy?

Do they even understand the basis of prudence? If so, where did they learn it?

Unless they have managed assets professionally, they are not likely to understand prudence. Thus, they are very likely to make ridiculously risky recommendations without realizing it.

Do they understand risk and can they measure it?

Are they able to estimate risk-adjusted returns?

4. Do they have a bias?

Does your source have any agendas which would provide any type of benefit accounting for their views?

Most individuals either sell ads on their site or are dealers of precious metals or securities. That means their views are biased and cannot be relied upon.

The bias is most often monetary but can also be political. You cannot ever expect to receive valuable investment insight from anyone who has a bias.

Would you ask a real estate agent if “now” is a good time to buy a house?

It is critical to keep in mind that Mike does not sell advertisements, precious metals or securities. Therefore, he has NO agendas.

5. Do they market to gullible investors?

These individuals spend most of their time kissing up to the media, flooding articles all other the Internet frequently, and making as many media appearances as they can. The reason for this is of course because they are really professional marketers.

You are what you spend most of your time doing. If you spend most of your time trading stocks, you are a trader. If you spend most of your time performing investment research and analysis, you are a research analyst.

And if you spend most of your time marketing yourself, you are a professional marketer.

We do not spend any money on advertising because we do not want to attract impulsive investors.

6. Do they sell greed and fear, and/or do they claim to be able to show you how to make millions in the stock market (also applies to commodities, futures, real estate, etc.)?

Do they post unbelievable profits? Ridiculous gains? Does it all seem too easy to believe?

These are typical signs of con artists. They target greedy, lazy and unsophisticated investors who do not know that such gains are impossible to achieve.

If they are delivering gains of 100% in a week or a month, why haven't they retired? Why are they bothering with you?

Based on several years researching the investment newsletter market, we have found not one single publication written by credible individuals with a consistently good track record.

Furthermore, based on our analysis not one of these individuals understands or has been trained in the required skills mentioned above.

The fact is that virtually all of these individuals are con artists.

Many have criminal records.

Many have been sued by the SEC.

If you are not aware of this, you simply have not performed adequate due diligence.

The largest collection of these rascals is based in South Florida.

But they also have a strong presence in the Baltimore area.

Do not compare us with all other publishers of investment newsletters in the market place.

We are NOT part of that marketing industry, which is run by crooks and idiots with no professional experience or expertise.

We provide research and analysis to investment professionals and are offering these publications to the investment public.

We are experts in securities analysis, trading, valuation analysis, distressed securities analysis.

At AVA Investment Analytics, we don't try to pump gold, silver or equities like many others you see because we are not promoters or marketers.

And we do not receive any compensation whatsoever (including from ads) from our content.

We provide individual investors, financial advisers, analysts and fund managers with world-class research, education and unique insight.

We have a spectacular track record predicting corporate bankruptcies.

We have not been bought off, nor will we ever be. We don’t just give you certain slivers of the truth and shy away from things others won’t talk about because they have been bought off. We speak the full truth and nothing but the full truth.

We have been banned by the media. The media is bought and paid for by the banks, corporate America and Washington. Figure it out.

All advertisers have banned us because they are owned by the same groups of people who run Wall Street, the media, corporate America and everything else, and they want to prevent the truth from getting out.

In this world, you are either a sheep or a wise man. If you are not patched into our research, chances are you’re a sheep.

Are you wondering how to assess financial advisers and mutual funds to determine which are the best?

We offer an analysis of advisers and funds on a limited basis. Email us for details.

Email service providers have banned us from being paid customers to their services because they are owned by the same groups of people who run Wall Street, the media, corporate America and everything else, and they want to prevent the truth from getting out.If you are not speaking the full truth you are lying.

We have the leading track record in the world on the economic collapse and the recovery period through current (March 1, 2014).

I want to remind those who have not yet signed up and paid form Membership or have become a Client via subscription of one of our investment newsletters that I have amassed the most detailed and comprehensive compilation of LIARS, SNAKE OIL SALESMEN, IDIOTS and such pertaining to the financial industry.

This work devoted to this publication reflects over a decade of research I have done on these clowns and utilizes my expertise in both the investment spectrum as well as deviant psychology.

This massive report is already thousands of pages and dozens of videos and continues to be expanded frequently.

The name of this publication is the ENCYCLOPEDIA of Bozos, Hacks, Snake Oil Salesmen and Faux Heroes.

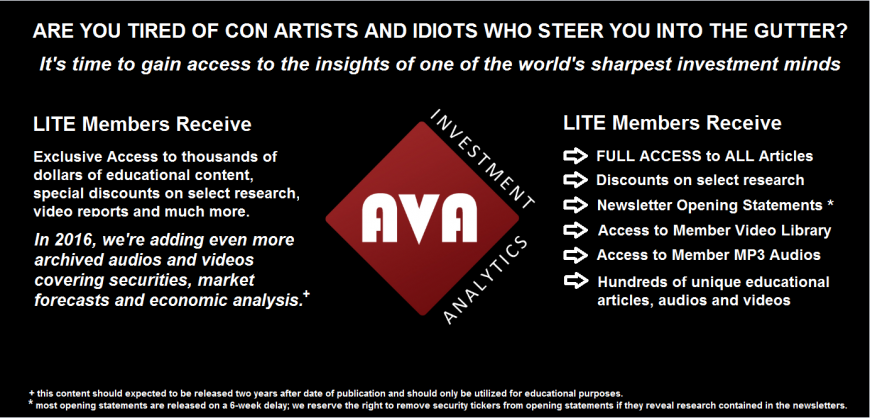

Access to this extremely informative continuously expanding publication is valued at many times more than the cost of the annual website Membership. But of course, Members receive access to this critical publication in addition to unrestricted access to all articles as well as huge discounts on select research and full access to the Member Video Library containing several educational videos covering securities, markets, economics and other topics.

Mike Stathis remains the lone voice of reason and wisdom for Main Street.