The second take is always better than the first, but you decide!

Long before Peter Schiff entered the broken clock circuit, Harry Dent was the media's go-to guy for marketing bullshit.

But Dent has made a recent remergence back into the scene. Now with Agora Financial (the top copyediting scam firm in the USA) as his business partner, Dent is able to reach every doomsday wacko who owns a PC.

Before I show you how wrong Harry Dent has been (video below), you might want to take a look at some articles I previously wrote exposing the reality about this man.

It is very important to take note of the track record of these guys because they tend to fool most of the sheep who either have short memories or else were not investors when these clowns laid out their previous failed predictions.

By now hopefully you realize that these guys are all the same - Dent, Schiff, Faber, Rogers, etc. If they are always being paraded in the media as experts, you can bet they are contrarian indicators.

You might recall that I have profiled a few mutual fund disasters. If you haven't already read these articles, I strongly suggest you do so ASAP.

And if you have already read them, you might want to take another look because one can never get enough of the truth when it comes to the financial industry.

It is important to understand that there are many more of these fund disasters; too many for me to cover.

And I'm sure there are hundreds more that I do not know about.

Perhaps the most important take away message from these articles is that you should never assume any fund manager or financial "expert" is worth a damn regardless what Morningstar (which serves as a hack firm for funds) or the media tells you because they are all playing on the same team.

You are viewed as the opposing team. And their intent is to grab as much money from you as possible, all while making it look like they are doing you a favor.

You should always assume that all fund managers and financial advisers are fairly useless, or else not worth what they are charging you until proven otherwise (and if you think that a 2 or 3% annual fee is small, try compounding this rate over several years and tell me what you think.

Have a look at the long-term impact of fees on your returns.

I am not saying that all of them are useless.

I am telling you that you must make this assumption until proven otherwise because the percentage of competent fund managers and financial advisers is unfortunately quite low.

Without a doubt, there ARE a few really good, ethical and honest fund managers and financial advisers out there. And it's always a great experience to run across one.

The problem is that everyone seems to always think their guy is one of the "few" good ones that exist within an industry filled with chumps and con men.

Don't be one of these suckers!

.png)

Always remember that all ad-based content is designed to screw you because you aren’t the one paying the bills.

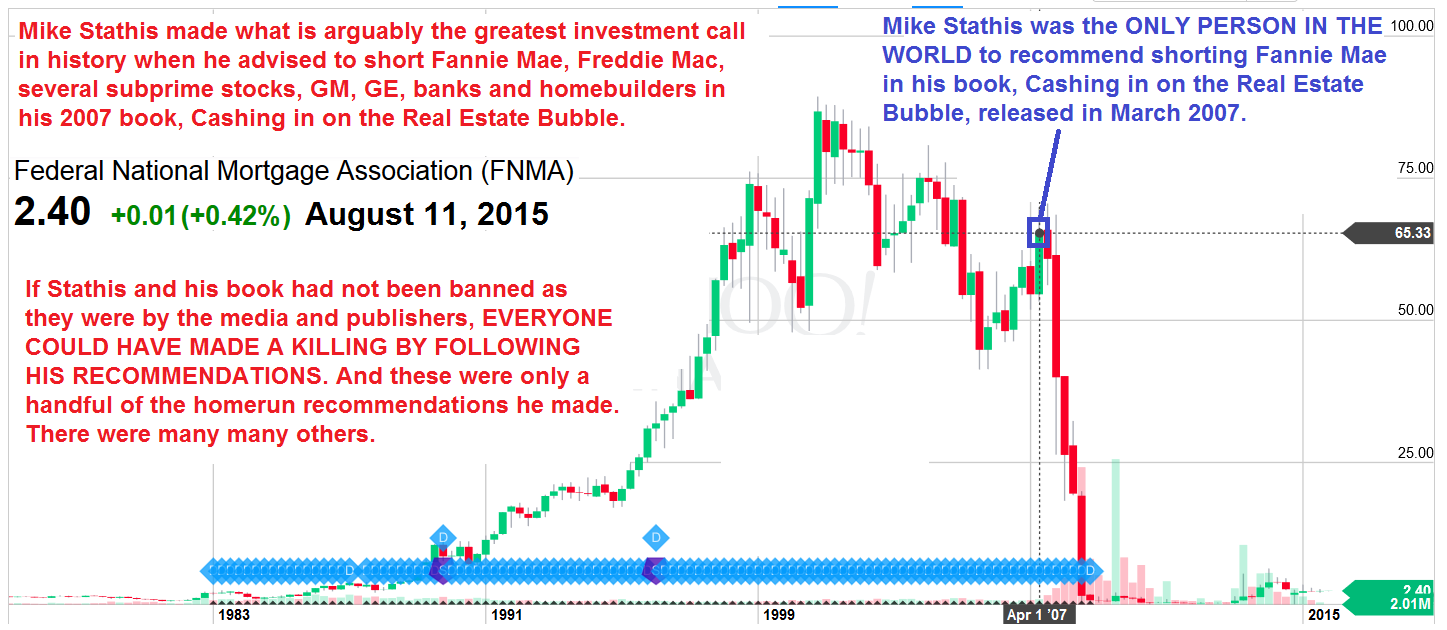

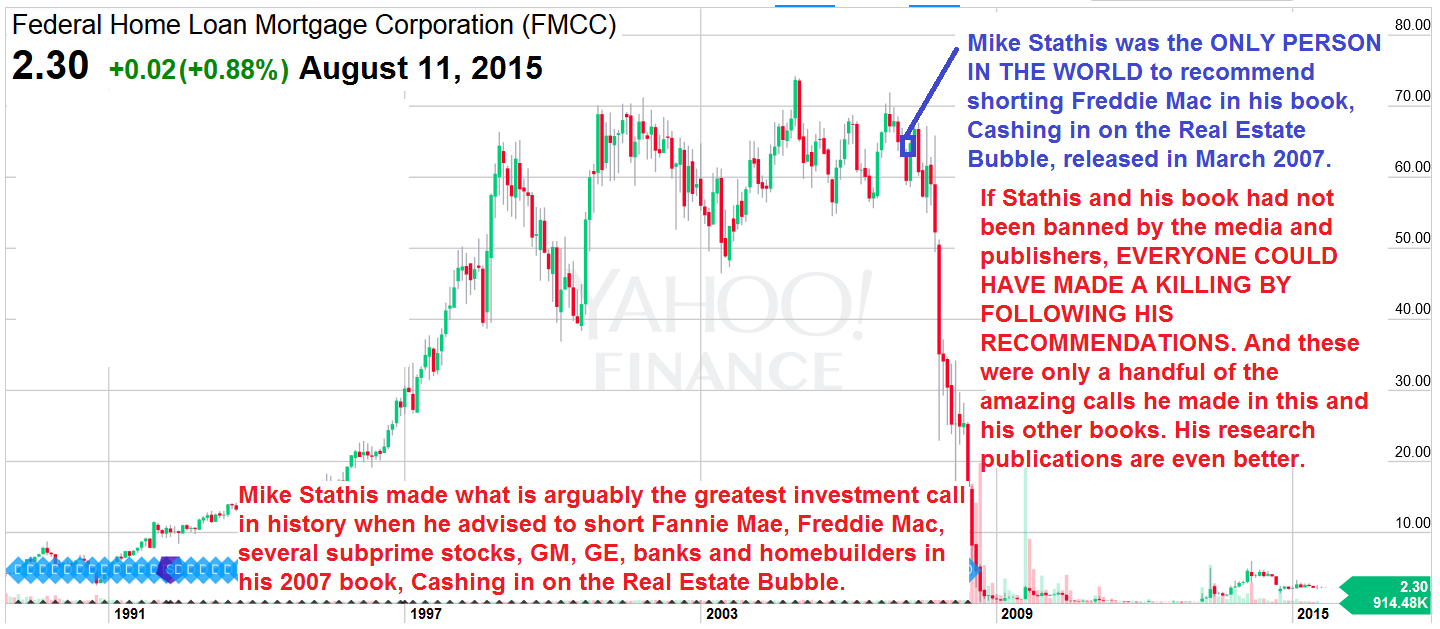

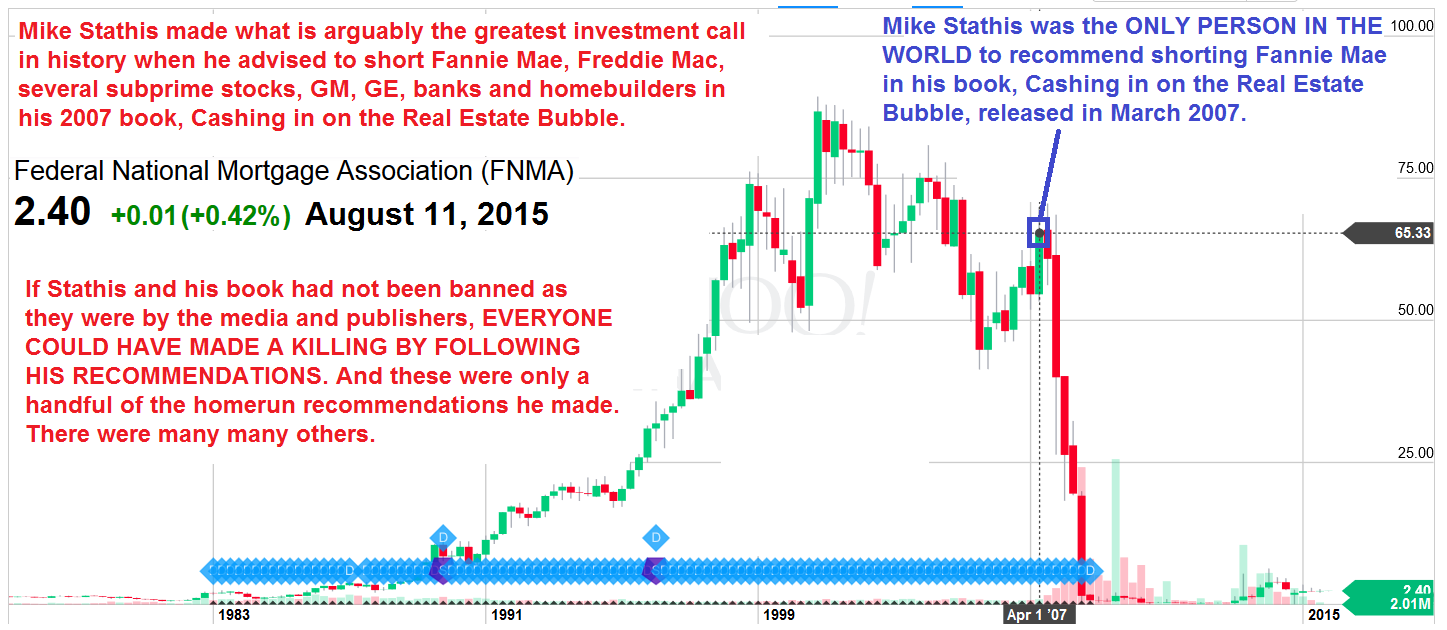

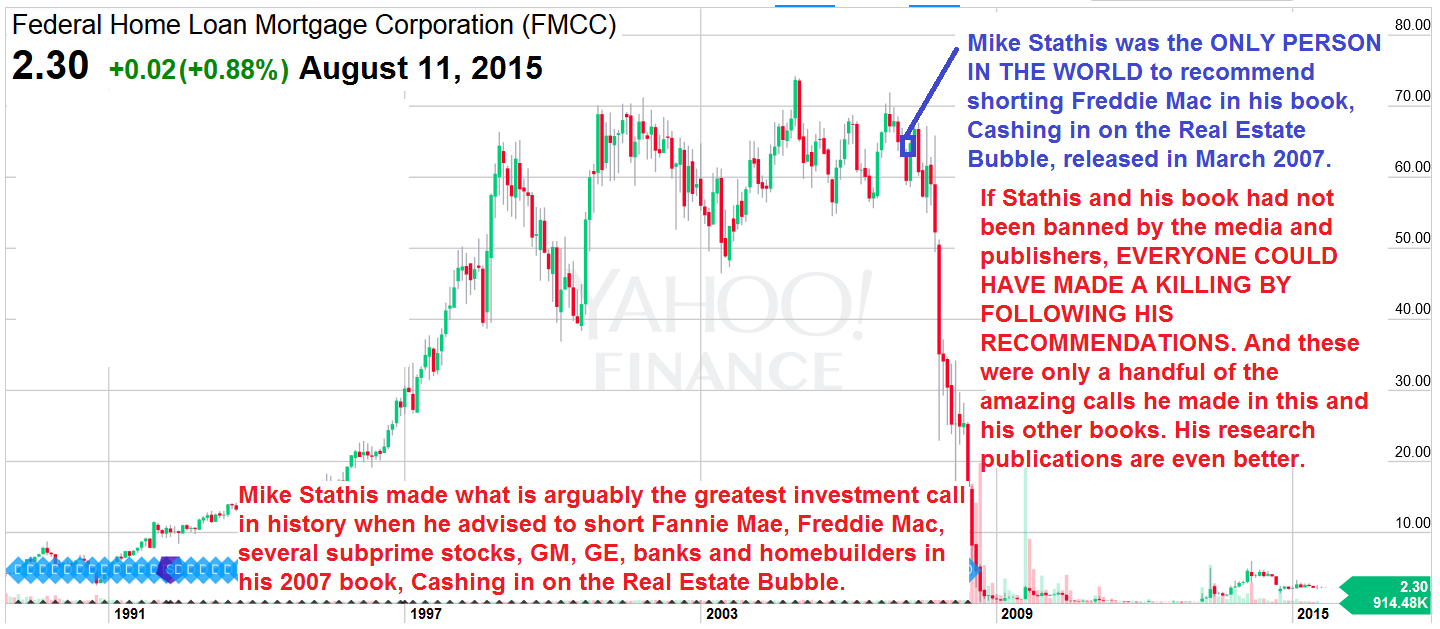

Below Mike has released Chapter 12 of his own 2007 book showing that he was the only one to not only have predicted the financial crisis, but also showed specific ways to land huge profits.

So why does the media continue to BAN Stathis?

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, home builders, GM, GE, etc.

__________________________________________________________________________________________________________________

.png)

.png)

.png)

I invite you to join other subscribers who wish to become great investors, as they learn how to navigate the financial landmines that promise to be commonplace for years to come. The best way to achieve this difficult task is to subscribe to one of our investment newsletters.

.png)

To see what you get with AVAIA Membership, check the Membership Resources, including 10 Special Bonuses being offered.

Click here to sign up and submit payment

Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)