Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Opening Statement from the October 2014 Intelligent Investor (Part 3)

Opening Statement from the October 2014 Intelligent Investor (Part 3)

First published on October 7, 2014 for subscribers to the Intelligent Investor

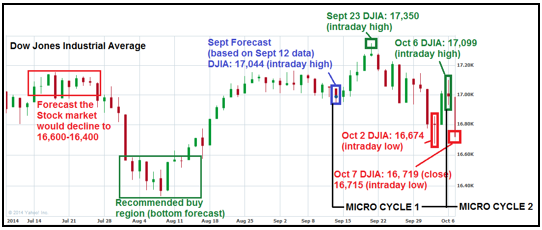

As forecast in the September Market Forecasting presentation (September 12, 2014), the Dow Jones has thus far retraced down to the 16,600 range on October 2.

It is important to note that the Dow made an intraday low of 16,674, but closed up slightly at 16,801 on October 2. Two days later the Dow rallied to an intraday high of 17,099. This is important because it represents the completion of a trading (micro) cycle because the Dow rose to a level higher than that when the September forecast was made (September 12).

At the time of the September forecast, the Dow had made an intraday high of 17,044 and closed at 16,987. Thus, the intraday high made less than three weeks later on October 2 (17,099) surpassed that made on September 12 (17,044), thereby signaling the end of this trading (micro) cycle, and the start of a new one.

We have designated this period as a “micro cycle” because the Dow only briefly remained at this 17,000-plus level and has sold off again. This indicates that at least two of these micro cycles are likely to combine to form a full trading cycle in coming days to weeks.

Since having surpassed the price level (17,099 on October 2) at the time of our September forecast (17,044 on September 12), the Dow has declined to an intraday low of 16,715, and actually closed at 16,719 on October 7. This is a bearish sign.

So what is the point of this?

In short, we could see a retest to the 16,600 support (highest probability) or lower in coming days. Broadly speaking, we see downside as low as the 16,000 support (worst case scenario but somewhat low probability which also includes down to the 15,800 level). As you will recall, this updated forecast is consistent with our September forecast (although we attached a higher probability to the 16,600/16,500 support). Nonetheless, we have NOT altered our bullish sentiment on the US stock market. That is the most important factor to keep in mind.

Recall from the September 2014 US Stock Market Forecast we stated that the expected selloff at 16,600-16,500 (highest probability, although the 16,000 level was still possible) was not likely to represent a trend reversal such that the bull market would be maintained.

Finally, we reemphasized the need to actively manage individual securities positions with a bias on trimming down certain positions as we move into window dressing and tax-loss selling season, which often lead to downward market volatility. We even provided some examples how to actively manage some securities on the Recommended List.