Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

The Rape of Greece by Jewish Bankers

Update: July 3, 2015,

We want to encourage everyone to spread this article around to social media, comment boards, YouTube, email and any other means.

We have lifted all copyright restrictions for this article with the following two conditions. You MUST contact us to receive approval to republish this article.

The article must be republished in its entirety with proper citation (you must list the author, company and provide a link to our website).

This article can only be republished onto a platform that does NOT use advertisements or charge any fees for viewing this or any other content on that platform. We strictly prohibit any money being made from our content unless we provide written consent.

Note that the “Fair Use” clause of copyright law does not apply to use of content that in any way monetizes the content (through direct or indirect payments or through leveraging any service or product that has monetary value).

As well, “Fair Use” has many limitations.Fair Use is ultimately determined in a court of law, so if you do not wish to go to court, you need to be very careful about using our content. The best route to take is to ask us prior to using our content.

Shortly after this article was published on Press TV in July 2012, the Jewish Mafia scrambled to further extend its ban on Mike Stathis and all sources who publish his world-class insights by banning Press TV from Europe.

If you were not previously aware of it, now you realize how much the Jewish Mafia fears Mike Stathis because Mike holds the rare combination of credibility, brilliant insight, unlimited courage, honesty and commitment to speak the truth.

June 11, 2015 Update:

As the propaganda continues to be churned out by the Jewish media monolpoly regarding Greece, take note of the idiotic comments spreading through the Internet, confirming just how much the Jewish media controls the minds of the population.

I wanted to republish the facts about the Jewish banking scum to make sure you all understand precisely what has led to the current economic woes in Greece and many parts of Europe.

July 3, 2015 Update:

We have been notified that Greece's Prime Minister, Yanis Varoufakis has deleted all mention of this article on his personal blog http://yanisvaroufakis.eu on numerouc occassions.

We are not surprised by this, as Mike believes that both he and Prime Minister Tsipras are being controlled by the bankers (despite despite their predicatible "Greek theatrical" performance).

We want to encourage everyone to post this link on his blog.

Greece Is Being Run By The Jewish Mafia

.png)

The Rape of Greece by the Jewish Bankers

Mike Stathis, Chief Investment Strategist, AVA Investment Analytics

Originally published at Press TV on July 10, 2012

For background info see The Solution to Greece's Sovereign Debt Crisis

After suffering through nearly five years of a very severe recession, the worst is yet to come for the Greek people. According to consensus estimates it will take twelve years for the Greek economy to regain its pre-recession output.

Although I view this estimate as generous, it nevertheless represents an extremely slow recovery when compared to the most adversely affected nations from previous financial crises. My own estimates indicate that it will take Greece at least eighteen years to reach its pre-recession economic output.

recovery when compared to the most adversely affected nations from previous financial crises. My own estimates indicate that it will take Greece at least eighteen years to reach its pre-recession economic output.

Even if Greece were to begin its recovery later this year, it will have lost more than 16% of GDP since its pre-recession peak, making it one of the most severe losses of economic output seen from all financial crises in the 20th and 21st centuries.

Of course, Greece is not going to begin a recovery in 2012, 2013 or 2014. In fact, by the time the IMF is finished with its austerity measures, Greece could set a new world record in terms of economic destruction.

So what is the root cause for the implosion of the Greek economy?

Is it due to the nation’s high rate of tax evasion, lack of competitiveness, its overly generous retirement system and poor labor participation, as we have all been told by the media and their “expert” sources?

If you believe these are the real reasons for the collapse of Greece, you may have also been fooled by other myths and lies spread by the banking cartel and their media friends.

The big secret is that the formation of the euro has been largely responsible for the economic problems seen in many of the euro zone member states. This has obvious implications for both of the future of the euro as well as the future composition of the euro zone.

economic problems seen in many of the euro zone member states. This has obvious implications for both of the future of the euro as well as the future composition of the euro zone.

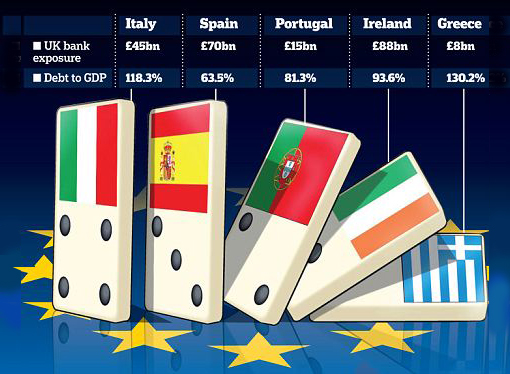

Numerous economic organizations aligned with the globalization and banking establishments have even acknowledged that the decline in the current accounts of South East Area (SEA) countries coincided with their entry into the European Monetary Union (EMU).

For instance, in a research report published nearly three years ago the IMF admitted that just prior to entry into the EMU, several SEA European nations began to record a current account deficit, reflecting various economic and infrastructural imbalances within the euro zone.

According to official data from a variety of sources, the current accounts in seven nations within the SEA have imploded since the mid-1990s. For instance, in 1994, these nations maintained an overall average current account balance to an average deficit of 10% in 2008.1

In contrast, the picture in Northern Europe (the Northern Euro Area, NEA) is radically different. When the current accounts of the NEA are examined, eight nations have accumulated current account surpluses over the same period.2

By the IMF’s own admission, it was the creation of the EMU that drove the declines in.png) current accounts by allowing countries to maintain their investment levels above what could be financed from lower domestic saving.

current accounts by allowing countries to maintain their investment levels above what could be financed from lower domestic saving.

This admission is quite striking considering that the IMF is not only part of the international banking cartel, but is also a component of the globalization establishment.

1 The SEA consists of Cyprus, Greece, Italy, Malta, Portugal, Slovenia, and Spain. SEA-4 denotes the four largest SEA countries: Greece, Italy, Portugal, and Spain; the latter three joined the EMU in 1994 and the euro area in 1999, and Greece joined the euro area in 2001. The remaining SEA countries, SEA-3 (Cyprus, Malta, and Slovenia) joined the EMU in 2004 and the euro area in 2007–08. Not included in this analysis is Slovakia, which joined the EMU in 2009.

2 The NEA comprises Austria, Belgium, Finland, France, Germany, Ireland, Luxembourg, and the Netherlands.

Thus, adoption of the euro has largely been responsible for the current economic problems seen in Greece, Italy, Spain, and other nations. They were doomed from the beginning due to the inherent differences in each nation’s economic, trade and infrastructural base. These differences served as inspiration for the formation of the euro as a way for NEA nations to exploit their SEA counterparts. This is a point that I detailed more than three years ago.

“One thing is for certain. In order for the union to succeed, all nations must be provided with a somewhat equivalent infrastructural base. Otherwise, the disparities in commerce will present problems.

Let me give you a simple example of this. Arguably, Germany has the most modernized road system in Europe. This enables an efficient means of transportation for a vibrant consumer and business activity.

In contrast, Greece’s transportation infrastructure is horrendous. As a result, the cost structure for goods and many services is higher by necessity. This disparity leads to a relative difference in the strength of the euro depending on which nation you are in. But there are other economic uncertainties, such as who will bail out troubled nations.

Given the economic, social and sovereignty issues, it is possible that by 2020, Germany will pull out of the union, most likely for economic reasons alone. If that happens, you can bet France will soon follow.”

Source: AVA Investment Analytics, June 2009 Intelligent Investor. May 27, 2009.

Also see the following article for more background: The Solution to Greece's Sovereign Debt Crisis.

As the true architects of the EMU, the Jewish Banking Cartel realized that the euro would create economic problems for SEA member states. But they didn’t tell German and French officials. Instead, they promoted the euro as a gateway to greater economic prosperity for NEA nations in order to gain support from Germany and France.

As the true architects of the EMU, the Jewish Banking Cartel realized that the euro would create economic problems for SEA member states. But they didn’t tell German and French officials. Instead, they promoted the euro as a gateway to greater economic prosperity for NEA nations in order to gain support from Germany and France.

The only problem was that the bankers neglected mention of contingent liabilities that would surface as SEA nations collapsed. Now that the destructive nature of the EMU is beginning to surface, German and French officials are second-guessing whether they will remain in the EMU over the long-term. These discussions have been ongoing for a while now, but they have not received much media coverage because the most serious talks have occurred behind the scenes.

There is a very good reason why the U.K. never joined the euro. Hopefully, by now you realize why.

My guess is that the IMF regrets publishing the research report referred to in this article because it really blows the lid off of the myths that the euro would bring economic prosperity for all member states.

Immediately after the euro was launched, Wall Street banks and their associates in Europe began flooding Greece and other EU member states vast sums of consumer credit. The idea was to pervert European consumers to become as irresponsible as those in the U.S. The bankers achieved this objective in just a few short years.

began flooding Greece and other EU member states vast sums of consumer credit. The idea was to pervert European consumers to become as irresponsible as those in the U.S. The bankers achieved this objective in just a few short years.

The timing of this financial bait-and-switch was indeed very convenient for Wall Street, as it coincided with the collapse of the dotcom bubble in the U.S. Thus, a refocus on European consumers during the dotcom recession in the U.S. provided Wall Street parasites and their colleagues in Europe with new hosts.

In the early stages of the take down, bankers made enormous sums of money flooding European nations with consumer and business credit. Now that many of these nations are economically distressed, the bankers are moving in to seize a good deal of taxpayer-owned assets using the IMF as its Trojan horse.

IMF officials have infiltrated many EU nations, offering to supply each with finance capital that has come from taxpayers from around the globe. In return, these nations are required to adhere to very specific criteria in order to receive new rounds of financing. With each round of financing comes the promise of further economic destruction.

IMF officials have infiltrated many EU nations, offering to supply each with finance capital that has come from taxpayers from around the globe. In return, these nations are required to adhere to very specific criteria in order to receive new rounds of financing. With each round of financing comes the promise of further economic destruction.

In short, rather than some humanitarian rescue fund, the IMF serves as a taxpayer-funded Leveraged-Buyout firm which for some strange reason is controlled by the international banking cartel.

Once a nation agrees to accept funds from the IMF, it has agreed to allow bankers to reengineer the entire nation. You can imagine which side stands to benefit and which stands to lose.

As part of its conditional loan agreements, the IMF has implemented a very controversial form of austerity which it has used since its formation decades ago. In fact, the austerity measures utilized by the IMF have been directly responsible for the much of the demise of the Greek economy since 2010.

form of austerity which it has used since its formation decades ago. In fact, the austerity measures utilized by the IMF have been directly responsible for the much of the demise of the Greek economy since 2010.

It is a well-known fact that the IMF’s approach to austerity most often destroys rather than restores economic stability. As history shows, in almost every situation when the IMF has become involved, it has made the nation worse off. Many nations are aware of this. Just ask officials in Brazil, Iceland, Hungary, Argentina, and many other nations what they think of the IMF. Greece is now learning how the IMF works.

The IMF’s approach to austerity has been structured as a pro-cyclical fiscal policy, which is designed to tighten the budget. The objective of this approach is to improve the target nation’s competition by a reduction in labor costs that is expected to materialize as the result of internal devaluation of the economy. In turn, export trade is supposed to become more competitive, which is expected to help the recovery process. But this cookie-cutter approach is riddled with numerous flaws.

In most cases when the IMF becomes involved, the pro-cyclical approach does more harm than good because it has been designed as a solution to address normal economic contractions. But the IMF only enters the picture when nations are facing very severe economic problems that extend beyond those encountered during typical economic contractions.

In most cases when the IMF becomes involved, the pro-cyclical approach does more harm than good because it has been designed as a solution to address normal economic contractions. But the IMF only enters the picture when nations are facing very severe economic problems that extend beyond those encountered during typical economic contractions.

As a result, the IMF’s pro-cyclical approach actually makes nations worse off because the “geniuses” at the IMF assume that the economic problems are cyclical in nature. Clearly, the problems in Greece do not resemble those seen during a normal economic contraction. Greece is in fact in a severe depression.

Furthermore, as a way to carry out its globalization agenda, the IMF disregards the cultural uniqueness of nations it seeks to “assist,” thereby inflicting lasting socioeconomic and political disruptions. This points to an entirely different topic of discussion that I may address in the future.

uniqueness of nations it seeks to “assist,” thereby inflicting lasting socioeconomic and political disruptions. This points to an entirely different topic of discussion that I may address in the future.

Overall, the economic approach taken by the IMF is one of privatization. This leads to a large reduction in government control of the economy. While some might view this as a good thing, the problem is that government control of basic goods and services is required in order to prevent industry collusion and price gouging which is often the result of privatization in nations with poor regulatory controls. The U.S. offers a good illustration of this point.

European politicians have been led to believe that the IMF’s recommendations are in the best interest of the people. Yet, the IMF’s misguided approach to austerity continues to harm the entire European economy. This is not by coincidence, as the IMF serves as an arm of the Jewish Banking Cartel, which itself is the primary component of the Jewish Mafia.

best interest of the people. Yet, the IMF’s misguided approach to austerity continues to harm the entire European economy. This is not by coincidence, as the IMF serves as an arm of the Jewish Banking Cartel, which itself is the primary component of the Jewish Mafia.

The Western media has also played a key role in the rape of Greece by the banking segment of the Jewish Mafia. As always, the Western media monopoly has teamed up with establishment economists in order to convince the people that the IMF is competent and is acting in their best interests.

The media has also placed sole blame for Greece’s economic problems on Greek officials and the Greek people. This is a theme that is all too familiar. As one example, you will recall how the media focused on “greedy” and “deceitful” homebuyers in the U.S. as the source of the real estate collapse rather than focusing on widespread fraud by Wall Street banks.

Serving as a very important component of the Jewish Mafia, the means by which the Western media monopoly operates is all too predictable. It always blames the victims and never the villains.

This mechanism serves as the primary means to prevent revolts in response to criminal activities committed by bankers, corporations and governments.

When this approach is not fully effective, the Jewish Mafia uses its operatives in the government to intimidate and incarcerate individuals that threaten to uncover the entire operation.

It is certainly true that Greece has a very high level of tax evasion, is not as competitive as nor is as open to trade in comparison to most E.U. member states. But the fact is that its system of commerce has served it well for centuries. The same can also be said of Italy, Spain, Portugal and other member states whose economies have imploded since joining the EMU.

Each of these nations made the vital mistake of joining the EU and more recently the EMU. Once they accepted the globalization philosophy engineered by the Jewish Mafia, each participant nation cast aside its sovereignty, and thus control over its destiny.

Each of these nations made the vital mistake of joining the EU and more recently the EMU. Once they accepted the globalization philosophy engineered by the Jewish Mafia, each participant nation cast aside its sovereignty, and thus control over its destiny.

Just as planned, the European component of the globalization scheme has served as a portal for the Jewish Mafia to pervert the society and extort the economy of each EU member state. Thus, Greece offers a glimpse of what the future holds for other nations in the EU.

Due to the IMF’s continued austerity, Greece’s economy continues to worsen. The unemployment rate in Greece is near record-highs, unit labor costs remain among the highest in the euro zone, while Greece’s Real Effective Exchange Rate remains higher than prior to its recession in 2006.

Not only has internal devaluation sought by the IMF’s pro-cyclical strategy not worked, Greece’s economy has been made much worse than it would have been without the “assistance” of the IMF.

Rather than focus on addressing longer-term issues, the bankers have continued to cut government spending and wages at the worst possible time. For instance, during the 2010-2011 period, the IMF demanded Greece cut spending by a whopping 8.7% of GDP.

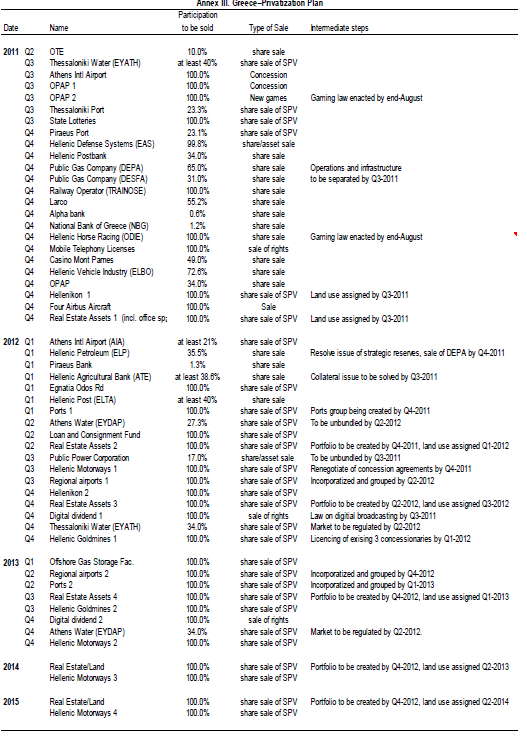

For 2012, the IMF has approved spending cuts of 2.8% of GDP, most of which is slated to come from revenue increases. Much of this revenue boost is expected to come from a clampdown on tax collection from wealthy citizens, while the rest will come from the IMF’s radical privatization plan.

Private property owners are also being targeted by the banking cartel. Greek property owners are now required to pay a special “emergency” property tax which has been linked to their electric bill. If this tax is not paid by the due date, the “plug is pulled.”

The IMF has also “convinced” Greek officials to slash 150,000 government jobs by 2015 and weaken collective bargaining arrangements. And the minimum wage was recently cut by 20% for workers 25 and over, and by 32% for those under 25.

The 2013-2014 period promises to cause much more pain for Greeks, as the IMF has pushed Greek officials towards spending cuts, specifically from pensions, social transfers and defense. While the Greek youth suffers an unemployment rate of 50%, Greek adults face pension cuts of up to 40%. There appears to be no end in sight to the rape of Greece by the Jewish Banking Cartel.

Since the IMF’s First Review of the Stand-By Arrangement released in September 2010, the organization has consistently underestimated the severity of Greece’s economic contraction. In total the miss in GDP by the IMF since this time has been greater than 7%. This is a huge miss, especially considering the short time span of the estimates, the IMF’s open access to official data, and the huge number of IMF staff members dedicated to this nation.

In each of the five reviews conducted by the IMF since September 2010, Greek GDP and unemployment rate projections missed by a huge mark. As a result, the IMF had to lower its GDP and raise its unemployment estimates in subsequent reviews.

As a result of the IMF’s austerity initiatives, virtually every economic and financial measure of Greece’s economy remains in a downward trend, from the stock market, retail sales, and current account balance, to GDP, PMI, bank deposits and new car registrations; many continuing to make new lows. The notable exceptions are the new highs being made in Greece’s interest burden on its debt, spreads with euro bonds, its unemployment rate (now at nearly 22%), and unit labor costs.

It is important to remember that the IMF is staffed with thousands of “highly trained” analysts and economists who are paid very handsomely. They also receive one of the most generous public sector retirement pensions which are of course funded by taxpayers from around the world.

Upon careful examination of the economic data and projections from each review conducted by the IMF, I have concluded that there is absolutely no way an economic organization staffed with reasonably competent individuals could consistently make so many mistakes of such a large magnitude over a period of less than two years. Thus, either the IMF is remarkably incompetent, or IMF officials have intentionally understated their estimates for the Greek economy.

What could be the motive of the IMF to mislead Greek officials?

Part of the blueprint of the Jewish banking heist is to privatize a great deal of Greece’s public assets. This privatization plan will turn over valuable public assets in Greece to the private markets, enabling the vultures to squeeze as much money from Greek citizens as possible. Accordingly, projections by the IMF rely heavily on the private sector to extract large sums of money from Greeks (€35 billion over the next two years, or 15.4% of GDP) in order to “improve productivity.”

It is my opinion that the IMF made extraordinarily optimistic projections and has only made modest revisions with each review it has conducted in order to lure Greek officials into accepting this privatization plan. In support of this accusation, it has been reported by highly reputable sources that other much less optimistic projections were not being made public.

On the other hand, if Greek officials had been provided with accurate projections early on, it is likely they would have opted to default on the national debt without accepting the privatization plan. A complete default in Greek debt would have hit the bankers very hard. But with the help of the IMF, the Jewish Banking Cartel will get taxpayers to pay back the debt while they strip Greece of government assets.

If my analysis is correct, the actions by the IMF represent a form of premeditated economic extortion. Even if I am wrong, at the very least, IMF head Lagarde should be forced to resign and a complete overhaul of this taxpayer-funded organization should commence.

Don’t expect anyone to face criminal charges for this heist because bankers are never held accountable, especially when they are Jewish. A large portion of their getaway always occurs through the hands of the media crime bosses who distract and spin things so that the real criminals are shielded from scrutiny.

By misrepresenting the reality of Greece’s demise, the media has hoodwinked people to think that this blatant fraud is the result of Greece’s own internal failures. As a result, very few people even realize the bankers are engaging in economic extortion.

In response to its own incompetence (or even complicit fraud), the IMF continues to ratchet down on Greece further, insisting that more austerity is needed. Thus, the highly inaccurate economic projections from the IMF have given it more bargaining power to gradually push Greek officials into a corner.

.png) Keep in mind that as the IMF makes the Greek economy worse, it lowers the value of assets planned for the privatization auction.

Keep in mind that as the IMF makes the Greek economy worse, it lowers the value of assets planned for the privatization auction.

Thus, the IMF has an incentive to make Greece’s economy even worse because it will enable the Jewish Banking Cartel to snatch up Greek airports, sea ports, utilities companies and other critical assets at fire sale prices. Thereafter, they will hold the Greek people to their own financial terms.

And finally, the social engineering segment of the Jewish Mafia will enter the crime scene to ensure the end of Greek religion, culture, solidarity and heritage. We are now witnessing the rape of Greece by the Jewish Banking Cartel.

Now that Greece has made the fatal decision to accept further assistance by the IMF and EU, it will face a much more severe depression in coming years. After the nation’s most valuable assets are sold, the Greek people will face an indefinite period of economic extortion and social reengineering at the hands of the Jewish Mafia.

EU, it will face a much more severe depression in coming years. After the nation’s most valuable assets are sold, the Greek people will face an indefinite period of economic extortion and social reengineering at the hands of the Jewish Mafia.

As I have discussed in the past, the only solution for Greece is to exit the European Monetary Union, and later the European Union. But because Greek politicians have already been bought off by the bankers, the only way Greece can be saved is by the efforts of the Greek people.

This is also the only viable solution for Italy, Spain and Portugal if in fact the people of these nations wish to restore their nation.

Careful observers are now witnessing the mechanism by which the IMF always functions. Unfortunately, the destruction caused by the IMF certainly is not going to end with Greece unless the people unite and reclaim their nation from the criminals. Most important, we must all prevent this from ever happening again.

Originally published at Press TV on July 10, 2012.

A Message To Those Who Deny The Existence Of The Jewish Mafia

Now get some balls and forward this article to everyone you know; or are you a spineless?

Also see Greece Is Being Run By The Jewish Mafia

.png)

See also IMF Sex Scandal Points To The Bigger Picture